Commodities and Inflation: The Long and the Short of It

Key Takeaways

-

Predictably, generationally high inflation has sparked renewed interest in commodities.

-

Unfortunately, easy commodity investing approaches are likely to disappoint. Buy-and-hold long allocations are subject to significant risks and costs, and timing is hard.

-

Commodities, in our view, are best held as part of a sophisticated portfolio that incorporates long-short positioning, nuanced returns forecasting, and holistic portfolio construction.

Table of contents

Oil prices have surged as a result of the world’s emergence from COVID and the war in Ukraine. Certain other commodities, including industrial metals like nickel, have also experienced dramatic price increases. With inflation across the OECD at the highest level since the late 1980s, it’s hardly surprising that we’ve seen renewed interest in buying commodities for inflation protection, especially given the sharp selloffs in both stocks and bonds. But do such allocations make for a ready and effective inflation hedge? If not, is there a better way to obtain inflation protection and, more broadly, to improve portfolio risk-adjusted returns with commodities?

Risks of Buy-and-Hold

Though commodities can do well during episodes of inflation (or even trigger them), simple buy-and-hold allocations are unlikely to deliver satisfying results for investors seeking insurance against inflation. The problem is that the insurance analogy is flawed. The buyer of insurance (or a put option) pays up-front premiums in return for guaranteed protection against losses on the covered asset. But in buying commodities to hedge against inflation: 1) the investor faces substantial principal risk, and 2) the desired payoff isn’t guaranteed.

Risks of holding commodities manifest over widely varying horizons. As a short-run measure, the Bloomberg Commodity Spot Index (BCOM Spot Index), a market-volume and production-weighted index designed to estimate the composite price level of 23 commodities (given current composition), has exhibited close to 15% annualized returns volatility since 1980, similar to equities.

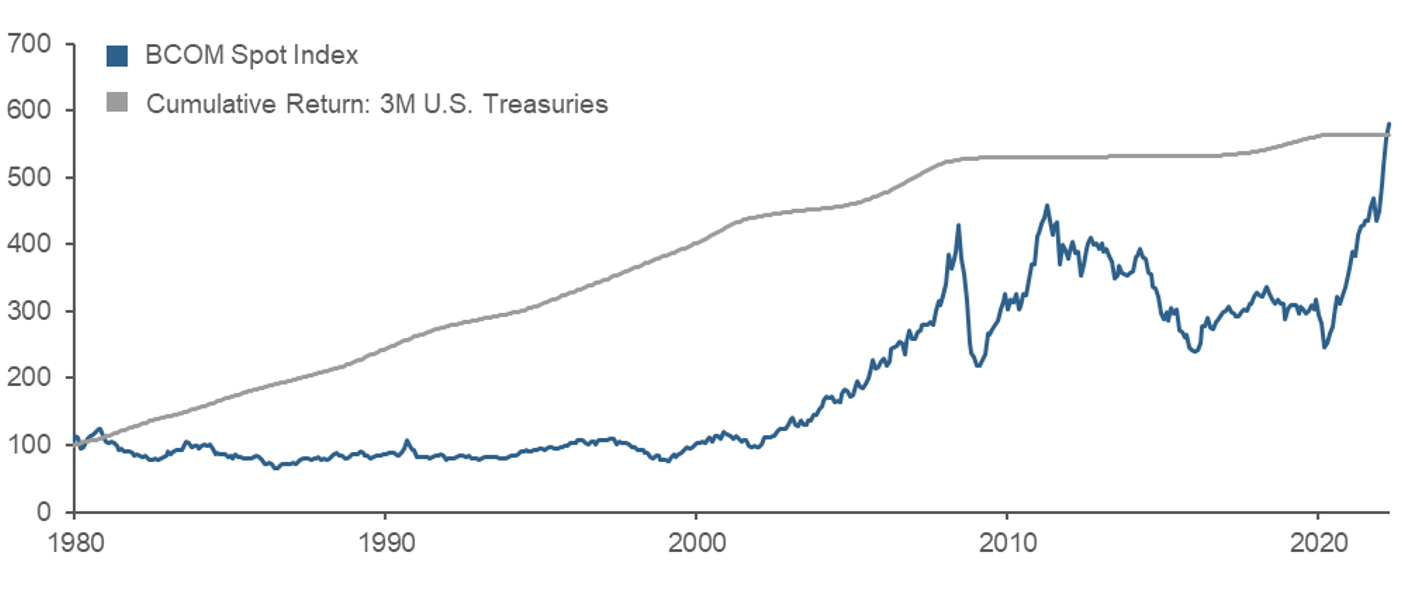

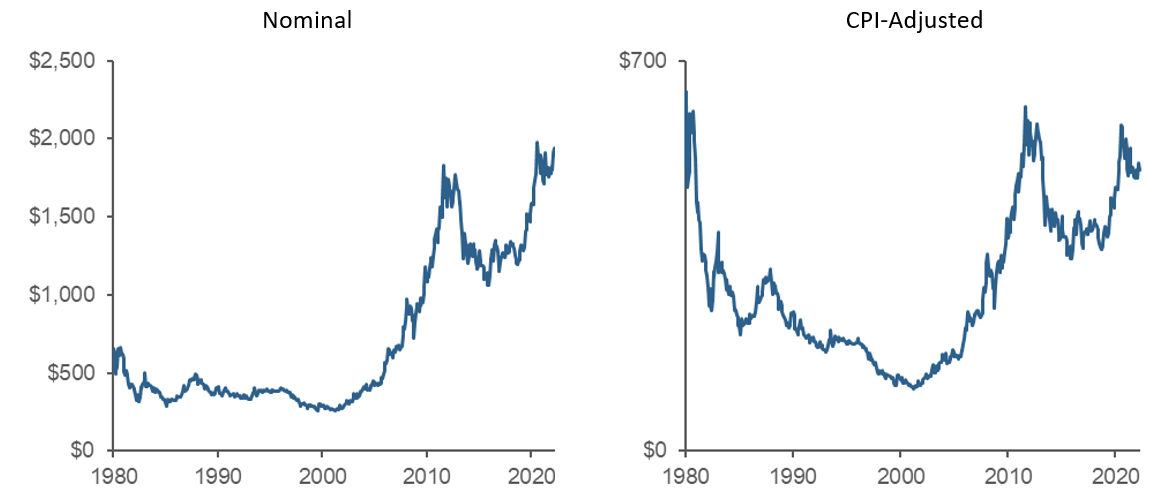

Over the long-term, the buy-and-hold approach to commodities comes at an opportunity cost: in our view, commodities don’t reward long-term holders with an attractive and reliable premium. As evidence, the (uninvestable) BCOM Spot Index has essentially been matched by the returns from holding cash since 1980.1 (Figure 1) Similarly, in CPI-adjusted terms the spot price of gold is roughly flat compared with where it was in 1980. (Figure 2)

Figure 1: Bloomberg Commodity Spot Index versus Cumulative 3-Month Treasury Returns

Figure 2: Gold Spot Price – Nominal and CPI-Adjusted

The charts also highlight another aspect of the longer-term risk connected with buy-and-hold commodities allocations. Commodities prices may experience large and extended swings, often described as “cycles,” associated with protracted supply and demand imbalances in the underlying physical markets. Across different commodities, the size and length of such cycles reflect the CAPEX and time required to bring new supply on-line, shifts in demand patterns, and the availability of close substitutes, among other factors.

The investment risk associated with these cycles is evident in Figure 1. The BCOM Spot Index’s rise in the decade prior to the Global Financial Crisis (GFC) and its decline in the following decade trace out global supply and demand imbalances associated with the acceleration and deceleration of China’s growth over the period. For an investor who had been sitting on a long-only commodities allocation as an inflation hedge, the recent surge in prices might offer some validation, but that run-up followed a painful decade that saw peak-to-trough price declines on the order of 50% across the commodities in the index. Gold, in isolation, also experienced a substantial decline when inflationary expectations suddenly dissipated in 2013. (Figure 2)

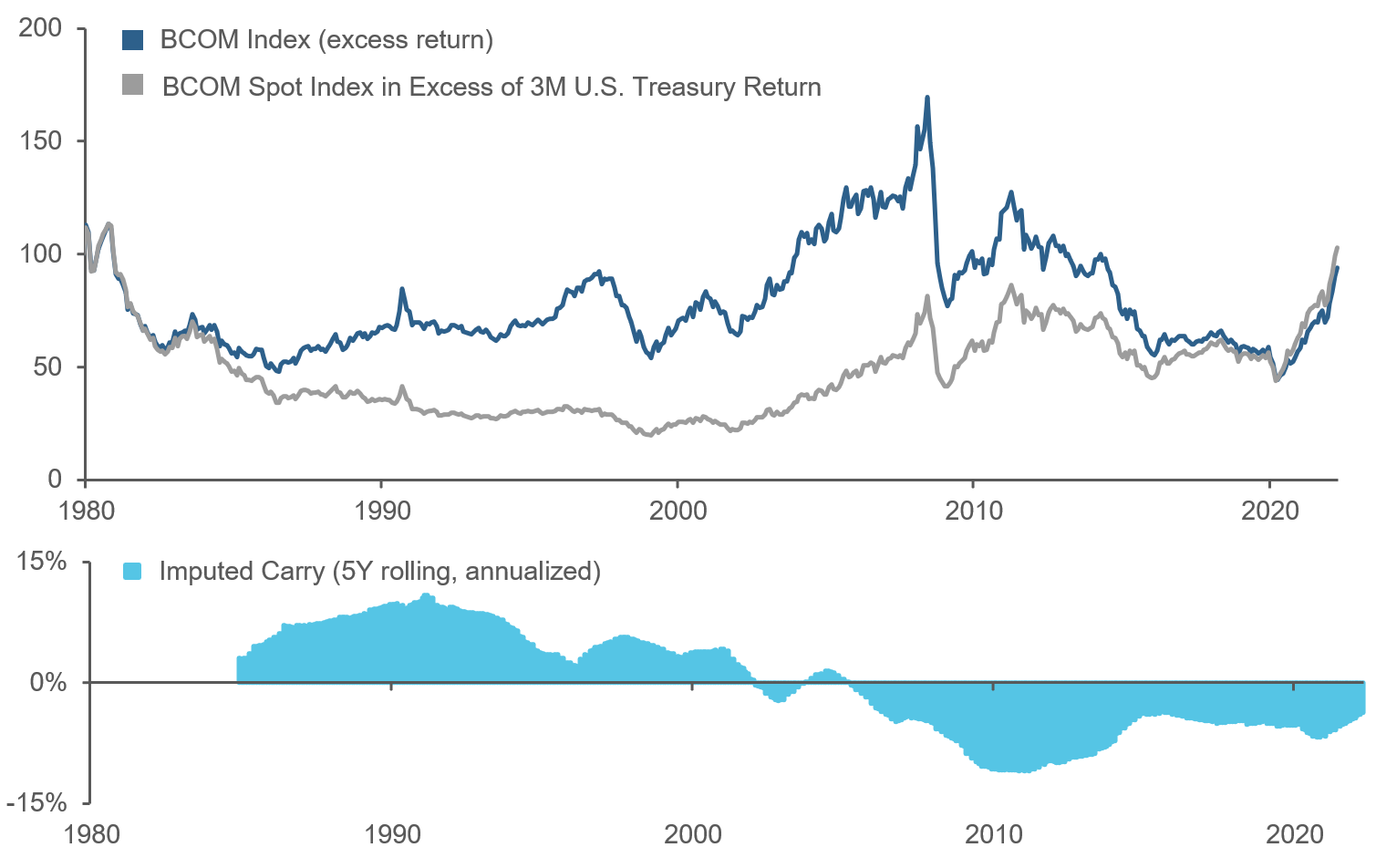

Moreover, actually establishing and maintaining long exposure to commodities involves a form of risk not associated with pure financial assets. For commodities, specifically, the investable instrument generally is a futures contract, or some other derivative, whose returns incorporate carry, which on the one hand reflects financing costs and costs of storing (or otherwise maintaining consistent exposure to) the underlying physical commodity, but also the benefit of holding commodities in inventory (known as “convenience yield”).2 Over the long-term, the average impact from carry has been fairly modest: As a first-order measure, returns to the Bloomberg Commodity Index (BCOM Index), which reflects (excess) returns from buying and rolling futures, and thus carry, have trailed returns on the BCOM Spot Index (in excess of 3-month Treasuries) by about 20 basis points annualized since 1980, as evident in the similar long-term cumulative returns shown in the top panel of Figure 3.

Figure 3: BCOM Index Cumulative Returns and Imputed Carry

But the bottom panel of the exhibit highlights that for long-only commodity investors carry can be a material headwind or tailwind for years at a time, generally coinciding with commodities cycles. In the commodities boom that preceded the GFC, for example, carry paid long futures holders handsomely, but it became a material headwind as the cycle reversed.

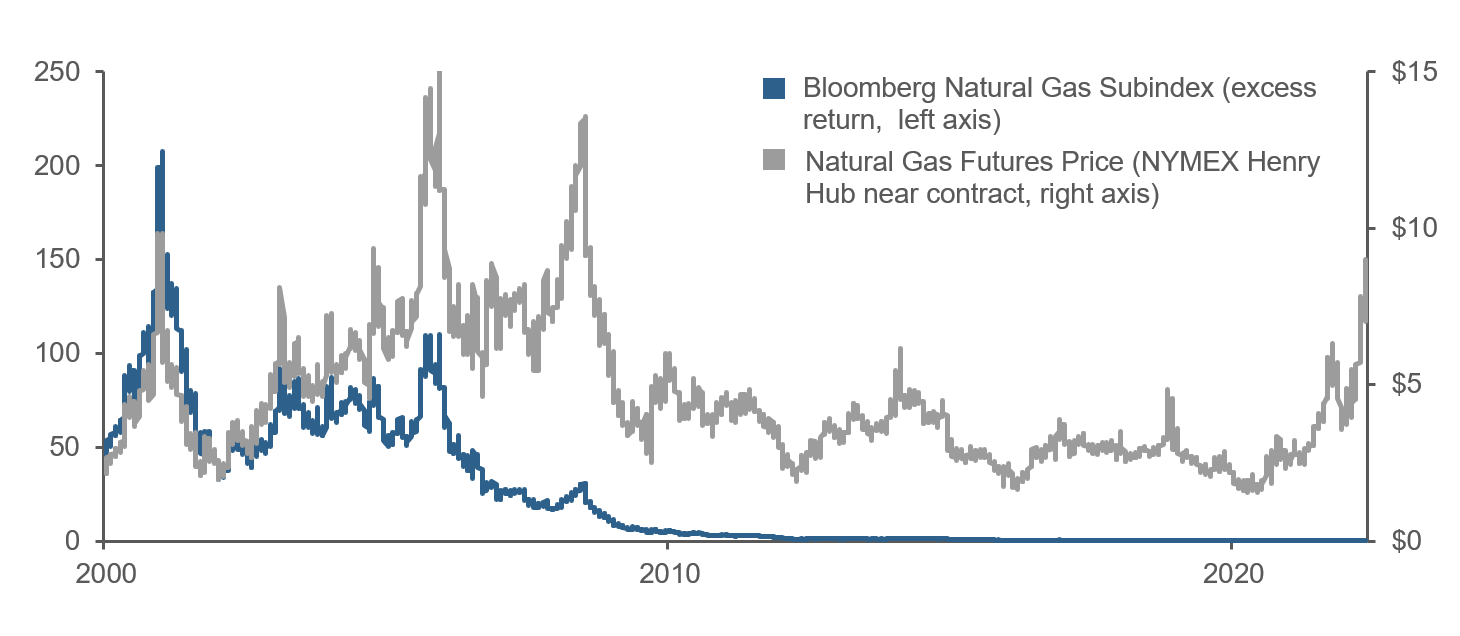

Moreover, carry will also vary across different commodities and, in some instances, may become quite large. For instance, Figure 4 shows that while natural gas price levels have not exhibited a consistent trend over the past 20 years, an investor who had gained exposure to natural gas through rolling futures starting at the turn of the millennium likely would have virtually nothing left of the initial investment, as a result of persistently high carry costs.3

Figure 4: Bloomberg Natural Gas Subindex Versus Natural Gas Futures Prices (near-month)

Drawbacks of Simple Active Hedging Strategies

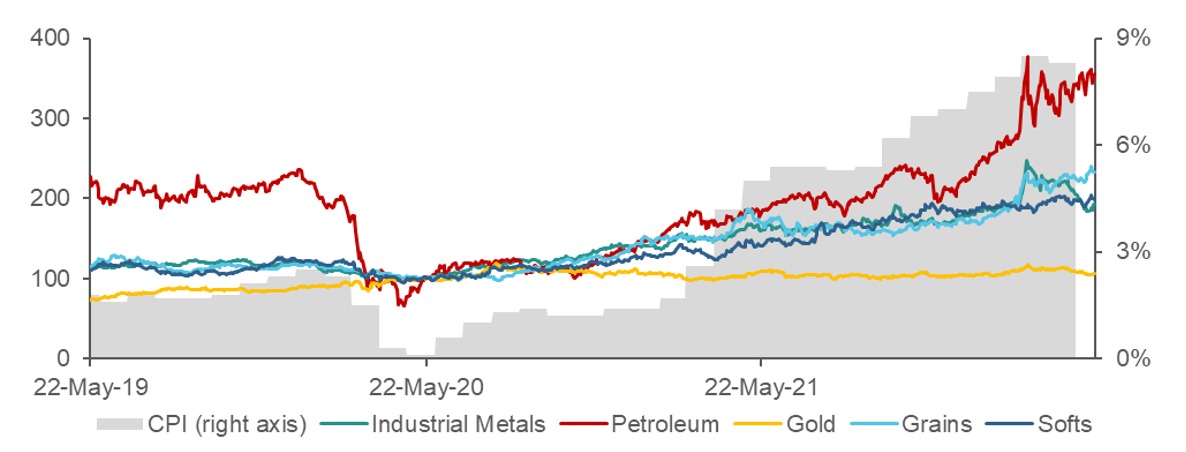

In trying to mitigate the risks and the opportunity cost of buy-and-hold commodities allocations, simple forms of timing or selection may fail to capture the desired benefits. Case in point, an investor who had flipped into gold over the past couple of years to hedge inflation might well be quite frustrated now. One reason for this is that this round of inflation is partly commodities driven. Figure 5 shows that as inflation has trended higher, gold has dramatically underperformed oil, industrial metals, softs, and grains— commodity sectors whose prices have been driven up far more than gold by a combination of factors, including Russia’s invasion of Ukraine, COVID disruptions, other supply constraints, and rebounding global demand.

Figure 5: Recent Inflation and Selected Commodities Prices

(left axis—commodities normalized to 100 on 22-May-2020, right axis—CPI)

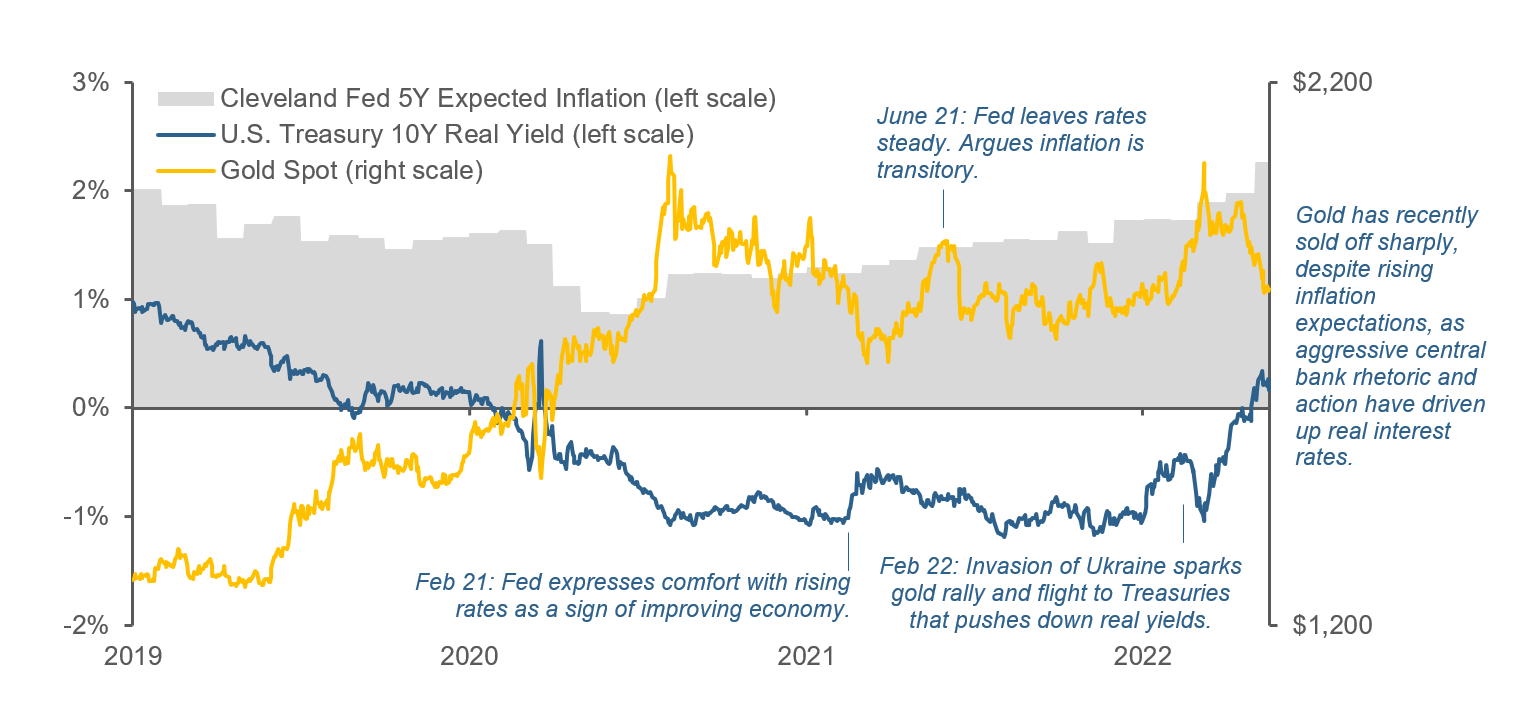

Moreover, even in its own right, gold’s recent behavior might confuse would-be inflation hedgers. Figure 6 shows that as inflation expectations trended higher starting in mid-2021 (grey-shaded area), gold prices (gold trace) traded more or less sideways. Perhaps even more surprising, gold has actually sold off as inflation expectations have soared in recent months.

Figure 6: Gold Price, 5-Year Inflation Expectations, and the 5-Year Real Yield

Looking across the broader timespan of the chart helps to explain why. While the price of gold is certainly influenced by inflation expectations, it is more closely associated with real interest rates (dark blue). The near mirror-image relationship between them in the chart reflects the notion that gold can be thought of as a zero real-yielding asset, which implies that when real interest rates rise or fall, gold becomes less or more attractive to hold.4 As a result, active positioning in gold should reflect not only inflation expectations, but also the drivers of nominal interest rates (as well as other factors, like the strength of the U.S. dollar, in which gold is denominated).

A Better Way to View Commodities

The shortcomings of simple commodities-based inflation hedges point to two constructive implications. First, the objectives of commodities investing shouldn’t be limited to protecting against inflation; instead, they should include alpha generation and overall portfolio diversification. Second, commodities investing implementations require richness that is consistent with those broader objectives as well as the heterogeneity and complexity of commodities.

To be specific, commodities return forecasts should reflect not only inflation, but many other drivers as well. Relevant themes include supply and demand in the physical market, central bank policy, carry, and the outlook for the U.S. dollar (or other relevant currencies). Moreover, return forecasts should be tailored to each commodity’s idiosyncrasies, since commodities are heterogenous in their uses, mixes of financial and non-financial market participants, scarcity, and CAPEX intensity and cycles, among other dimensions.

Rather than static long-only allocations or crude timing, we would advocate dynamic long-short positioning over the cross section of commodities. This reflects a view that commodities are regularly mispriced relative to one another, owing to the complexity of their price drivers and market segmentation. Long-short positioning also can be used to optimize exposure to carry, rather than blindly assuming the associated risk or long-term drag.

Finally, commodities positioning should not be determined by ex-ante heuristics, such as volume and production weighting, or in a silo, separately from other investments. The risk relationships among commodity sectors—energy, precious metals, industrial metals, softs, and grains—vary with the evolving economic and financial context. So does the ability of different commodities to help diversify stock and bond holdings. As such, commodities holdings should be determined jointly with those of other assets, based on dynamic risk forecasting and framed by overall portfolio risk and return objectives.

Conclusion

The attention drawn to commodities by the current bout of inflation certainly has positives. We believe that commodities can add meaningful value to a diversified multi-asset portfolio that goes beyond providing a simple inflation hedge. In contrast, proposals of “passive” commodities allocations, simple timing trades, and other rudimentary strategies that consume much of the bandwidth across financial media, practitioner literature, and message boards probably won’t help investors and, in fact, may pose substantial risk. Current conditions underscore that the drivers of commodity returns are diverse and complex. Embracing that messy reality provides a source of real opportunity in these markets.

Endnotes

- All analysis in this write-up is presented in U.S. terms, e.g., commodities denominated in U.S. dollars and inflation from the perspective of U.S. consumers. Please contact us to discuss perspectives of other currency holders.

- Carry is reflected in the shape of the futures price curve. For commodities, when costs of maintaining a physical position are high, all other things being neutral, longer-term futures prices should exceed shorter-term futures prices (a shape known as “contango”). Similarly, when investors put a high premium on having a commodity at their disposal rather than taking delivery in the future, shorter-term futures prices should exceed longer-term futures prices (a shape known as “backwardation”). Derivatives based on futures contracts, e.g., ETNs, also reflect carry

- The illustration is based on the Bloomberg Natural Gas Subindex, which is based on the performance of NYMEX Henry Hub Natural Gas futures. In an another, extreme circumstance illustrating the materiality and complexity of carry-related risk in commodities, during April 2020, May WTI crude oil futures prices famously became negative just prior to settlement, when speculators rushed to liquidate contracts against a backdrop of weak demand for oil and a shortage of storage capacity. See Quick Take: Crude Below Zero?, Acadian, April 23, 2020.

- For further discussion of the relationship, and other drivers of gold prices, see our 2020 piece, “Gold in Crisis?”

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.