The Death of Value?

Table of contents

April 2016

Introduction

In June 2000, The New York Times published a story noting sharply reduced attendance at a prominent Columbia University seminar on value investing.1 Over the prior two years, the MSCI USA Growth index had outperformed its value counterpart by 42%,2 as waves of investors came to believe that new technologies had changed the world so dramatically that enormous valuations could be justified for companies that had no earnings or even revenue.The Times story ran just as the dot-com bubble began to burst. This ended a spectacular run for growth stocks, and ushered in a multi-year period of value strategy outperformance.

Interest in value investing has risen and fallen for decades. We believe that episodic preoccupation with growth stocks—another example being the “Nifty Fifty” period in 1971-72 when a small group of high-perceived-growth companies drove U.S. market performance—helps to explain the long-term excess returns offered by value strategies historically.

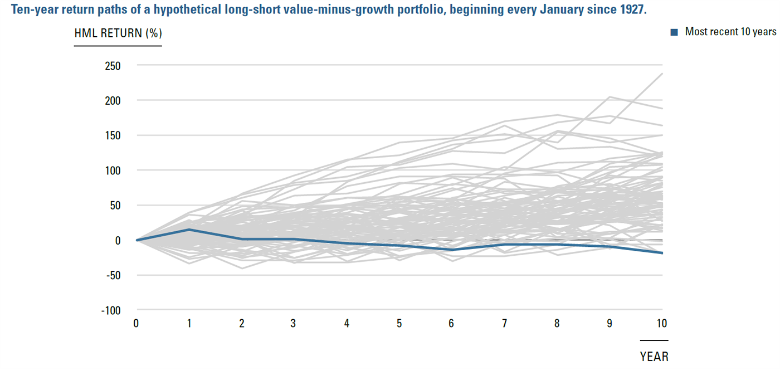

Figure 1: Recent Value Performance in Historical Context*

The HML factor represents returns of a long-short portfolio formed from high book/market stocks minus low book/market stocks, controlling for market capitalization. This is meant to be an educational example and is not intended to represent investment returns generated by an actual portfolio. They do not represent actual trading or an actual account. Results do not reflect transaction costs, other implementation costs and do not reflect advisory fees or their potential impact. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

Investors tend to pay too much for growth for reasons that vary with changes in economic circumstances. During a bubble, future growth expectations for certain companies often become excessively optimistic. Investors may also feel insurmountable pressure to chase the very stocks that have enjoyed strong run-ups, to align their holdings with those of peers who have enjoyed success. During lackluster economic environments, in contrast, portfolio managers may seek the security of well-known, conventional stocks even if they seem expensive; at such times, companies with a scent of distress may pose unacceptable career risk. In either case, growth may outperform value for prolonged periods.

As most professional investors are already aware, the past several years have marked another episode of significant underperformance for value-oriented strategies, well out of line with value’s long-term relative results. Figure 1 places recent value returns in their long-term historical context. Each trace represents a 10-year price path for a long-short value-minus-growth portfolio originating every January since 1927. The most recent, from 2006-2015, is highlighted in blue.

The chart demonstrates just how aberrant value’s recent performance has been. By this measure, value lost 19.2% relative to growth in the decade ending 2015. It has performed worse than this only once in the other 79 (overlapping) 10-year runs. Indicative of the durability and consistency of value underpricing, the median outcome represents value outperformance of 58%, and value-minus-growth returns have been positive in 93% of (overlapping) ten-year periods.

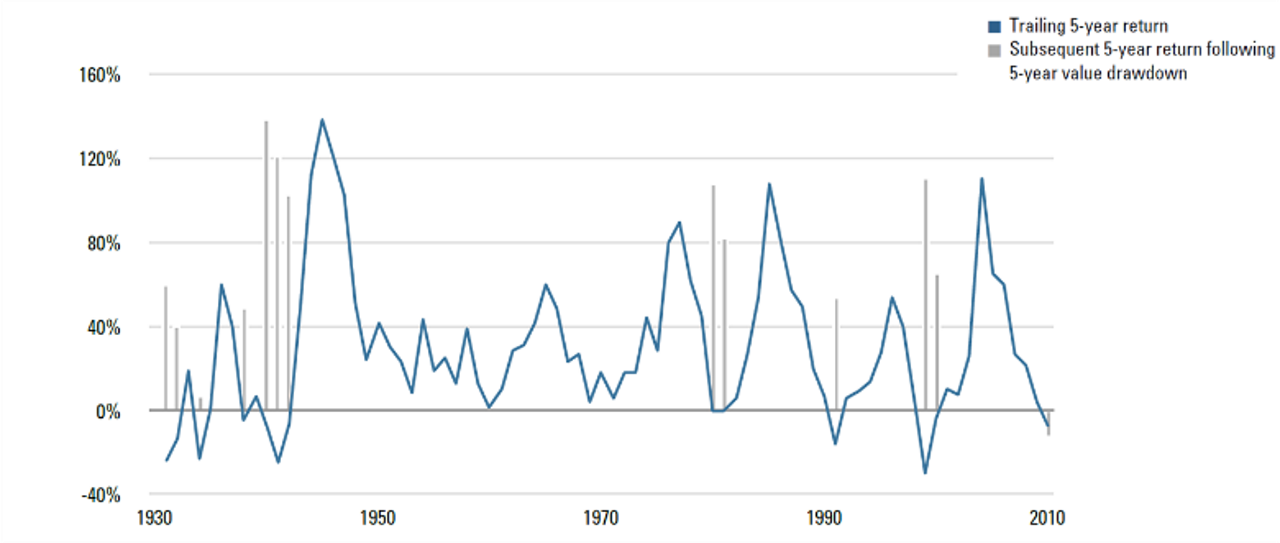

Value strategies have also had a strong tendency to recover from periods of underperformance. These reversions are illustrated in Figure 2, which shows that prior episodes of five-year value drawdowns over the past 80 years have often been accompanied by substantial outperformance over the subsequent five years. The current drawdown has thus far been a notable exception.

As we write this, we see evidence that investor sentiment may be turning back towards value. We have seen a rebound in its relative returns, and even popular financial press is suggesting a brightening outlook.3 This would not be the first time that sentiment has quickly shifted back towards value following a slump. Almost a year to the day after the Times published its June 2000 article on dwindling interest in value investing, it ran a story entitled the “Rising Tide for Value,” noting a major shift in flows into value-oriented strategies. Over the prior year, value funds had outperformed growth by 30%.4

As we look at the performance history of value stocks, investors should be prepared for the potential of a similar significant reversal.

Figure 2: 5-Year Value-Minus-Growth Returns Following 5-year Value-Minus Growth Drawdowns*

Endnotes

- Fabrikant, Geraldine, “Investing; A Dwindling Few in Search of Value,” The New York Times, June 18, 2000.

- Price Return. Source: MSCI USA Growth, MSCI USA Value indexes. For illustrative purposes only. Past performance is no guarantee of future results. Investors have the opportunity for loss as well as profits. Copyright MSCI 2016. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI.

- Bray, Andrew, “Move Over, Facebook and Netflix: Value Investing Is Rebounding,” Barron’s, March 12, 2016.

- “Investing Diary: A Rising Tide for Value Funds,” The New York Times, June 24, 2001.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.