The Outlook for Value

-

In assessing the outlook for value, we see no reason to abandon value as a long-term component of a multifactor investing approach.

-

From a tactical perspective, we advocate maintaining a value allocation in light of the market’s current “one-factor bet on growth.”

-

We believe that refined value implementations informed by ongoing research are more likely to succeed going forward as the investing environment continues to evolve.

Value’s underperformance has spawned a wave of financial media and practitioner discussion questioning its relevance as an investment approach. But, as we pointed out in recent research, “Returns to Value: A Nuanced Picture,” prevalent narratives tend to gloss over aspects of value’s performance that are germane to its interpretation, including material variation in efficacy across regions and market segments, asset versus income-based signals, and refined versus simple implementations.1 Informed by these observations, we examined how macroeconomic conditions, investor thirst for long-term growth opportunities, and evolving economic structure and accounting practices all have influenced value’s performance. The key question arising from that prior analysis is: what is the outlook for value going forward?

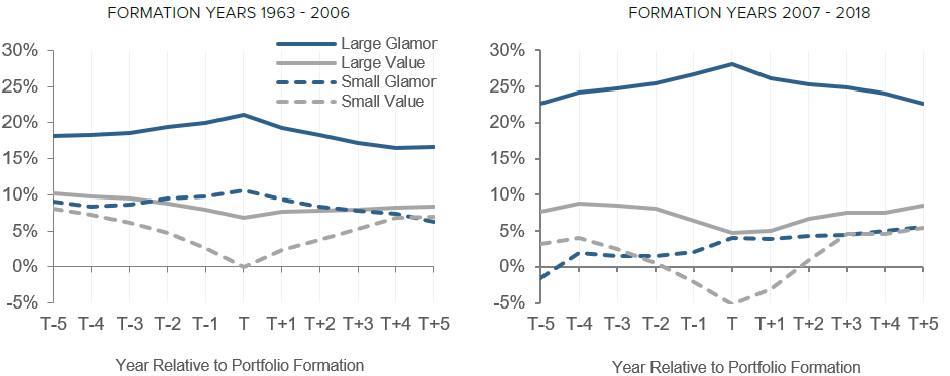

A pivotal issue is whether value investing has become obsolete as a concept. We do not believe that it has. In our view, as we discuss in our paper “Acadian’s Approach to Value Investing,” the long-term value premium results from investors’ mis-extrapolation of fundamentals.2 We are skeptical that investors have somehow become much better at interpreting and forecasting them than in the past, and we continue to see patterns in fundamentals that we would associate with mis-extrapolation. For example, Figure 1 shows that glamour and value stocks’ profitability still tend to reverse their prior trends.3

Figure 1: ROE Trajectories for Hypothetical U.S. B/P Glamour and Value Portfolios

U.S. universe.

From a more tactical perspective, we advocate maintaining a value allocation as part of a multifactor approach. While, as we’ve described in our recent research, the tepid macroeconomic climate has weighed on value efficacy, producing neither robust-enough growth to reward exposure to companies with fragile fundamentals nor a washout that punishes expensive valuations and/or generates panicked selling that is blind to valuation, economic conditions can change quickly. It’s worth recalling that the U.S. Federal Reserve was still hiking rates in December 2018. Six months from now, we could be discussing the outlook for value in the context of a vibrant global rebound or a pronounced cyclical downturn.

Even if a middling economic climate were to continue, for much of past ten years the efficacy of income flavors of value held up relatively well, particularly in DM ex-U.S. and EM. As well, multifactor strategies benefitted from the efficacy of other factor groups, including momentum, quality, and growth. Diversification of alpha exposures across factor groups is one of the central tenets of Acadian’s multifactor implementation of value, based in part on an expectation that individual factor groups will experience downdrafts, some severe or protracted, that are at best difficult to time. (See “Acadian’s Approach to Value Investing,” Acadian, November 2019 for an articulation of the principles and key design choices of our implementation.)

Beyond macroeconomic conditions, we see headwinds to trends that have contributed to increasing U.S. large-cap B/P glamour profitability and challenged investment strategies that are underweight this segment. Globalization and technological disintermediation of labor have sparked political backlash around the world, both nationalist and populist. The FAANGs and other technology, communications, and consumer giants have come under increasing regulatory scrutiny regarding privacy concerns and the disruptive impact of their business models. These considerations raise questions as to whether evolving government policies will prevent investors from harvesting endless streams of outsized earnings associated with insurmountable leadership or monopolistic power in emergent or evolving industries.

Further, we would expect high and seemingly secure profit margins among these companies to generate strong incentive for new entrants. Rapidly evolving technologies may afford opportunities for a new generation of competitors to quickly challenge incumbent business models based on what now seem like dominant approaches. Moreover, some already large, persistently profitable firms may reach a scale where they cannot consume their cash flows with R&D and instead turn to acquisitions to source growth, a behavior which would resemble a more traditional glamour-stock profile associated with historically familiar book value trajectories. Such developments might help to reverse deterioration in relevance of even simple asset-based value formulations.

We believe that value’s struggles over the past few years resemble a market capitulation with respect to profitability, effectively the capitalization of historically high and rising ROEs among already expensive large- cap stocks. Strategies that have been underweight this market segment, including those tilted towards value or small-cap stocks, have underperformed. But reversion or even stabilization of those ROEs could remove a material headwind.

In summary, we conclude that there is no reason to abandon value as a long-term component of a multifactor investing approach, although simple and static implementations, e.g., smart beta, are vulnerable to degradation. We believe that sophisticated approaches, like Acadian’s, that embrace both nuance in signal design and adaptivity in response to changes in the investing environment are more likely to succeed going forward. Tactically, we advocate maintaining a value allocation in light of risks to the market’s current one factor bet on growth.

2 See also “Acadian’s Approach to Value Investing,” Acadian, November 2019.

3 Specifically, as Fama-French originally noted, earnings for glamour stocks grow faster than book in years prior to formation and fall in the years

following formation. On the other hand, earnings for value stocks recover faster than book in the years following formation.

Legal Disclaimer

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive.

Hypothetical Legal Disclaimer

Acadian is providing hypothetical performance information for your review as we believe you have access to resources to independently analyze this information and have the financial expertise to understand the risks and limitations of the presentation of hypothetical performance. Please immediately advise if that is not the case.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.