Brokers and bubbles

How can you tell if you’re in a speculative bubble? Well, bubbles are all about frenzied trading activity. And who benefits from frenzied trading activity? Brokers and other providers of trading services. Just as it’s profitable to sell picks and shovels during a gold rush, it’s profitable to sell trading services during a speculative bubble. Thus, when retail brokerages are extremely successful, that’s a clue that you may be in a bubble.

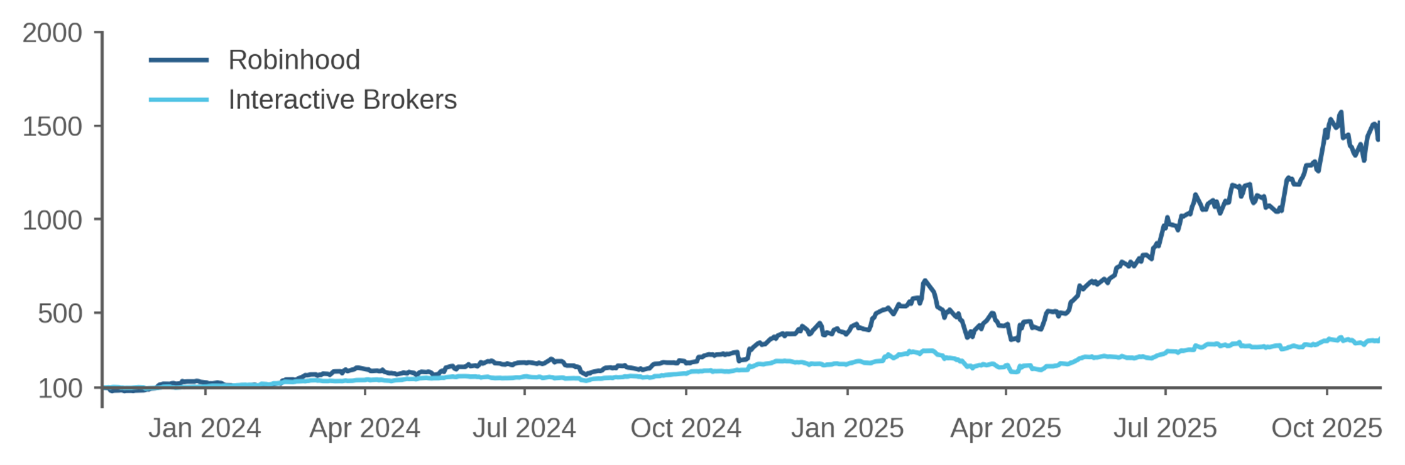

Today, retail broker stocks are ripping. As shown in Figure 1, Robinhood is up more than 15x in the past two years, with Interactive Brokers up more than 3x.[1] Both were added to the S&P 500 this year (Interactive Brokers in August and Robinhood in September).

Figure 1: Cumulative Return on Robinhood and Interactive Brokers

Normalized to 100 as of Nov 3, 2023. Through Oct 31, 2025.

This outperformance by brokers is yet another sign of speculative excess in the U.S. stock market today. Throughout history, periods when brokers have prospered amid frenetic trading have been followed by market declines.

Let’s go on a whirlwind tour of historical bubbles. We start in Paris in 1719. Here’s Mackay (1841) describing John Law’s Mississippi Bubble:

The public enthusiasm, which had been so long rising, could not resist a vision so splendid. At least three hundred thousand applications were made for the fifty thousand new shares, and Law’s house in the Rue de Quincampoix was beset from morning to night by the eager applicants …

… The Rue de Quincampoix was the grand resort of the jobbers, and it being a narrow, inconvenient street, accidents continually occurred in it, from the tremendous pressure of the crowd. Houses in it, worth, in ordinary times, a thousand livres of yearly rent, yielded as much as twelve or sixteen thousand. A cobbler, who had a stall in it, gained about two hundred livres a day by letting it out, and furnishing writing materials to brokers and their clients. The story goes, that a hunchbacked man who stood in the street gained considerable sums by lending his hump as a writing-desk to the eager speculators!

While today we have trading apps on mobile phones, the technology of 1719 supposedly involved human beings acting as mobile writing desks. While I’m guessing that the Hunchback of the Rue de Quincampoix is as fictional as the Hunchback of Notre Dame, Mackay was probably right that providers of trading services prospered during the Mississippi Bubble.

Moving 210 years ahead, we go to Wall Street in 1929. Here’s The Commercial and Financial Chronicle of April 6, 1929:

And the buyers from the hinterland roll up a tremendous volume of trading, in which the fools splash and swim like frantic salmon running over a dam, and where brokers gather commissions like manna falling from heaven …

Now let’s jump to Japan of the late 1980s, with a stock market bubble peaking in December 1989. The inflating bubble brought prosperity to Japan’s “Big Four” securities companies, including Daiwa Securities. Their prices peaked in mid-1987, with Daiwa up about 5x over two years. Here’s how Daiwa prospered:[2]

Daiwa is first of all a brokerage house with commission revenues approaching $2.5 billion a year … Every morning, at precisely 8 o'clock, a senior manager in Daiwa's sales division turns on a microphone that will carry his voice over leased lines to loudspeakers in Daiwa's 105 branches scattered around the islands. His message consists of an analysis of the action on the market the previous day and a ''suggestion'' of one or more stocks salesmen should push at their customers ... The salesmen sell, these days, most frequently to housewives … Daiwa now hires housewives part time to give parties in their homes, like Tupperware parties, at which investing becomes a social activity.

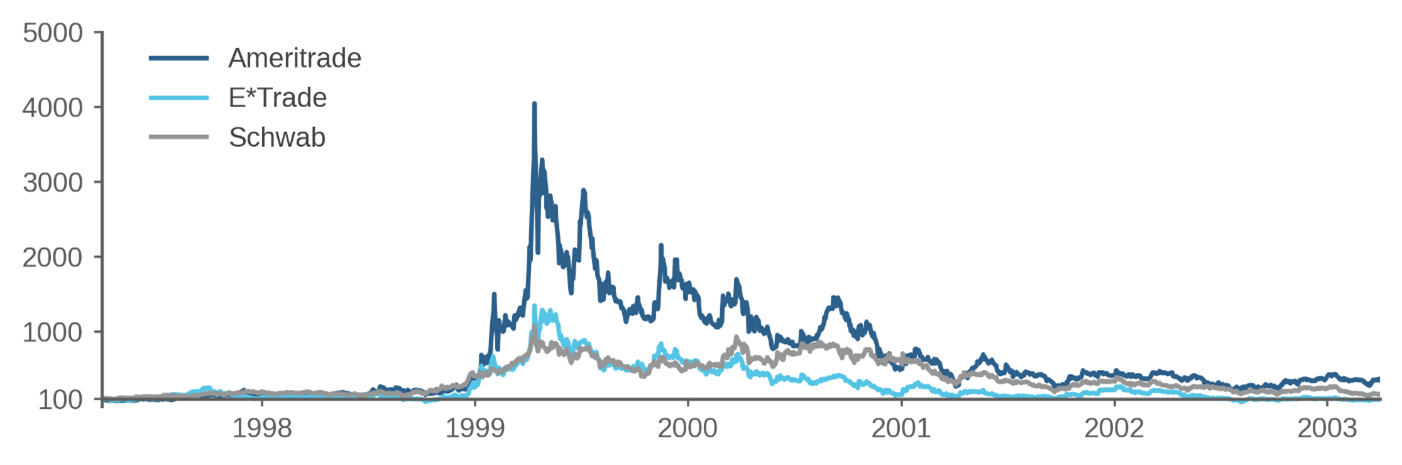

Next, let’s go ten years forward to 1999 and the U.S. tech-stock bubble. The cutting-edge online brokerages of the late 1990s were Ameritrade, E*Trade, and Schwab. Figure 2 shows their performance from April 1997 to April 2003.

Figure 2: Cumulative Return on E*Trade, Ameritrade, and Schwab

Normalized to 100 on April 1, 1997. Through April 1, 2003.

All three peaked in April 1999, with Ameritrade up 40x from two years prior. The New York Times reported that:[3]

Having evolved from a nation of savers to one of investors, America is rapidly becoming a country of traders.

As proof, several brokerage firms have just reported record profits, fueled in large part by a surge in stock trading among both individuals and institutions.

Part of the frenzy comes from day traders, who take advantage of the low cost of trading stocks over the Internet to buy and sell rapidly and profit from small changes in stock prices. A formidable market force, this group has recently focused on one of the areas they like best, brokerage firms, bidding up the stocks of the very companies profiting from their business.

… The stock price of Schwab, which operates the largest on-line brokerage, has soared 40 percent in the last five days … Shares of Ameritrade, another on-line discount broker, have more than doubled in the last five days …

The whole stock market peaked 11 months later.

Last, we go to the Chinese stock market bubble peaking around May 2015. It involved companies offering stock trading apps, such as East Money and Hithink Flush. Both of these had shares that were up more than 15x over two years, peaking at about the same time as the entire China A shares market.

So, in summary, many past bubbles have seen surging broker share prices, peaking either prior to or concurrent with the bubble. Of course, here I have not performed a rigorous study demonstrating reliable predictive power; I’ve just cherry-picked extreme examples. All I can say is that, for me, these historical instances sure resonate.

Another bubble indicator is issuance; I call it the Third Horseman of the bubble apocalypse. When you see many IPOs, that means you might be in a bubble. Let me now go further: when you see many IPOs of brokers, that really means you might be in a bubble, as it indicates both high trading activity and selling by the smart money (issuers).

Looking at the tech-stock bubble peaking in March 2000, E*Trade had its IPO in August 1996 and Ameritrade had its IPO in March 1997. Looking at the COVID-era bubble peaking in December 2021, Robinhood’s IPO was July 2021. So far in 2025, we’ve seen two retail brokers go public in the U.S. (eToro via IPO in May 2025 and Webull via SPAC in April 2025), not counting the wave of crypto-related IPOs flooding the stock market.

What does it all mean? Brokerage stocks have soared, just as they did in April 1999. So is it obvious you should get out of U.S. stocks immediately? Maybe you should short the market? No way. The Nasdaq composite approximately doubled from April 1999 to March 2000. Euphoric brokerage stocks might be a sign of excess, but excess can always get more excessive.

Is the U.S. stock market in a bubble? I don’t know. Ask me again after prices double from their current level.

Endnotes

[1] References to this and other companies should not be interpreted as recommendations to buy or sell specific securities. Acadian and/or the author of this post may hold positions in one or more securities associated with these companies.

[2] “Japan Roils the Market,” The New York Times, September 20, 1987.

[3] “THE MARKETS: Market Place; Day Traders Are Formidable Market Force,” The New York Times, April 14, 1999.

References

Mackay, Charles. Extraordinary Popular Delusions and the Madness of Crowds. London, 1841.

Don't miss the next Acadian Insight

Get our latest thought leadership delivered to your inbox

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.