Bubble Watch, Part 3: No, the U.S. stock market isn’t “giving Enron vibes”

Is the AI boom just a big Ponzi scheme? Is the whole U.S. stock market a house of cards that will swiftly collapse, Enron-style? Are the hyperscalers actually hyperlevered?

Nonsense. Today’s large firms bear little resemblance to Enron or any of the other financial monstrosities of the tech-stock bubble. Enron sold equity to gullible investors, issuing more and more shares prior to its collapse. Enron was not alone; during the tech-stock bubble, corporations collectively issued massive amounts of new shares. In contrast, today, U.S. corporations are collectively repurchasing equity. The stock market of 2025 does not look like the stock market of 2000.

Here's some recent commentary about today’s stock market:

- Financial Times: Is it just a Ponzi scheme? That is the question that currently haunts American tech — and wider markets — as the valuation of artificial intelligence-linked groups soars to evermore eye-popping heights.[1]

- Dave Karpf: the AI bubble isn’t predominantly giving off Pets.com or Global Crossing vibes anymore. It’s giving Enron vibes.[2]

- The Economist: To finance its splurge on data centres and takeovers, America Inc is feasting on debt … companies have been experimenting with more novel forms of debt … As borrowing increases, it will be further obfuscated.[3]

- The New York Times: To obtain the capital they need, hyperscalers have leveraged a growing list of complex debt-financing options, including corporate debt, securitization markets, private financing and off-balance-sheet vehicles. That shift is fueling speculation that A.I. investments are turning into a game of musical chairs whose financial instruments are reminiscent of the 2008 financial crisis.[4]

These concerns are overblown. Maybe AI firms are overspending on capex and maybe they are overpriced. But I see few parallels to Enron. Yes, some firms are simultaneously issuing debt and repurchasing equity, but that’s what you do when your shares are cheap, not when your shares are expensive.

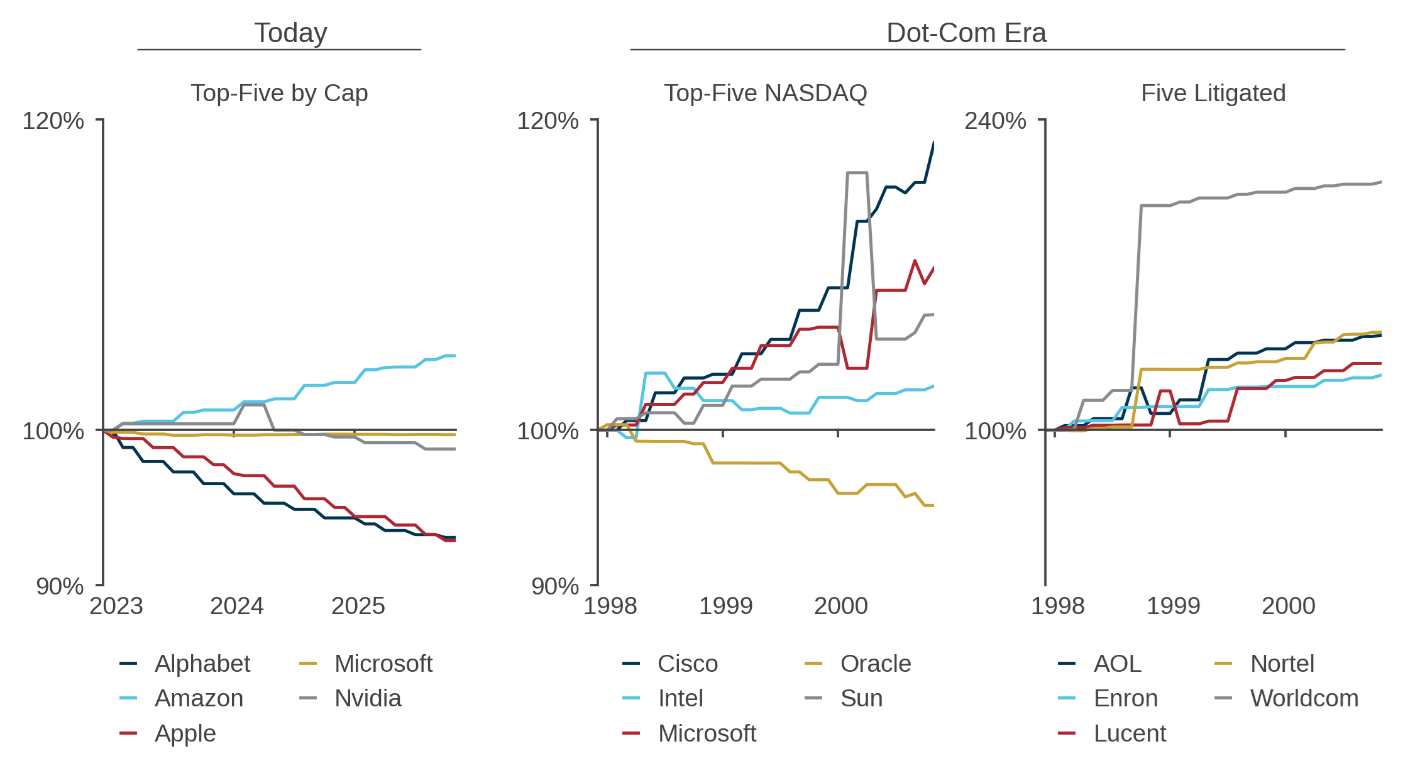

Figure 1: Issuance – Today Versus Dot-Com Era

Shares outstanding normalized to 100 at start of relevant period

Let’s start by looking at the current situation. The leftmost panel of Figure 1 shows shares outstanding data for the five largest U.S. stocks as of November 2025. Net issuance by firms can be measured by (split-adjusted) share count. When share count goes up, the firm is issuing on net. When share count goes down, the firm is repurchasing on net.

Figure 1 shows that only one of today’s largest stocks is issuing equity, with the other four repurchasing over the past three years. This pattern is representative of today’s U.S. stock market, which, as I’ve previously shown, has been (on net) repurchasing about one percent of total shares per year. The largest firms today are repurchasing equity. They’re acting like they believe their shares are cheap.

Now let’s look at the tech-stock bubble. The middle panel of Figure 1 shows the five NASDAQ stocks with the highest market capitalizations as of March 2000: Microsoft, Cisco, Intel, Oracle, and Sun Microsystems.[5]

At the peak of the bubble, four of these five firms have increased share count. Only one firm (Oracle) was a net repurchaser as of March 2000. In 2000, top technology firms were issuing equity, in line with the aggregate stock market. That’s the mirror image of today.

Last, let’s consider a different sort of top-five ranking: the five technology stocks of the tech-stock bubble that subsequently paid the largest settlements in class-action lawsuits alleging accounting fraud. The rightmost panel in Figure 1 shows issuance for the five stocks with the highest dollar amount of securities-fraud litigation settlements: Enron, WorldCom, Nortel, AOL, and Lucent. I’ve previously discussed Lucent as an example of the circular financing of the tech-stock era.

All five of these stocks were increasing share count from 1997 to 2000, with WorldCom’s share count more than doubling thanks to its merger with MCI in 1998.[6] As you can see, accounting skullduggery and obfuscatory off-balance-sheet transactions go hand-in-hand with equity issuance. Figure 1’s rightmost panel looks nothing like its leftmost panel.

How can you tell if something’s a Ponzi scheme? Follow the money. A Ponzi scheme raises new money to pay earlier investors. Thus, if something is paying out more dollars than it’s taking in, it’s not a Ponzi scheme. As of 2025, the U.S. stock market is a cash-generating machine, distributing cash via repurchases and dividends. That doesn’t sound like a Ponzi scheme to me.

Perhaps there’s a giant Ponzi scheme in private equity or private credit. Perhaps the repurchases we see in public equity markets are being funded by unsustainable borrowing by corporations. If so, that’s certainly different than Enron and the financial chicanery of the tech-stock bubble.

Today’s AI firms resemble neither the fraudulent firms (such as Enron) nor the horrifically overpriced firms (such as Cisco) of 2000. I doubt the stock market is in a bubble. If it is, it’s a different animal from the tech-stock bubble.

Endnotes

[1] "AI has a cargo cult problem," The Financial Times, October 17, 2025.

[2] “It’s Giving Enron,” The Future, Now and Then, October 14, 2025.

[3] “The seven deadly sins of corporate exuberance,” The Economist, November 12, 2025.

[4]"Debt Has Entered the A.I. Boom," The New York Times, November 8, 2025.

[5] References to this and other companies should not be interpreted as recommendations to buy or sell specific securities. Acadian and/or the author of this post may hold positions in one or more securities associated with these companies.

[6] AOL’s merger with Time Warner is not reflected in Figure 1,because the merger took place in 2001.

Don't miss the next Acadian Insight

Get our latest thought leadership delivered to your inbox

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.