Quick Take: Does decarbonization require betting against oil?

Rising oil prices exposed dormant risk in decarbonization strategies

The conventional approach to portfolio decarbonization divests from fossil fuel-heavy industries, typically inducing negative active bets on oil prices and energy stocks.

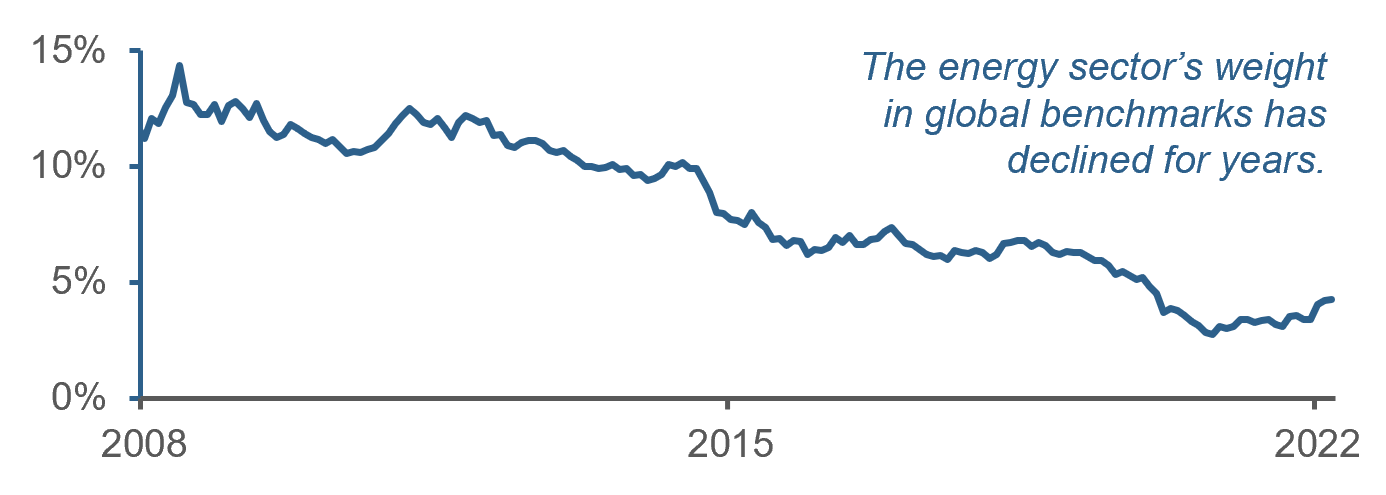

In recent years, such positioning looked benign or even appealing to many investors as the energy sector’s benchmark weight shrank (top chart) as 1) technology stocks surged, and 2) the emergence of shale supply, COVID, and the Saudi-Russia oil price war put downward pressure on crude.

But risks associated with broad exclusions resurfaced as oil prices first rose in late 2021 and then spiked when Russia invaded Ukraine.

Investors have alternatives

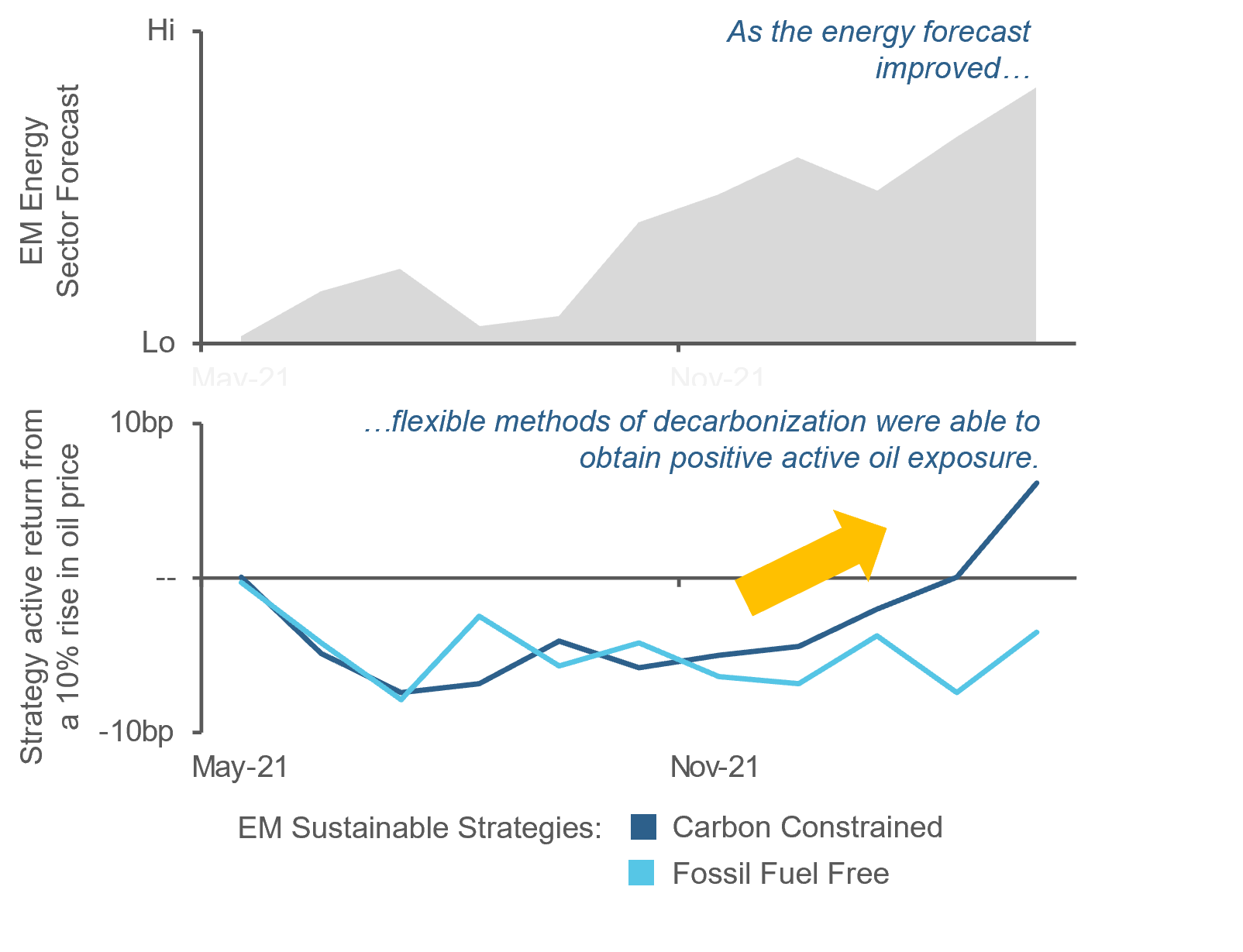

For sustainable investors who are concerned about risks of rigid negative oil price exposure, there are alternatives. Instead of broad divestment, constraining the portfolio’s total carbon exposure provides greater flexibility to decarbonize through stock selection or sector reallocation, even allowing for positive energy-related positioning when prospects look favorable.

To illustrate, the bottom chart compares the active oil exposure of an Emerging Market “carbon constrained” strategy, which restricts portfolio carbon exposure1 and only selectively divests high emitters, to a “fossil fuel free” strategy that employs similar carbon exposure restrictions but also broadly divests companies that own fossil fuel reserves. As the energy sector forecast improved in 2021, the carbon constrained strategy’s active oil beta rose and became positive. In contrast, imposing broad divestment meant that the fossil fuel free strategy maintained a negative oil price beta. (Both strategies achieved similar reductions in carbon exposure.)

The example highlights that investors have alternatives in constructing sustainable strategies. Nuanced portfolio construction can help to balance responsible investing and financial objectives.

Shrinkage of the Energy Sector: Weight in MSCI ACWI Index

Oil Price Forecast and Active Oil Exposures

Don't miss the next Acadian Insight

Get our latest thought leadership delivered to your inbox

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.