Constructing Superior Sustainable Portfolios

Key Takeaways

- Sustainability investors seek exposure to responsible investment (RI) or environmental, social and governance (ESG) themes that can influence portfolio positioning.

- Incorporation of Sustainability objectives into investment strategies is often complicated by limited ESG data coverage and murky trade-offs between RI and investment attributes.

- Acadian’s quantitative investment process is distinctively well-suited to confront these challenges, more precisely aligning implementations with Sustainability goals while improving investment outcomes.

Table of contents

August 2019

Over the past decade, investors have pursued a growing range of RI objectives. Increasingly, investors recognize the alpha potential and risk mitigating properties of RI solutions. In addition, Sustainability investors often prefer exposure to companies with strong ESG practices even if they don’t view those attributes as additive to investment performance, perhaps driven by a Sustainability-focused mission or regulatory requirements. Regardless of their motivations, RI- sensitive organizations must still meet their fiduciary investment obligations.

In achieving Sustainability objectives, the choice of implementation approach is crucial. ESG investing often involves challenges, including poor data coverage and murky trade-offs between portfolios’ RI and investment attributes. In this note, we demonstrate how the sophisticated quantitative investing process is distinctively well-suited to confront these challenges, bringing to bear a broad investment universe to increase flexibility in stock selection, data science techniques that expand and enrich the ESG information set, and systematic portfolio construction to reduce unintended risks and costs. We also provide a sense of the investment impact associated with many prevalent Sustainability objectives.

Sustainable Investing: One Size Doesn’t Fit All

Investors vary in terms of their Sustainability objectives. Their focuses may relate to either business products or practices:

- Products: Companies that produce or distribute objectionable goods or services. Common examples include tobacco, weapons, and coal. The complexity involved in identifying such firms depends on how the criteria are specified. For example, while conditions expressed in terms of third-party industry classifications, e.g., GICS, tend to be straightforward, other conditions, such as revenue contribution thresholds, often involve imprecise definitions, unreliable data sources, and ongoing monitoring.

- Practices: Companies with poor ESG-related business policies and procedures identified on the basis on one or more criteria, such as labor standards, climate change, and cyber security. It is often more difficult to find reliable and comprehensive data to support practice-based than product-based ESG implementations. Developing the required data may require material analysis and enrichment of readily available information. As well, companies’ commitment to Sustainability practices varies over time, meaning that practice-based assessments tend to require regular updating.

Sustainability investors also vary in their implementation preferences. Some favor restrictions through divestment, i.e., strictly avoiding or capping exposure to any company whose products or practices are inconsistent with their Sustainability objectives. Others choose to tilt their portfolios, targeting exposure to one or more ESG attributes in aggregate across all holdings but without placing limits on individual securities. One prevalent example of a portfolio tilt would be capping portfolio carbon emissions relative to the benchmark. Investors can also apply tilts to boost portfolio exposure to beneficial Sustainable practices, such as renewable energy and clean technologies.

Interestingly, while exclusions and tilts may seem qualitatively different from the investor’s perspective, they represent quite similar problems from the perspective of a quantitative portfolio construction approach.

Benefits of a Quantitative Approach in ESG Investing

The optimal Sustainable solution depends on both RI and financial objectives. In many cases, flexible quantitative tools can improve outcomes. Even with respect to divestment, which may seem a straightforward exercise, sophisticated techniques can play a significant role. First, a sophisticated quantitative process better informs and broadens the opportunity set. For example, in evaluating business practices and analyzing product offerings, Acadian employs modern data science tools including textual analysis to determine appropriate classifications. As another example, we employ imputation techniques to estimate Sustainability-related data items for companies where disclosure is missing. Our other tools to augment the information set include machine learning, data scraping, and direct engagement.

Second, sophisticated, quantitative portfolio construction can inform how exclusions affect a strategy’s risk characteristics and how to best rebalance or augment the portfolio as a result. In the case of tilts, our advanced portfolio construction tools provide a disciplined framework to assess aggregate exposure to one or more ESG-attributes of interest and seek to make optimal, simultaneous adjustments to control them while limiting both costs and impact on investment attributes. Quantitative portfolio construction is designed to optimally substitute excluded stocks that are high-alpha and low-risk with a set of RI-acceptable securities that has similar return and risk characteristics. In this process, it is valuable to have a broad universe of securities from which to draw. This optimization-based approach contrasts with the simplistic method that simply re-weights the remaining portfolio after restricted stocks are removed.

The following three case studies demonstrate the value of the quantitative investing approach in varying RI contexts.

Case Study #1: A “Do No Harm” Exclusion: Tobacco

An increasingly common Sustainability objective is divestment of tobacco companies. In imposing this restriction, a broad investment universe helps to limit the impact on portfolio risk and return characteristics by providing flexibility in stock substitution.

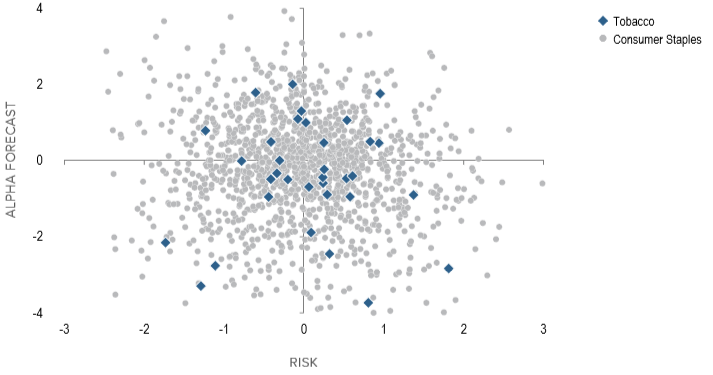

To illustrate the benefit, Figure 1 presents our return forecasts (on the y-axis) and sector-relative betas (on the x-axis) for Consumer Staples stocks in our All-Country investable universe.1 The blue diamonds represent tobacco companies, while the circles represent the remaining securities in the sector.

The chart highlights the number of stocks in our investment universe that are available to serve as ready substitutes for tobacco companies – securities from the same sector and with similar alphas and risk exposures. It’s easy to overlook that the quantitative investment process makes this visualization possible, by generating rich alpha forecasts for a broad-investment universe. Further, while in this example we’ve reduced the assessment of risk to beta, a single number, in practice we employ a variety of conventional and proprietary risk metrics. Systematic risk modeling makes this information available, and sophisticated portfolio construction exploits it in a disciplined and efficient manner.

Figure 1: Alpha and Risk Characteristics: Consumer Staples Sector

Stocks within Acadian’s All-Country Investment Universe

*As at December 31, 2018. Min cap of USD100m. Alpha Forecast based on Acadian proprietary models. Risk represents the sector-relative (cross-sectionally scored) betas to the cap-weighted index. Source: Acadian. The information provided is for illustrative purposes only based on proprietary models. There can be no assurance that the forecasts will be achieved.

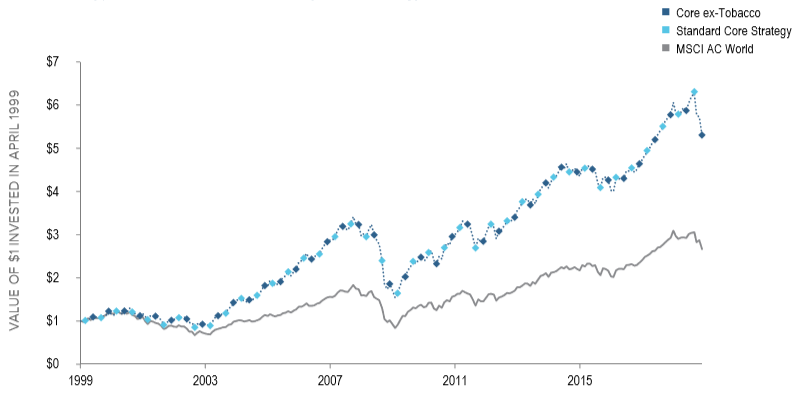

Figure 2: Hypothetical Impact of Tobacco Exclusion Applying Quantitative Investing Method

Past 20 Years, Hypothetical Acadian All-Country Core Strategy, MSCI ACWI Benchmark

Hypothetical portfolios based on an Acadian ACW long only strategy from Jan 1999 to Dec 2018. Initial AUM of USD500m. ACW universe with $100m market cap minimum. Exclusion is Based on Tobacco Industry Classification. Source: Acadian, MSCI. For illustrative purposes only. This is meant to be an educational illustrative example and is not intended to represent investment returns generated by an actual portfolio. The Carbon-Unrestricted, Imputed, and Restricted portfolios we have created for educational illustrations and include unique sustainability criteria. The hypothetical results do not represent actual trading or an actual account but were achieved by means of retroactive application of a model designed with the benefit of hindsight for the period specified above. Results are gross and would be reduced by advisory fees. Results reflect transaction costs and other implementation costs. Reference to the benchmark is for comparative purposes only. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit. Index Source: MSCI Copyright MSCI 2019. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI.

In Figure 2, we demonstrate the hypothetical performance impact of our systematic approach to tobacco exclusion on a hypothetical Acadian active All Country World strategy over the past 20 years. Over this period, our unrestricted investment portfolio would naturally invest in tobacco companies when they exhibit attractive fundamentals. In a tobacco-free portfolio, the process would, roughly speaking, replace tobacco companies with securities that have similar alpha and risk characteristics. As shown in the chart below, the performance of the two strategies is visually indistinguishable, demonstrating the effectiveness of our substitution capability.

Case Study #2: Implementing a Carbon Tilt: Imputing Data for Non-reporting Firms

Climate risk is an increasingly pertinent RI theme. Rather than brute divestment, we find that many investors prefer a solution that tilts their portfolio towards a lower overall carbon emissions footprint than the benchmark’s.

In applying an emissions tilt (as well as other implementations), it is critical to have carbon data covering a broad universe of stocks. Unfortunately, the vast majority of companies does not report emissions; in fact, only approximately 2,500 firms in Acadian’s 40,000 stock universe do so. One way of dealing with this problem is to restrict the investable universe to reporting companies, but that reduces available breadth by over 90%. A more sophisticated approach is to impute emissions information for non-reporting firms. To do so appropriately requires additional quantitative tools and expertise.

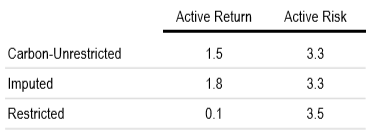

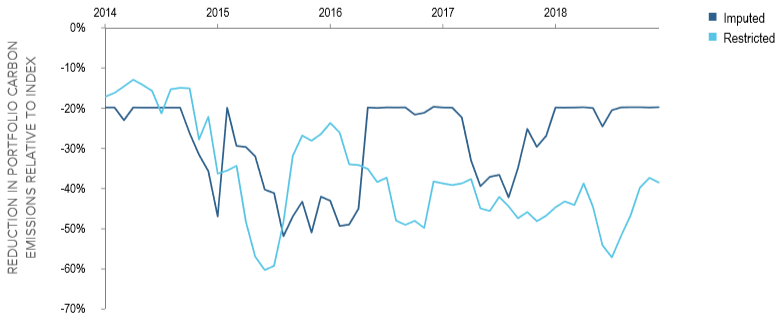

Table 1 and Figure 3 demonstrate benefits of an imputation approach based on Acadian proprietary carbon data modeling. Specifically, we compare the hypothetical historical performance of “Restricted” and “Imputed” implementations for a hypothetical Acadian active ACWI strategy since 2014. We choose this starting date because it represents the point in time at which adequate carbon data became available to support emissions-based investing, broadly speaking. In the hypothetical portfolio, we target a 20% reduction in carbon emissions relative to the MSCI ACWI benchmark.

As shown in Table 1, the Imputed approach meaningfully outperforms the Restricted one. Limiting the universe by only allowing investment in carbon-reporting companies materially constrains the ability to maximize alpha exposure, as reflected in negligible realized active returns for the Restricted implementation (0.1% annualized). The Imputed strategy, in contrast, generates materially higher annualized active hypothetical returns of 1.8% per year.* This also happens to represent modest outperformance relative to the unconstrained strategy, largely due to the carbon constrained portfolio’s lower allocation to the energy sector.

Further examination of the results highlights other drawbacks of the Restricted approach. Table 1 shows a modest increase in the Restricted implementation’s active risk relative to both the baseline strategy and the Imputed version. Figure 3 highlights that while both methods achieve meaningful carbon reduction on average, early in the historical exercise the hypothetical Restricted approach cannot achieve the targeted 20% reduction, because it doesn’t have access to a broad enough investment universe to meet the carbon constraint in combination with financial criteria.

Table 1: Hypothetical Carbon Reduction Outcomes: Imputation versus Restriction

Percent, Annualized. Hypothetical Acadian Active Strategy Benchmarked to MSCI ACWI Index.

*Hypothetical portfolios based on an Acadian ACW long only strategy from Jan 2014 to Dec 2018. Initial AUM of USD500m. ACW universe with $100m market cap minimum. Reported carbon emissions data supplied by MSCI CarbonMetrics. Imputed carbon data uses Acadian’s proprietary estimation model. Source: MSCI, Acadian. For illustrative purposes only. This is meant to be an educational illustrative example and is not intended to represent investment returns generated by an actual portfolio. The CarbonUnrestricted, Imputed, and Restricted portfolios we have created for educational illustrations and include unique sustainability criteria where applicable. The hypothetical results do not represent actual trading or an actual account but were achieved by means of retroactive application of a model designed with the benefit of hindsight for the period specified above. Results are gross and would be reduced by advisory fees. Results reflect transaction costs and other implementation costs. Reference to the benchmark is for comparative purposes only. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit. Index Source: MSCI Copyright MSCI 2019. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI.

Figure 3: Reduction in Carbon Emissions: Imputation versus Restriction

20% Target Reduction, Hypothetical Acadian Active Strategy, MSCI ACWI Benchmark

See Table 1 for a description of the methodology for hypothetical strategies. Portfolio carbon emissions calculated as portfolio weighted total company scope 1 + 2 carbon emissions Source: MSCI CarbonMetrics, Acadian. For illustrative purposes only. This is meant to be an educational illustrative example and is not intended to represent investment returns generated by an actual portfolio. The hypothetical results do not represent actual trading or an actual account but were achieved by means of retroactive application of a model designed with the benefit of hindsight for the period specified above. Results reflect transaction costs and other implementation costs. Results may not reflect the impact that material economic and market factors might have had on the adviser’s decision-making if managing actual client assets, and do not reflect advisory fees or their potential impact. Reference to the benchmark is for comparative purposes only. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit. Index Source: MSCI Copyright MSCI 2019. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI.

Case Study #3: Minimizing Unintended Risks in Implementing a Composite ESG Restriction

Simultaneously applying several Sustainability considerations raises the prospect of material changes to portfolio alpha and risk characteristics. This case study highlights the value of our systematic approach in maintaining optimal factor exposures in such contexts.

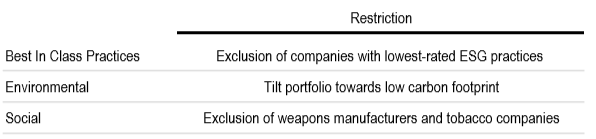

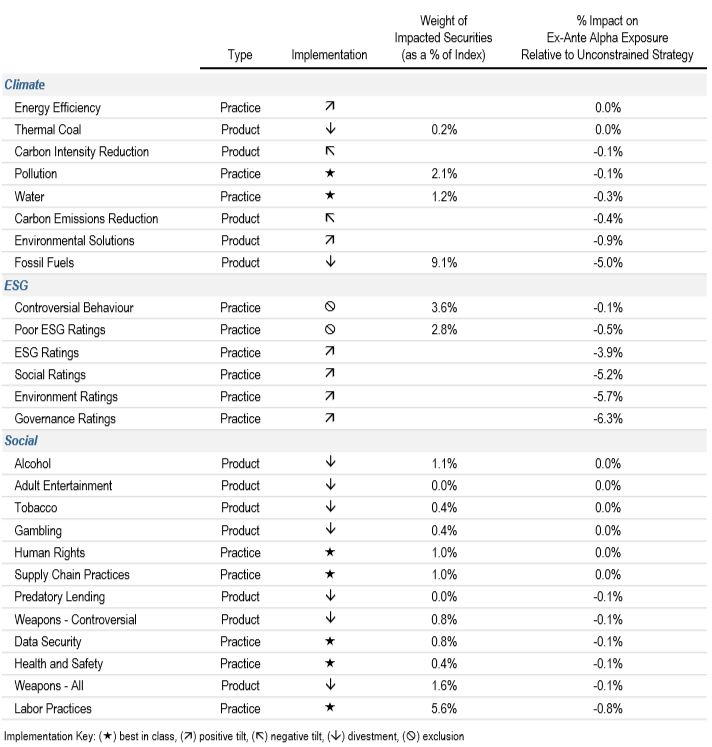

To illustrate, Table 2 presents a common set of Sustainable exclusions and tilts. Their simultaneous imposition requires a meaningful reduction in the investable universe.

We compare two potential methods of constructing portfolios that simultaneously satisfy all of these restrictions, which we label “Reweighted” and “Optimized.” For both, the process begins by excluding the designated companies from the investable universe. The simple Reweighted approach then proportionately redistributes assets freed up by the exclusions across the remaining portfolio holdings, keeping their relative weightings unchanged. In contrast, the Optimized approach creates a new portfolio by maximizing forecasted alpha subject to multifaceted risk constraints with awareness of trading costs. In doing so, it makes use of a broad investment universe to add new ESGadmissible stocks to the portfolio that also help to best achieve investment objectives.

Figures 4-6 demonstrate the benefit of the Optimized approach, again in the context of a hypothetical Acadian ACWI strategy from January 2009 to December 2018. Similar to the prior case study, we choose the start date based on availability of sufficient RI data on which to base such strategies.

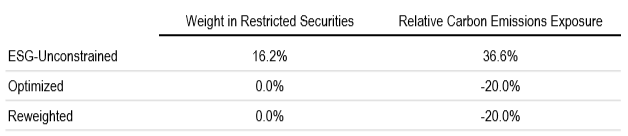

The combination of restrictions is material. On average over time, companies that fail the ESG criteria comprise 5.4% of the unconstrained strategy (a 2.3% average underweight to the cap-weighted index). Their weighting reaches a high of 16.2% in October 2013, a period in which the strategy has higher exposure to carbon emissions than the benchmark.

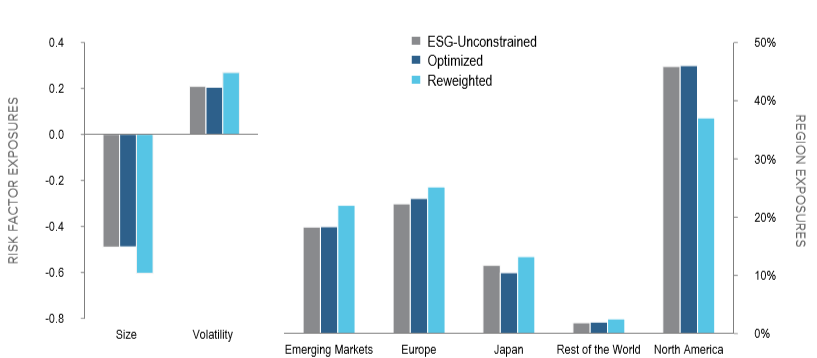

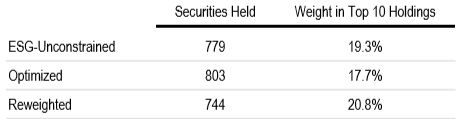

Figures 4 and 5 show that while both the hypothetical Reweighted and Optimized ESG implementations meet their Sustainability targets, the Optimized approach is materially more effective at controlling risk factor and regional exposures. The charts in Figure 5 compare characteristics of the ESG-unconstrained, Reweighted, and Optimized portfolios during October 2013, showing that the systematic optimization results in materially smaller deviations in risk factor and sector exposures from the baseline unconstrained strategy. Further, Figure 6 shows that the Optimized portfolio holds more stocks and is less concentrated than the Reweighted version (as well as the ESG-unconstrained strategy), reflective of the benefits of the expanded investment universe in managing the risk factor exposures, stock specific risks, as well as trading costs.

Table 2: Representative Composite ESG Strategy Criteria

Source: MSCI, Acadian.

Figure 4: ESG Exposures—Reweighted versus Optimized Implementations of Composite ESG Restriction

Hypothetical Acadian Active Strategy, ACWI Benchmark, October 2013

Hypothetical portfolios based on an Acadian ACW long only strategy from Jan 2009 to Dec 2018. Initial AUM of USD1000m. ACW universe with $100m market cap minimum. Reported carbon emissions data supplied by MSCI. Imputed carbon data uses Acadian’s proprietary estimation model. Restricted securities identified by MSCI. Source: MSCI, Acadian. For illustrative purposes only. This is meant to be an educational illustrative example and is not intended to represent investment returns generated by an actual portfolio. The hypothetical results do not represent actual trading or an actual account but were achieved by means of retroactive application of a model designed with the benefit of hindsight for the period specified above. Results reflect transaction costs and other implementation costs. Results may not reflect the impact that material economic and market factors might have had on the adviser’s decision-making if managing actual client assets, and do not reflect advisory fees or their potential impact. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

Figure 5: Risk Factor and Regional Exposures: Reweighted and Optimized Implementations of Composite ESG Restriction

Hypothetical Acadian Active Strategy, ACWI Benchmark, October 2013

See Figure 4 for a description of the methodology. Source: Acadian. For illustrative purposes only. This is meant to be an educational illustrative example and is not intended to represent investment returns generated by an actual portfolio. The hypothetical results do not represent actual trading or an actual account but were achieved by means of retroactive application of a model designed with the benefit of hindsight for the period specified above. Results reflect transaction costs and other implementation costs. Results may not reflect the impact that material economic and market factors might have had on the adviser’s decision-making if managing actual client assets, and do not reflect advisory fees or their potential impact. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

Figure 6: Portfolio Composition: Reweighted versus Optimized Implementations of Composite ESG Restriction

Hypothetical Acadian Active Strategy, ACWI Benchmark, October 2013

See Figure 4 for a description of the methodology. Source: Acadian. For illustrative purposes only. This is meant to be an educational illustrative example and is not intended to represent investment returns generated by an actual portfolio. The hypothetical results do not represent actual trading or an actual account but were achieved by means of retroactive application of a model designed with the benefit of hindsight for the period specified above. Results reflect transaction costs and other implementation costs. Results may not reflect the impact that material economic and market factors might have had on the adviser’s decision-making if managing actual client assets, and do not reflect advisory fees or their potential impact. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

The Cost of Sustainability

With our quantitative modeling techniques, we can help investors assess the costs of incorporating a variety of Sustainability restrictions in their portfolios. We can also compare the impact of and construct different types of implementations. As an illustration, Table 3 provides a high-level comparison of the materiality of 26 popular ESG constraints in terms of portfolio weight and ex-ante alpha in the context of a hypothetical ACWI-based active strategy. The results suggest that we can impose nearly all of the constraints with limited performance impact by making use of our broad investment universe, our expansive data coverage, and our sophisticated portfolio construction capabilities.

Table 3: Financial Impact of a Variety of ESG Restrictions

Hypothetical Acadian Active Strategy, ACWI Benchmark, Jan 2009 – Dec 2018

Results based on a hypothetical Acadian ACW long only strategy from Jan 2009 to Dec 2018. Starting AUM of USD1bn. ACW universe with $100m market cap minimum. Exclusions based on MSCI data, where available. Business activity exclusions are based on a 10% revenue threshold. Carbon tilts target a 20% reduction relative to the index. Positive ESG tilts target a 10% increase relative to the index. Business practice exclusions are based on the bottom 5% of companies. For illustrative purposes only. This is meant to be an educational illustrative example and is not intended to represent investment returns generated by an actual portfolio. The hypothetical results do not represent actual trading or an actual account but were achieved by means of retroactive application of a model designed with the benefit of hindsight for the period specified above. Results reflect transaction costs and other implementation costs. Results may not reflect the impact that material economic and market factors might have had on the adviser’s decision-making if managing actual client assets, and do not reflect advisory fees or their potential impact. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

Conclusion

At Acadian, we have a long history of integrating Sustainable considerations throughout our investment process. Our clients have varying motivations for implementing these considerations into their investment strategies. We use our quantitative tools and expertise to assist in defining, implementing, and assessing the impact of these considerations on financial performance. Our sophisticated and flexible quantitative portfolio construction process, combined with a large investment universe and proprietarily-enhanced data coverage, allows for implementation of a wide range of sustainable considerations while managing the consequences for risk and return. We look forward to continued discussion with our investor base about their RI requirements and to sharing more detailed results of the analyses presented here.

Endnotes

- Cross-sectional scoring of the betas horizontally centers the cloud of points around 0 and limits the scaling, easing interpretability of the chart.

Hypothetical Legal Disclaimer

Acadian is providing hypothetical performance information for your review as we believe you have access to resources to independently analyze this information and have the financial expertise to understand the risks and limitations of the presentation of hypothetical performance. Please immediately advise if that is not the case.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.