Climate Change Considerations in Investment Portfolios

Table of contents

November 2015

This month, global delegates will meet to develop a binding agreement to reduce the pace and impact of climate change. This conference marks the awareness that climate change is a concern that may require international legislative action. Regardless of whether an agreement is reached, varying approaches to greenhouse gas (specifically, carbon) reduction will continue to emerge. Whether the implementation is regulatory or market-based, such policies can impact equity investments and deserve investor attention. Acadian offers an array of resources to help asset owners evaluate and address environmental issues. This includes carbon exposure reporting, portfolio-level carbon exposure controls, research on potential carbon-related alpha signals, and shareholder engagement.

Climate Change Negotiation in Paris: What is at Stake?

From November 30 through mid-December, Paris will host the 2015 United Nations Climate Change Conference (COP 21). The objective is to develop a binding agreement that will reduce global greenhouse gas emissions. It will be the 21st annual conference supporting the United Nations Framework Convention on Climate Change, whose goal is to “stabilize greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system.”

The movement to reduce our impact on the environment is motivated by the scientific consensus that rising greenhouse gas emissions, of which carbon based pollutants are the leading contributor, may have catastrophic impact on our global climate. Some cited examples of the impact of climate change include extreme drought (e.g. Syria, Brazil), rising sea levels threatening low lying coastal areas with erosion (such as the Maldives) and higher intensity and frequency of major storms.

There is growing recognition that environmental externalities can impact not only our daily lives but also businesses and investment portfolios. For example, regulatory and market-based responses to climate change can affect business operations and, hence, investment returns. As of today, we can group policy responses into two broad categories:

- Regulation: Some countries favor an approach based on hard limits in terms of emissions. For example, in the U.S., following recent regulation of coal-fired power plants, many utilities foresee earlier-than-originally-expected retirement of such plants and have written down the value of their assets accordingly. Similarly, in 2011, the U.S. updated its “Corporate Average Fuel Economy” (CAFE) standards that require tighter fuel economy standards for automobiles through 2025, and this is materially shifting the industry.

- Market based: under these schemes, companies are allowed at any given point in time a certain quota of emissions that they can trade if they need more or could generate less (“cap and trade” system). This creates a “price” for carbon emissions and, ideally, motivates companies to invest in cleaner technologies. In Europe, emissions are managed by setting a price on carbon, which is dynamically set by a market-based mechanism.

Whether or not the conference achieves its objective of reaching a binding legal agreement, convening international leaders to address the issue marks the potential for increased focus. Regional approaches to greenhouse gas management will likely differ, as will timelines for implementation, but we expect to see further regulation, whether legislative or market-based. Many corporations around the world also foresee further action despite uncertainty about timing and form; as a result, some firms that may be materially impacted by new regulations are calling for resolution. For example, six major oil companies, among them Shell and BP, have proposed the introduction of a global price on carbon.1

Finally, we increasingly see large institutional investors taking action with their own investment portfolios by engaging with or divesting from certain companies.2

How Can Climate Change Management Affect Asset Owners?

There are three primary channels through which COP21, and climate change and its regulation more broadly, may affect investment outcomes and processes:

- Portfolio performance: We would expect regulations that directly restrict or incentivize changes in the business operations of some types of firms to affect their stock returns; whereas there is limited regulation of major commodity producers’ carbon emissions today, risk of future regulatory action may not be priced into current stock prices. For example, an agreement to lower emissions may inhibit some energy companies’ ability to extract resources, effectively de-valuing company reserves. An investor may elect to actively manage this “stranded asset” risk or other forms of exposure to potential regulation; we describe some possible approaches, including a portfolio limit on carbon exposure, below. Investors might also wish to increase exposure to industries that could benefit from changing policies, including promotion of alternative transportation models and energy sources.

- Relationships with stakeholders: Plan beneficiaries may call for more carbon awareness from their funds. In Europe and Australia, in particular, we see significant interest in portfolios that have lower carbon profiles.3 North American, and specifically U.S., beneficiaries have been relatively muted in calling for climate change awareness, but several prominent U.S. college endowments are facing pressure to divest their exposure to carbon assets. Further encouraging responsible investing, the U.S. Department of Labor recently clarified that it does not discourage ERISA plans from investing in such strategies.4

- Reporting requirements: Emblematic of the growing importance of carbon exposure measurement, the 2014 UN Principles for Responsible Investing (PRI) Montreal Pledge calls on signatories to measure the carbon footprint of their portfolios.5 The objective is to facilitate establishment and implementation of targets for carbon reduction. Since then, some countries have also mandated the disclosure of portfolio characteristics on environmental, social, and governance (ESG) issues. For example, France adopted mandatory disclosure in 2015.

How Can Acadian Portfolios Account for Environmental Considerations?

A Signatory of the UN PRI

Acadian became a signatory of the UN PRI in 2009, the first quantitative manager to do so. We believe that responsible investing, including consideration of ESG information, goes hand in hand with traditional investing; company externalities and exogenous factors are material business issues, and it is consistent with our fiduciary duty to account for such non-financial data. The UN PRI has rated our over-arching approach to responsible investing an “A” in the 2015 review period.6

Our disciplined, quantitative investing approach can provide advantages in addressing ESG concerns in a rigorous framework. There are four specific capabilities that Acadian offers to help investors formulate and meet their carbon-related objectives: portfolio level carbon emissions reports, lower-carbon portfolios, alpha research on environmental factors, and shareholder engagement on environmental matters.

Reporting on Carbon Exposure

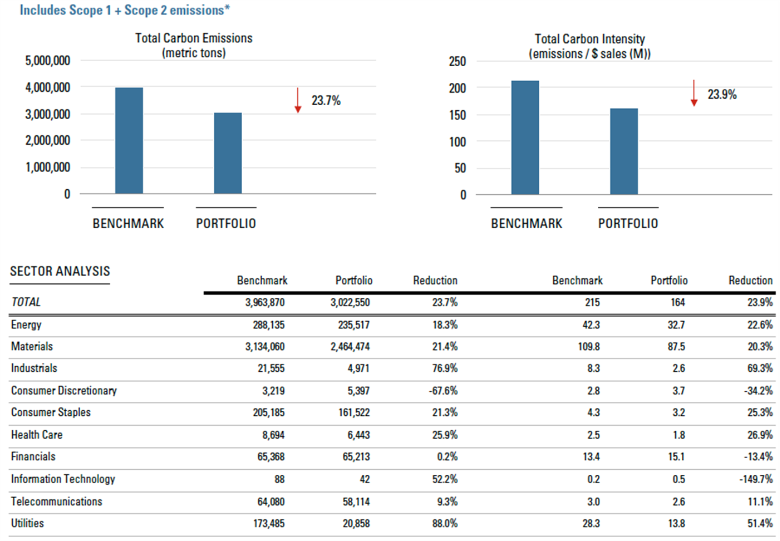

The first step in managing carbon exposure is measuring it. Acadian can provide clients with a report that measures the carbon footprint of an equity portfolio, whether or not it is an Acadian strategy; see Figure 1. This report displays benchmark-relative carbon emissions and “carbon intensity” of the invested portfolio, i.e., emissions divided by sales. The report also displays the exposure’s sector composition.7

Figure 1

Constraining Carbon Exposure While Reducing The Investment Impact

Investors who believe we are transitioning towards an economy that will reward lower carbon companies and industries may wish to tilt their portfolios now towards lower emissions. While simple divestment may create significant tracking error and shrink the opportunity set for finding alpha, we can help investors find a less costly path towards a lower carbon profile. For example, we may be able to target a lower emissions level without outright exclusions, achieving ESG objectives while minimizing the impact on forecasted alpha and risk.

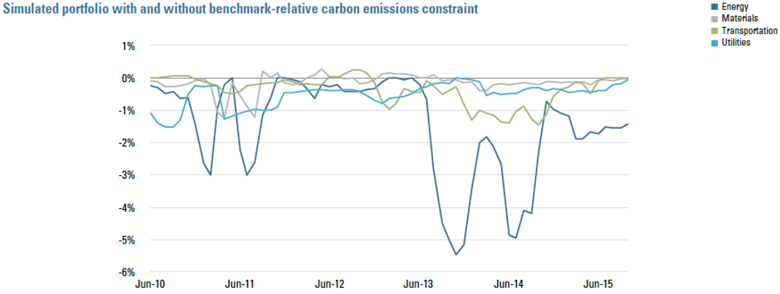

Utilizing our systematic portfolio construction process and broad investment universe, implementing such constraints may turn out to be less costly than investors might fear. Restricting a portfolio’s carbon emissions to a fraction of the benchmark’s may have only a modest impact on the return and risk profiles of a portfolio. Simulations of a global reduced-emissions portfolio, benchmarked to MSCI World, show a modest alpha decline with a negligible impact on risk.8 While alpha is reduced, the negative impact is offset by shifts in industry exposure as well as preferential stock selection to lower-emitting companies within industries. Notably, in the simulation environment, low-emissions portfolios seek lower exposure to high-emissions sectors (Figure 2), including the energy sector, but the overall sensitivity to oil prices remains the same, suggesting that this constraint limits undesirable carbon exposure but is not a simple tilt away from oil.

Figure 2

Our process allows clients to explore tradeoffs of pursuing a policy of moderate to aggressive carbon controls. Adding almost any constraint to portfolio construction will reduce expected alpha, and limiting carbon footprint is no exception. Even so, investors who believe that carbon exposure is a material risk, one that is not incorporated into conventional risk models, may view a carbon-restricted portfolio as a superior risk-adjusted outcome.

Not only can we customize carbon profiles of Acadian strategies, but we can help investors tune the carbon footprint of their overall portfolios as well. Given information on holdings in a multi-manager portfolio, we can evaluate total carbon exposure and develop a “completion” strategy that will target desired investment characteristics subject to a carbon constraint. We work with clients over time to manage carbon targets and restrictions as their objectives vary.

Alpha Signals Using Environmental Data

Climate change regulation may not only create risk, but opportunity as well. To this end, Acadian continues researching environmental policy as a source of alpha to expand our existing family of governance signals.

There are two main reasons why firms’ efforts to reduce carbon footprints may be good for investors. First, companies that increase the efficiency of their facilities and products, or invest more in low-carbon technologies relative to competitors, may be better at recognizing and addressing risks to their core business in the form of increased regulatory costs or liabilities. Such efforts may attract a valuation premium over time, especially if environmental risks become even more prominent. Second, firms that pay more attention to carbon emissions via measurement and reduction policies may generally be doing a better job of controlling costs and achieving operational efficiency than less carbon-aware competitors. In this sense, having a proactive carbon-reduction policy may proxy for better operational and reporting quality.

Acadian is actively researching the potential investment rewards of firms’ efforts to reduce carbon. Although lack of historical data makes such research challenging, we are seeing an increase in the amount and quality of carbon metrics that firms make available. In time, this should play to the advantage of quantitative models, which thrive on “breadth”, i.e., application of signals across large numbers of stocks. What’s more, Acadian’s process allows for modulation of signal weights by industry and region, so we will be able to increase their influence in sectors or geographic areas where we expect particular carbon-related signals to be most effective. Finally, since carbon policies tend to be long-lived, we would expect related signals to have relatively long workout horizons, which we can capture through our process’s Time Horizon Adjustment (THA) factor.

Shareholder Engagement

Acadian participates in shareholder advocacy via proxy voting. We have adopted the voting policy of an industry-leading proxy provider, which casts votes according to principles relating to board structure, accounting policy, and share issuance.9 We provide transparency on voting outcomes to our investors.

To meet increasing interest in environmental considerations, our clients may wish to learn more about adopting an SRI policy. Such policy would advocate for increased disclosure, adoption of UN norms, and generally support shareholder proposals on environmental matters.

Conclusion

Climate change represents both risk and opportunity for investors. Indeed, some industries and companies will benefit from policy initiatives, while others may see their markets erode or become subject to government intervention.

Acadian has been a signatory to the UN PRI since 2009, and we have recognized the importance of ESG factors to our clients for many years.10 We have centered our efforts on three axes:

- Reporting and risk mitigation—we can help investors evaluate the carbon exposure in their portfolio and its underlying sources. We can help investors understand the trajectory of regulation and the potential impact of new restrictions or market-based approaches;

- Alpha generation—we believe that policy response may benefit particular industries and companies. This research is not trivial, however, and we apply the same rigorous standards to development of environmentally based signals as to any other potential source of excess return;

- Shareholder engagement—as investors, we want companies to know that we value long-term sustainability. We are also prepared to pass through our clients’ specific views on ESG matters through tailored voting policies.

Climate change and the responses to it have uncertain implications for investors. We are eager to help our clients assess and address their context-specific risks and opportunities. Please contact us for an in-depth consultation.

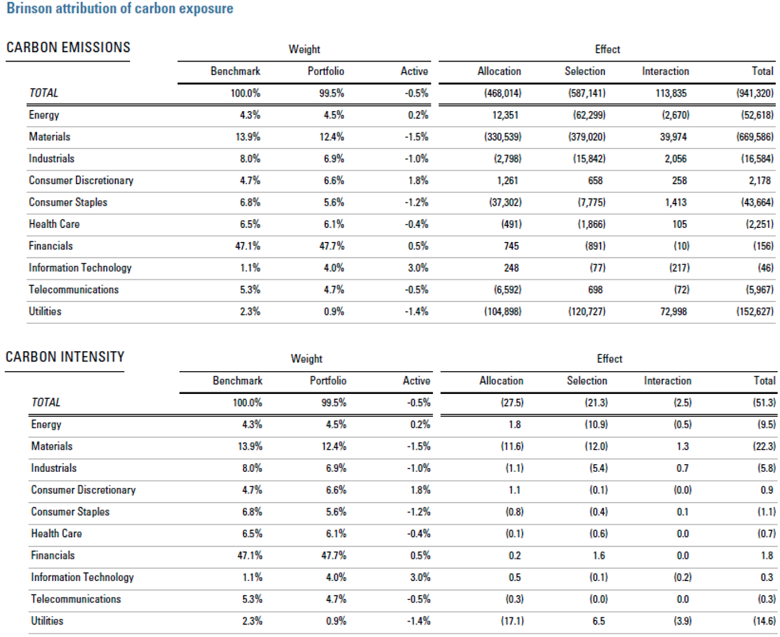

Appendix A

This example shows a portfolio with 941,320 metric tons lower carbon emissions than the benchmark. This profile was achieved through both allocation effects and stock selection; the greatest reduction in carbon emissions comes from the materials sector, driven by both reducing exposure to the sector itself and preferentially selecting lower emitters with the sector. With respect to carbon intensity, the improved profile is driven by similar trends as well as diminished exposure to utilities, which are heavy emitters relative to their size.

Endnotes

- BP. Oil and Gas Majors Call for Carbon Pricing. 1 June 2015. Web. 18 Nov. 2015.

- “Divestment Commitments.” Fossil Free. 350.org. Web. 18 Nov. 2015.

- Kozlowski, Rob. “ABP looking to double ‘cleaner future’ assets by 2020, cut CO2-related investments.” Pensions & Investments. Crain Communications, Inc. 14 Oct. 2015. Web. 18 Nov. 2015. Reeve, Nick. “Dutch Pension to ‘Halve Carbon Footprint by 2020’. ” Chief Investment Officer. Asset International Inc. 17 Nov. 2015. Web. 18 Nov. 2015.

- U.S. Department of Labor. New Guidance on Economically Targeted Investments in Retirement Plans from U.S. Labor Department. 22 Oct. 2015. Web. 18 Nov. 2015.

- “PRI Montreal Pledge.” UNEP Finance Initiative; United Nations Global Compact. Web. 18 Nov. 2015.

- This rating is not indicative of future performance. Acadian Asset Management has been awarded an A grade in the Overarching Approach module of the PRI Reporting Framework. This rating is taken from the assessment report, which is compiled from AAMs responses to the PRI Reporting Framework. The Transparency Report showing these responses is available on PRI’s website.

- Acadian additionally offers a Brinson attribution, shown in Appendix A, to further identify and understand the sources of carbon exposure, whether they are from allocation effects or stock selection within a region or sector.

- Setup: Simulated global carbon constrained portfolio. Reduces total emissions exposure to no more than 60% of MSCI World benchmark’s emissions. Starting from cash. Based on simulations, 6-20-2010 to 10-1-2015. The low carbon portfolio limits the investable universe to securities where carbon emissions data is available. See Figure 2 for full disclosures.

- The details of these principles are available upon request.

- The full implementation of ESG considerations into our investment process remains client driven and client specific.

Hypothetical Legal Disclaimer

Acadian is providing hypothetical performance information for your review as we believe you have access to resources to independently analyze this information and have the financial expertise to understand the risks and limitations of the presentation of hypothetical performance. Please immediately advise if that is not the case.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.