Value Revisited: Executive Summary

Key Takeaways

- Value isn’t dead. Although by certain measures it has endured historically poor performance for more than a decade, there has been significant variation in efficacy across formulations, regions, and market segments.

- We see no reason to abandon value as a long-term component of a multifactor investing approach. We believe refined, adaptive formulations of value are more likely to succeed than simplistic, static approaches.

- We see risks to the market’s “one factor bet on growth” that justify a continued allocation to value.

Table of contents

November 2019

Value’s Performance

Conventional impressions of value’s recent performance are based on the Fama French “HML” factor, a well-known and rudimentary U.S. long-short B/P-based value-minus-glamour portfolio, which has suffered a historically large loss over the past 12 years (as shown in Figure 1 below). But such accounts ignore meaningful variation in value’s performance across dimensions including company size, geography, and signal definition.

Acadian’s Value Philosophy

Acadian’s approach to value reflects three guiding principles:

PRINCIPLE #1: The value premium arises from investors’ behavioral mistakes

We believe it represents an alpha opportunity rather than a risk premium. This behavioral perspective helps to set an expectation that value will be an uncomfortable, contrarian exercise, prone to a pattern of episodic drawdowns and payoffs that will be extremely difficult to time. It also motivates our investment process and research agenda.

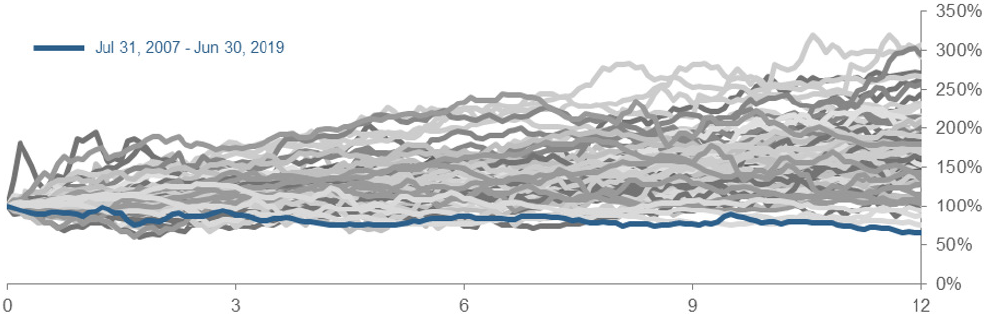

Figure 1: Recent Value Performance in Historical Context

Twelve-year return paths of a hypothetical U.S. B/P-based long-short value-minus-glamour factor portfolio (“HML”) beginning every July since 1926.

Source: Calculated from monthly “HML” factor returns as found in the “Fama/French 3Factors” file at Kenneth R. French data library. Copyright 2019 Kenneth R. French. All Rights Reserved. The HML factor represents returns of a hypothetical long-short portfolio formed from high B/P minus low B/P stocks, controlling for market capitalization. For illustrative purposes only. The chart represents an educational exhibit and does not represent investment returns generated by actual trading or an actual portfolio. Hypothetical returns trading costs, borrow costs, and other implementation frictions and do not reflect advisory fees or their potential impact. For these and other reasons, they do not represent the returns of an investible strategy. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

PRINCIPLE #2: Value should be implemented within a multifactor process

A multifactor approach diversifies sources of alpha, helping to protect against severe or protracted drawdowns in any one factor, including value. Moreover, interacting value signals with quality, momentum, and growth information provides for more precise exposure to genuinely mispriced fundamentals, helping to distinguish them from stocks that are cheap for good reason, i.e., value traps, and to minimize unintended risk exposures. The presence of value in a multifactor approach also helps in gaining exposure to attractive quality, technical, and growth characteristics at a reasonable price.

PRINCIPLE #3: Value implementations should be nuanced and evolving

Simple value strategies employ crude signals. For example, a commonplace design flaw is a failure to distinguish between peer-relative and sector- or country-level valuation differences, which introduces noise and unintended exposures. A strong value process must also evolve to keep pace with changes in industry structures, management practices, and financial reporting (e.g., adjusting for intangibles, which represent an increasingly large portion of firms’ assets). Ongoing research into refinement of signals and other process elements is a central priority of an active, systematic value process.

Drivers of Value’s Recent Performance

We focus the analysis on the U.S., where value’s struggles have been particularly pronounced, but the discussion is relevant to understanding global patterns in value’s performance.

Macroeconomic conditions, market sentiment, and evolving economic structures and accounting practices all have influenced value’s recent performance in the U.S.

Macroeconomic

- Earnings of companies with low P/B multiples tend to be relatively sensitive to economic conditions. The Great Recession and the subsequent slow recovery exposed the vulnerability of cheap stocks’ earnings growth.

- Earnings deterioration of value stocks relative to “glamour” (expensive growth-oriented) stocks in the U.S. between 2007 and 2016 is a major component of value’s underperformance.

- Strong washout and recovery surges can contribute substantially to value returns. Washouts shrink the multiples of glamour stocks and create indiscriminate selling that provides a rich opportunity set of mispricings. This also sets the stage for the kind of economic rebounds that are strong enough to pay off sharply discounted stocks.

- Unlike other periods such as the early 2000s, the post-GFC period has not seen this kind of sharp washout/rebound, thus muting the environment for value returns.

Market Sentiment

- Declining market sentiment has increasingly contributed to the deterioration of value since 2017.

- In 2017 and 2018, investors mainly rewarded already expensive glamour stocks with earnings multiple expansion, even though value stocks generated robust earnings growth.

- We see evidence of a “one-factor bet on growth,” particularly in the U.S., that reflects investors’ extrapolation of prior trends in both fundamentals and the investing environment, as well as pressure to find growth opportunities in an economic climate marked by modest growth.

Evolving Economic Structure And Accounting Practices

- One of the most striking patterns in fundamentals has been the rising profitability of large-cap expensive P/B stocks in the U.S. relative to large cap value and small-cap stocks.

- This helps explain the underperformance of asset-based versus income-based value approaches, as rising ROE will cause stocks to appear more expensive based on B/P than on E/P.

- ROE has increased broadly, with the strongest growth seen in IT, consumer discretionary, and communication services—home of the FAANGs.

- Efficiency gains from globalization and technological advances, as well as deregulation, have helped large cap glamour stocks maintain profitability. Such stocks are also marked by high levels of intangible assets, suggesting that artificially depressed book values may be boosting measured profitability in that market segment.

- Stock buybacks represent another accounting-oriented driver of large-cap ROE growth, at least in the U.S., as they reduce total outstanding shareholder equity and hence boost ROE.

The Outlook for Value

The value premium derives from investors’ misextrapolation of fundamentals, a phenomenon that is deeply rooted in human behavior and that is likely to persist. As such, we believe value remains an attractive and important component of a multifactor investment process.

We believe, however, that simple, static value formulations are increasingly vulnerable to obsolescence. Value formulations that aren’t robust or adaptive to trends in economic structure and financial management practices are vulnerable to bias and noise. We believe that refined and evolving implementations, like Acadian’s, will improve performance over the long-term.

From a tactical perspective, we see a continued allocation to value as justified given risks to growth strategies. While the tepid macroeconomic climate has weighed on value efficacy, conditions can change quickly. What’s more, we see headwinds to large-cap glamour profitability, as FAANGs and similar companies come under increased regulatory scrutiny, threatening the outsized earnings associated with monopolistic positions in emergent industries. In addition, rapidly evolving technologies may afford opportunities for competitors to challenge incumbent business models. We see value’s struggles over the past few years as a market capitulation with respect to profitability, effectively the capitalization of historically high and rising ROEs among already expensive large-cap stocks. Reversion or even stabilization of those ROE trends would remove a material headwind to value.

Hypothetical Legal Disclaimer

Acadian is providing hypothetical performance information for your review as we believe you have access to resources to independently analyze this information and have the financial expertise to understand the risks and limitations of the presentation of hypothetical performance. Please immediately advise if that is not the case.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Don't miss the next Acadian Insight

Get our latest thought leadership delivered to your inbox

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.