FAANG Stocks Underpin New GICS Sector

Key Takeaways

- In October, S&P Dow Jones and MSCI will implement a major GICS overhaul, headlined by expansion and renaming of the Telecommunication Services sector as Communication Services.

- The revisions will noticeably change benchmark indexes’ sector weightings; FAANG stocks Facebook, Netflix, Google (Alphabet) will leave their current sectors for Communication Services.

- The changes will flow through to Acadian’s process via forecasting and portfolio construction channels, although we do not anticipate a material impact on our potential to add value.

Table of contents

June 2018

In November 2017, S&P Dow Jones and MSCI announced the renaming and expansion of its GICS Telecommunication sector. The change recognizes the convergence of telecommunications, media, and internet services that rendered the existing Telecommunication Services sector obsolete.

The sector will be renamed Communication Services, and it will consist of both Telecommunication Services and Media & Entertainment industry groups. As a result, the new sector will absorb companies that facilitate communication and interactivity as well as companies that produce and provide content. In January, S&P Dow Jones and MSCI published a preliminary list of companies that will be reclassified.

In this note, we explain key elements of the changes and how they will likely affect benchmark equity indexes and Acadian’s process.

Rationale For The Change

The revisions to GICS classifications reflect developments in communications industry structure and breadth. First, the creation of a new Communication Services sector acknowledges a dramatic transformation in how people interact and how they consume entertainment and information, which has been associated with a convergence among telecom, media, and internet companies.

Second, for the purposes of financial practitioners, S&P Dow Jones and MSCI contend that the Internet Software & Services industry has become too large and diverse to be useful for analysis or index construction. As a result, this industry will be discontinued in October. Its current members, including Facebook and Alphabet, will be repositioned, with the vast majority finding their new home in the Communication Services sector. Others will migrate to Consumer Discretionary or join new or existing sub-industries in Information Technology.

The New Structure

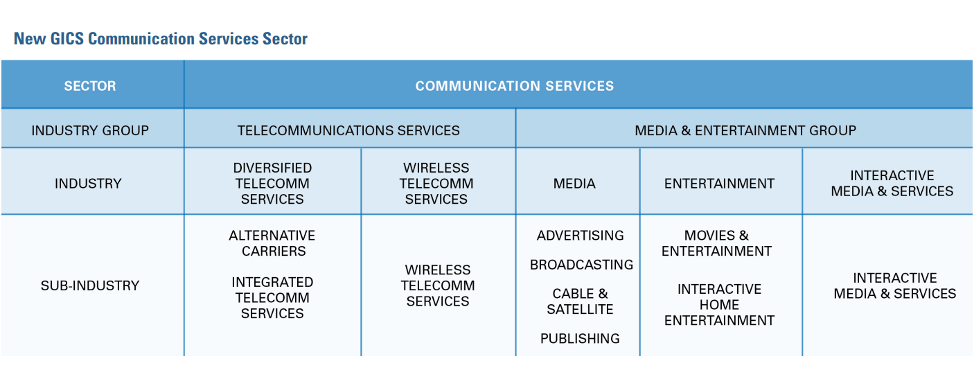

As depicted in Figure 1, the Communication Services sector will include two industry groups, Telecommunication Services and Media & Entertainment. Telecommunication Services will remain unchanged in terms of membership and focus (companies that provide communication services through a fixed-line, cellular, wireless, high-bandwidth and/ or fiber optic cable network).

Figure 1

Media & Entertainment will consist of three industries:

- Media: This will contain four sub-industries from the existing Media industry group in the Consumer Discretionary sector: Advertising, Broadcasting, Cable & Satellite, and Publishing.

- Entertainment: This will be composed of two sub-industries: Movies & Entertainment and Interactive Home Entertainment. The former will migrate from the existing Media industry. The latter will include producers of interactive gaming products (e.g., Activision Blizzard Inc. and Nintendo Co. LTD) and educational software drawn from two existing IT sub-industries, Home Entertainment Software and Application Software.

- Interactive Media & Services: This will consist of a single sub-industry representing companies that provide social media, search engines, photo sharing, and mobile messaging applications. Constituents will be drawn from the existing IT sector’s Internet Software & Services and Application Software sub-industries. It will include some of the largest and most prominent companies, including FAANG stocks Alphabet Inc. and Facebook Inc.

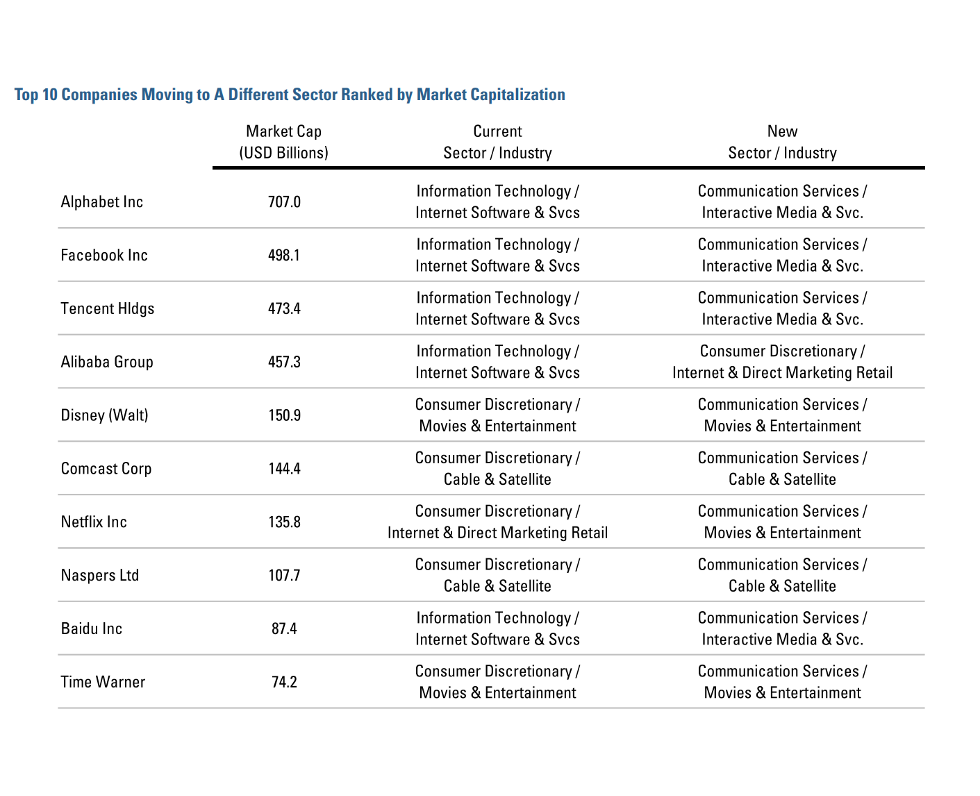

Retirement of IT’s Internet & Software and Services sub-industry will require reclassification of its constituents. These include members of key benchmark indexes, for example 25 stocks in the MSCI World Index (based on April 30, 2018 composition) and 5 stocks in the S&P 500 Index. Figure 2 shows the top 10 affected companies.

Figure 2

Impacts: Benchmark Indexes

The overall set of changes is large enough to materially affect sector compositions of benchmark indexes.

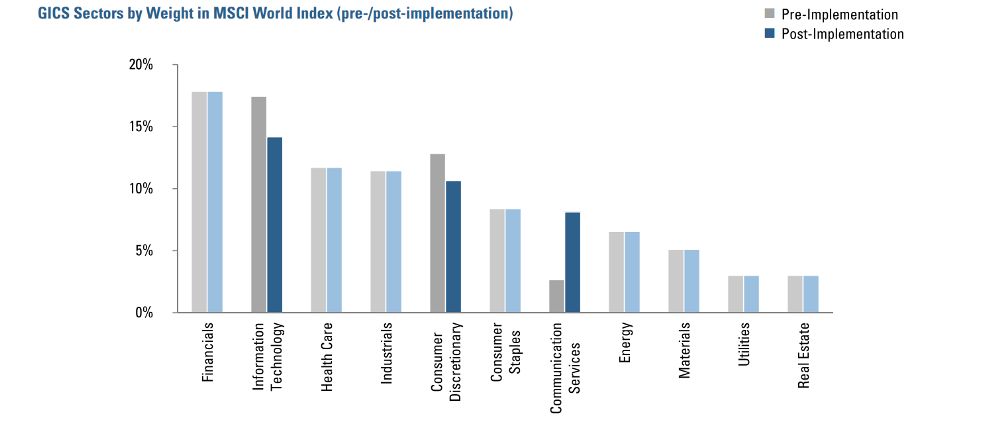

MSCI World: Data from S&P Dow Jones and MSCI indicates that 68 companies within the MSCI World Index will be reclassified. The Communication Services sector will gain 63, 43 from Consumer Discretionary and 20 from Information Technology. In addition, two companies, EBay Inc. and Mercadolibre Inc., will move from the Information Technology sector to the Consumer Discretionary sector.1 As illustrated in Figure 3, these changes will increase the weight of the Communication Services sector from 2.7% to 7.2%, with Facebook and Alphabet alone accounting for a 2.6% increase. Information Technology will fall by 2.5%, dropping to 15%. Consumer Discretionary will lose 2.1%, reducing its weight to 10.7%.

Figure 3

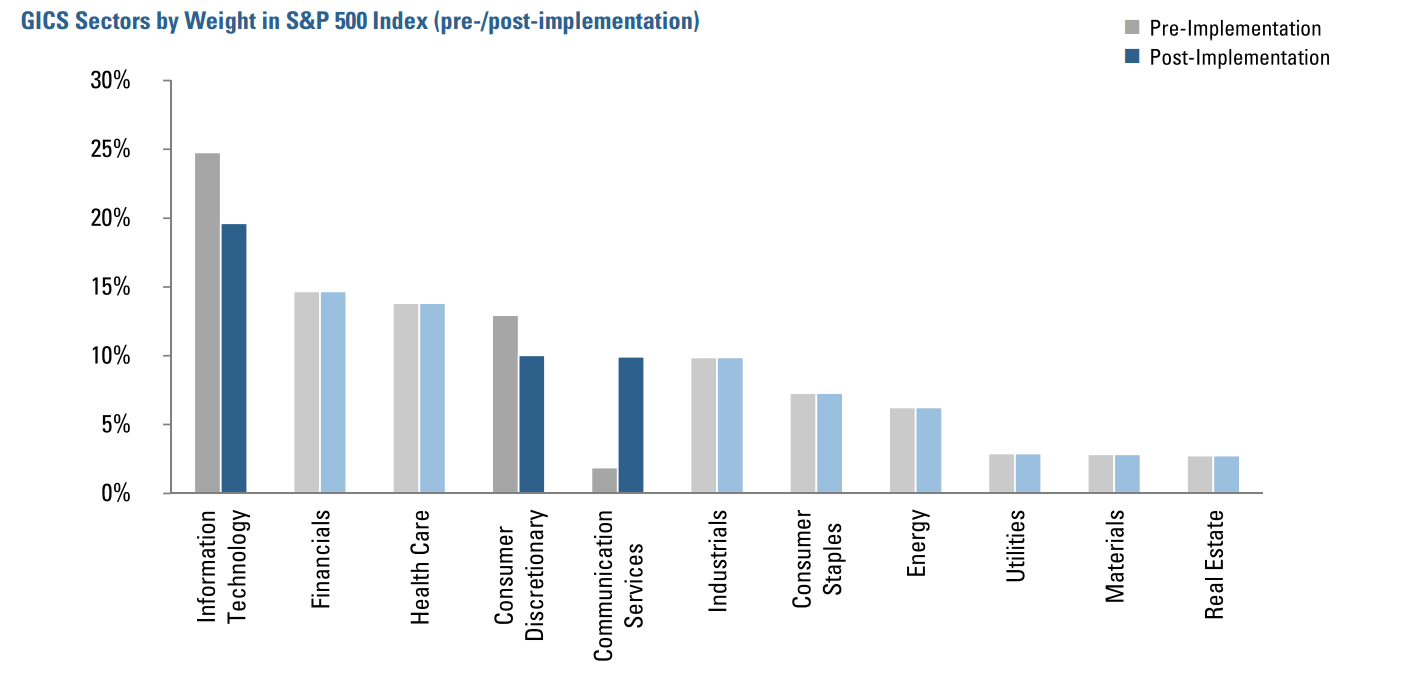

Figure 4

S&P 500: We anticipate that 22 companies will be re-categorized. The Communication Services sector will take 19 of them, 14 from Consumer Discretionary and 5 from Information Technology. Similar to the MSCI World Index, S&P 500’s Information Technology grouping will relinquish EBay Inc. to Consumer Discretionary.2 As a result, the weight of the Communication Services sector will jump from 1.9% to 9.9%, as shown in Figure 4.

Currently, the Telecommunication sector contains only Century Link Inc., AT&T Inc., and Verizon Communications Inc. The addition of Alphabet and Facebook alone will account for a 4.5% increase in weight. Additions of Walt Disney, Comcast, and Netflix from Consumer Discretionary will contribute another 2%. The weight of the Information Technology sector will fall from 24.8% to 19.6% following the reclassification of several large stocks. Consumer Discretionary’s weight will fall from 13.4% to 9.9%.

Impacts: Acadian’s Process

The transformed GICS structure will better align with current economic realities and provide clearer sector, industry, and sub-industry definitions. These changes will influence Acadian’s process through a few channels.

For one, Acadian’s bottom-up stock forecasts are formed on a peer-relative basis, where the peer groups are defined by the intersection of stocks’ regional and industry group affiliations. More precise, economically relevant industry group definitions will change these peer group definitions and should make them more informative. As prominent examples, peer sets based on the new Media & Entertainment industry group will include large internet stocks Alphabet and Facebook. These stocks will no longer influence peer sets based on the Software & Services industry group.3

The GICS changes will also influence our top-down model, which relies on GICS for industry classifications, although we do not expect the changes to have a meaningful impact on our process. Acadian is currently phasing out its single top-down model and in its place, integrating three separate models: country, industry, and country/industry intersection. All three top-down models generate forecasts for developed markets, emerging markets, and frontier markets. We do not expect the new models to be materially impacted by the reclassifications and may be well suited to acclimate to the GICS modifications due to the new models’ tiered stock evaluation approach. Direct comparisons to the new GICS classifications versus the old, in the context of our new top down models, are essentially moot as the new models are being gradually implemented between now and year-end, and therefore will not have any material history with the old GICS classifications.

The GICS reclassifications will also have some impact on portfolio construction, because we constrain portfolios’ active exposures at the industry group and sector levels. Implementation of the reclassifications may cause a one-time increase in turnover in portfolios where the risk controls now “bind” where they had not previously, or vice versa. We will be able to forecast the impact of the changes with greater precision when the full list of affected stocks is announced on July 2, 2018.

Conclusion

As quantitative investment managers, significant consumers of market data, and users of the GICS framework, Acadian welcomes the upcoming GICS

restructuring, which will better align classifications with economic realities. The last significant GICS change was in 2016 when Real Estate became its own sector. By comparison, the current reclassification is more extensive as it impacts more sectors, industry groups, industries, and sub-industries. Despite the complexity of the reorganization, Acadian believes the revised structure will offer more precise, informative, and economically meaningful categories, each populated by a more homogeneous set of companies. We will closely monitor markets as the implementation of the GICS change approaches later this year although the influence of these changes on our process will be minor. We do not expect that they will materially affect our potential to add value.

Endnotes

- Within the Information Technology sector, 3 companies will be repositioned into different sub-industries and therefore do not impact sector weight.

- Two companies will realign within Information Technology sector.

- Importantly, the characteristics, or factors, used in generating peer-relative stock return forecasts will not change as a result of the GICS reclassifications.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.