Crisis and the Active Opportunity Set

Table of contents

May 2020

Introduction

One of the principle objectives of systematic investing is to maintain a dispassionate and disciplined approach through periods of market stress so as to benefit from mistakes that other investors make in the heat of the moment. They include behavioral errors reflecting the influence of emotion, herding, and perceptual biases associated with highly uncertain conditions, as well as price-insensitive trading triggered by margin calls and other forms of forced deleveraging. Does the COVID crisis bear hallmarks of such an environment? Evidence suggests that it does.

How Attractive is the Current Opportunity Set?

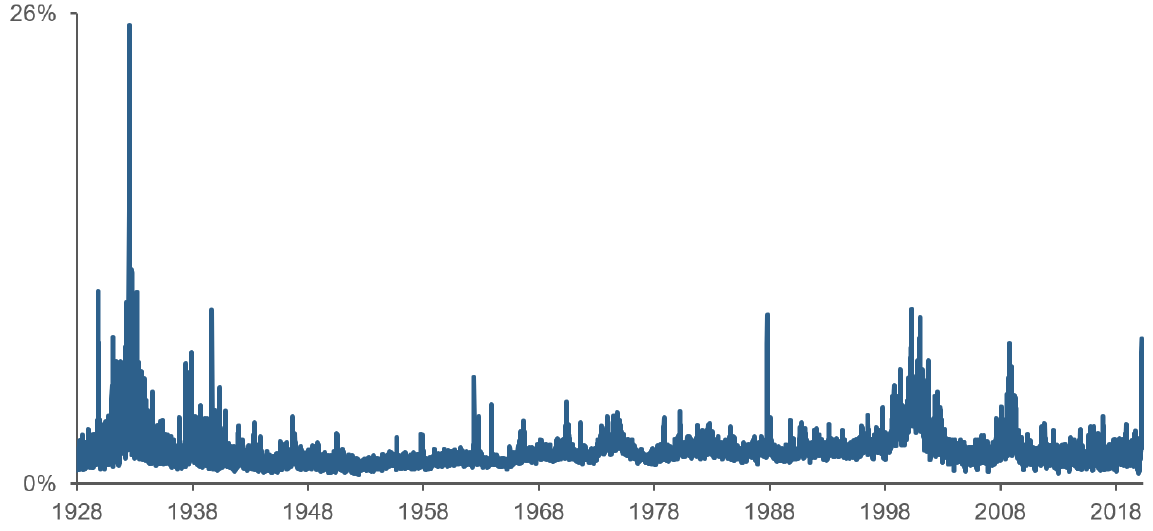

Figure 1 shows that the recent market turmoil generated a high degree of cross-sectional divergence in stock returns.

Figure 1: Returns Dispersion among Large-Cap U.S. Stocks*

Cross-sectional standard deviation of daily returns of largest quintile of U.S. NYSE, AMEX, NASDAQ common stocks with a $2 price floor with clipping of the returns distribution to reduce the effect of outliers. Source: Acadian Asset Management LLC. Based on prices from CRSP® (Center for Research in Security Prices. Graduate School of Business, The University of Chicago. Used with permission. All rights reserved. Crsp.uchicago.edu.). For illustrative purposes only. Past results are not indicative of future results. Investors have the opportunity for losses as well as profits.

* A prior version of the paper contained an incorrect chart. This version has been corrected for clarity and accuracy.

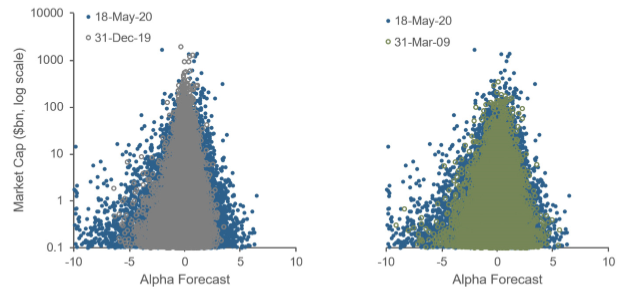

Figure 2: Acadian Alpha Forecast Dispersion — Now vs. Year-End 2019 (left) and GFC (right)

Stocks within Acadian’s All-Country Investment Universe

Stock forecasts are based on Acadian proprietary models. X-axes are truncated at -10/+10. Excludes China A-shares. Min cap of USD100m. Source: Acadian Asset Management LLC. The information provided is for illustrative purposes only based on proprietary models. There can be no assurance that forecasts will be achieved.

Returns dispersion, in and of itself, doesn’t necessarily imply an attractive opportunity set, however. Although unlikely, it might be that returns dispersion entirely reflects rational, informed, precise pricing of the crisis’s divergent impact on earnings prospects and risk across industries, countries, and companies.

But our stock return forecasts, a direct measure of the opportunity set, also show significant dispersion. The forecasts reflect market pricing relative to various fundamental indicators. They also control for industry and region effects, i.e., identifying aberrant prices within reasonably homogeneous peer groups. Figure 2 shows greater cross-sectional range in our forecasts now than at year-end 2019 (left panel) or in March 2009, shortly after the nadir of the GFC (right panel).

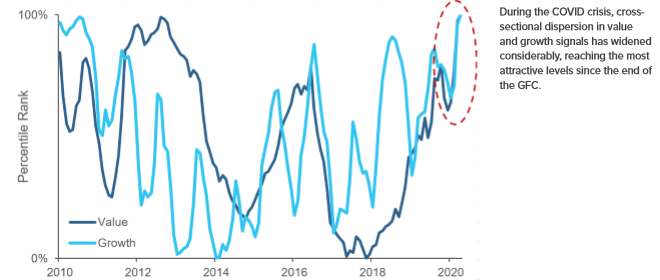

Looking more closely at the sources of this increased forecast dispersion, Figure 3 shows that distributions of value and growth characteristics, each measured on a peer-relative basis, have widened out considerably. This is consistent with heightened uncertainty regarding the crisis’s impact on companies’ earnings generation potential. Value, in particular, shows a considerably more attractive opportunity set than that which typified the post-GFC environment, when many value-focused strategies struggled. The COVID crisis has had less of an impact on dispersion of technical and quality attributes.

Figure 3: Dispersion at the Signal Level — Value and Growth Factor Spreads

Acadian’s All-Country Investment Universe; percentile ranks from 2010 – Apr 2020

Based on Acadian proprietary models. Percentile ranks for each factor spread are calculated within each factor’s own history. Source: Acadian Asset Management LLC. The information provided is for illustrative purposes only based on proprietary models. Investors have the opportunity for losses as well as profits.

Even when forecast dispersion suggests that the opportunity set looks attractive, though, it is always possible that reverberations of noise or additional shocks could temporarily diminish signals’ effectiveness. Nevertheless, based on long-term empirical evidence, we expect that as markets calm and uncertainty abates, investors will focus more clearly on fundamentals, including valuation, balance sheet quality, cash flows, and prospective growth opportunities, correcting mispricings. In the interim, awareness of transaction costs in portfolio construction can help to limit costly churn.

Concentration vs. Quant: Contrasting Relationships with Active Risk

Sophisticated quantitative processes target active risk by taking into account a broad range of market circumstances.1 This implies trading off the amount of active risk taken during “normal” market environments in order to be able to remain fully engaged throughout periods of market stress.

In contrast, during the relatively subdued post-GFC environment, some asset owners who were starved for excess returns in a low interest rate environment turned to concentrated equity strategies. Under a premise that stock pickers who make outsized bets on a few “best ideas” can generate higher absolute returns, concentrated strategies take on higher levels of active risk under ordinary market conditions.

As a result, during crises,concentrated strategies are vulnerable in two respects. First, high levels of active risk that appeal in quiet times may become alarming or unacceptable amid market turmoil. Concentrated managers who pull back under such circumstances to stem losses on individual positions, to reduce risk, or to boost liquidity may miss out on especially attractive opportunity sets.

Second, concentrated strategies, by their nature, have less flexibility to control their exposure to myriad risk factors, including the market, industries, countries, sentiment, and interest rates, just to name a few, and they often don’t seek to measure, let alone manage, such risk factors in the first place. Crises have a knack for revealing unintended positioning, however. So before crises occur, investors who own collections of concentrated strategies would be wise to carefully monitor the overall composition of their holdings for material risk factor exposures.

Conclusion

Our view of quantitative investing is predicated on a dispassionate and long-term investing perspective. It’s naturally well suited to benefit from the mistakes of investors who overextend themselves in quiet periods, creating opportunities for more disciplined investors during crises. Doing so isn’t easy, however. It requires a nuanced and market-aware approach to successfully manage portfolio risk and avoid unintended exposures, to distinguish stock-level mispricings from the appropriate discounting of uncertainty, and to weight signals based on available opportunities. We believe those challenges are well worth embracing.

Endnotes

- This characterization would apply to strategies that don’t try to aggressively time markets or factors. Such approaches would generally test signals across a broad range of market conditions.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.