Investing Responsibly in China

Key Takeaways

- Given the perception that Chinese companies lag peers with respect to environmental, social, and governance (ESG) criteria, many investors are incorporating responsible investing considerations into their assessment of Chinese equities, even if they haven’t prioritized them in other contexts.

- Despite validity to the conventional wisdom, we see evidence of progress in China with respect to ESG issues, driven to a large degree by the government’s reform agenda.

- In our view, ESG considerations represent universally relevant investment criteria and, as such, they influence our China investment process.

Table of contents

August 2018

Introduction

Following MSCI’s recent inclusion of China A-shares in its Emerging Markets index, many investors are evaluating their exposure to Chinese equities. A popular perception that Chinese companies lag with respect to ESG considerations has drawn attention to such issues even from investors that have not pursued ESG-based approaches in other contexts. In this note, we review ESG risks that are particularly prevalent in China, including corruption and human rights. We also highlight areas of ESG-related progress that may be overlooked by investors, such as dramatic improvements in health, education, and standards of living, as well as innovation in renewable energy and green industries. We close with a discussion of how we integrate these considerations into our alpha forecasts for Chinese stocks, and we highlight challenges in engagement.

ESG in China: Challenges & Progress

China faces a unique set of ESG-related challenges, but the government has strong incentives to improve ESG practices in order to promote sustainable growth and social stability.

Environmental

China suffers from rampant air, water, and soil pollution following years of unconstrained growth governed by a weak environmental regulatory framework. Today, China is the largest emitter of carbon dioxide,1 responsible for more than a quarter of total global carbon dioxide emissions. Not only do China’s environmental practices create health risks for citizens, they pose political risk for the ruling Communist Party and economic and financial risk for investors.

In recognition of environmental risks to social and political stability as well as to long-term economic growth, President Xi has prioritized pollution control, setting a 2035 deadline for achievement of a “beautiful China.” To reduce carbon emissions, China has implemented a series of seven pilot emissions trading schemes (ETS) and anticipates being the world’s largest carbon market by 2020. This program enables companies to buy and sell emission allowances and provides incentives to invest in cleaner energy. China joins only a handful of European nations that have established such markets, and it is one of only two emerging markets to have done so. (Colombia is the other.) By this measure, China is one of the most progressive nations with respect to pollution control.

To encourage transparency and accountability, China is requiring its heaviest producers to disclose more information about emissions. The China Securities and Regulatory Commission (CSRC), the country’s analogue to the U.S. Securities and Exchange Commission, issued new guidelines in late 2017 and early 2018.

Further, China is at the global forefront of a number of green industries. China has added solar electric generation capacity faster than any other country to help meet its growing energy demand. Overall, China’s renewable power capacity is more than double that of the U.S. and accounts for roughly one-third of the global total.2China has become one of the largest producers of solar photovoltaic panels. It has become a leader in the manufacture of electric vehicles, representing over 40% of global production as of 2016, and it is cultivating an extensive domestic market.3

Social

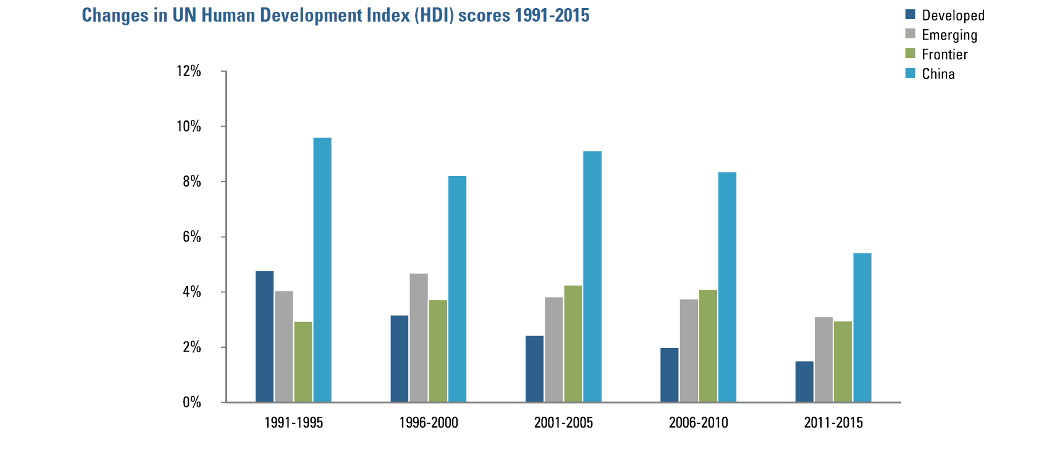

China frequently comes under fire regarding human rights, privacy, intellectual property, and labor issues. Although China lags many countries in such categories, it has shown progress in other areas related to social considerations. For example, standards of quality of life and longevity have improved dramatically in the last few decades. According to a World Bank study, nearly one billion people have risen from extreme poverty in this time.4 China’s recent development in terms of health, standards of living, and education stands out globally. As a summary statistic for social progress, we monitor the United Nations’ Human Development Index (HDI), a composite measure of life expectancy, education, and per capita income. Figure 1 shows that over the past 25 years, China has shown remarkable improvement, vastly outpacing developed, emerging, and frontier market averages. Over the full period, developed market HDI scores gained 15%, emerging markets gained 21%, and frontier markets gained 19%; in stark contrast, China’s HDI score improved by 48%.

This progress on the HDI has transformed the country’s socioeconomic profile. At the beginning of this decade, China’s middle class made up less than 10% of urban households; McKinsey predicts that by 2020, it will represent well over half.5Household net worth has tripled in the last 15 years. The Communist Party considers further reductions in poverty a key to maintaining its support and to achieving the “great rejuvenation.”6

Governance

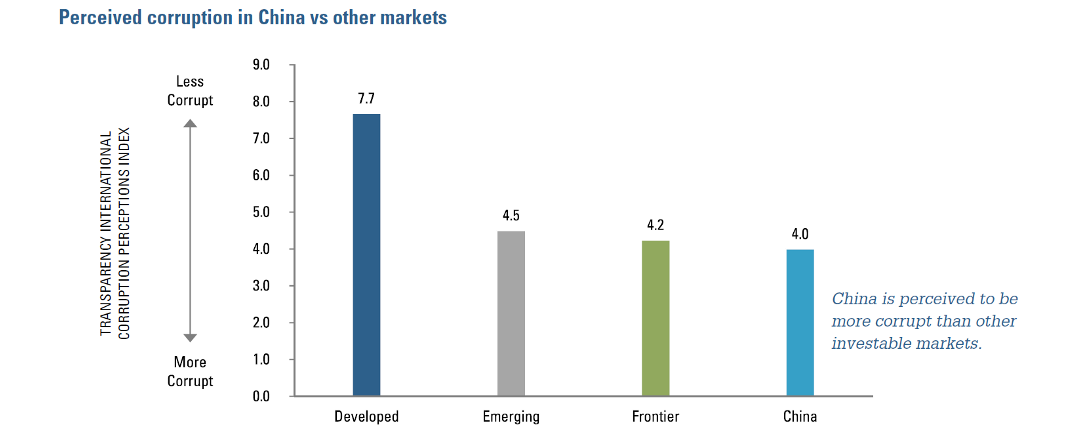

Among all ESG issues raised in relation to China, concerns about governance practices and questionable data tend to be particularly prominent. Against the backdrop of the centralized economy and intrusive regulatory framework, China has a history of poor corruption and transparency indicators. Figure 2, for example, shows poor scores in Transparency International’s corruption ratings between China and other investable countries.

Figure 1

Figure 2

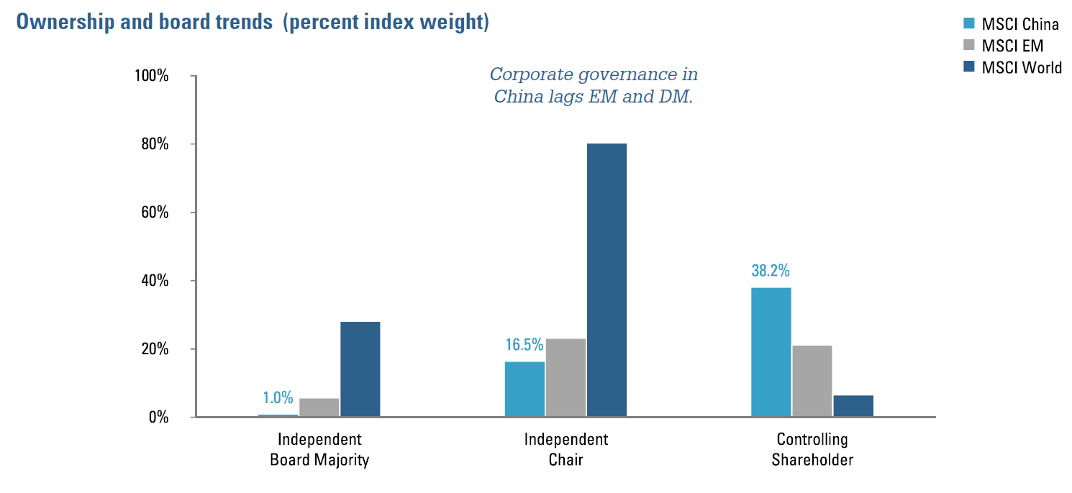

Broad concern about macro-level governance translates to concern at the company level. Corporate governance risk arises from limited shareholder rights, often resulting from the presence of a controlling stakeholder, whether a majority shareholder or a Variable Interest Entity.7 For example, as shown in Figure 3, 38% of Chinese corporates in the MSCI China index, by weight, are dominated by a controlling shareholder as opposed to 17% of companies in the MSCI EM index.8

In particular, the Chinese government represents the controlling stakeholder for state-owned enterprises (SOEs), which represent a larger percentage of market capitalization in China’s equity market than in emerging markets broadly: 50% versus 30%. Chinese corporates lag their EM counterparts in other common areas of strong governance practices, including in having both an independent board majority and an independent board chair.

However, China has made progress over the last few years to improve governance mechanisms. President Xi has launched an anti-corruption campaign targeting companies in industries with high corruption rates. In the private sector, we expect improvement as well, because Chinese regulatory authorities have demonstrated reasonable progress in aligning Chinese governance practices with global standards; evidence of this advancement includes 1) the convergence of IFRS standards and PRC GAAP, 2) a crackdown on insider trading and stock suspensions, and 3) enforcement of rigorous reporting standards, including comprehensive and frequent disclosure.

To further support such progress, one of the objectives of opening the onshore market to foreign investors is to further “institutionalize” it and improve standards of corporate governance. Particularly notable, the CSRC is preparing to require further mandatory disclosures from 2020; early signs indicate that these disclosures may include ESG data.9 Progress is underway, as the National Social Security Fund, China’s largest pension fund, has already acknowledged “responsible investing” as part of its core philosophy in asset allocation.10

Figure 3

Acadian's Approach to ESG in China

We believe that ESG considerations represent universally relevant investment criteria. They influence our China investment process via both alpha factors and investor stewardship.

In our global alpha model, we integrate ESG factors in an effort to ensure that we have a holistic view of investable companies. Examples of ESG considerations relevant to forecasting Chinese equities include:

- Environmental: As the global economy transitions to lower carbon emissions, Acadian seeks to avoid investing in companies that are particularly at risk for stranded assets. As such, we apply a valuation discount to companies that exhibit significant unpriced carbon emissions. Given the extent of carbon emissions by Chinese corporates and the government’s focus on their reduction, we anticipate that carbon taxes will be increasingly priced into corporate valuations.

- Social: In our view, corruption, lagging transparency, and weak rule of law represent sources of drag on economic growth because they drive up prices, reduce investment, and diminish legal protections accorded to minority shareholders. As such, we apply a corruption adjustment to distinguish countries that are fundamentally undervalued versus those with low valuations due to persistently poor political, judicial, and shareholder rights records. In China, our adjustment is typically higher than in other markets given the outsized corruption risk, as indicated by the Transparency International data presented previously.

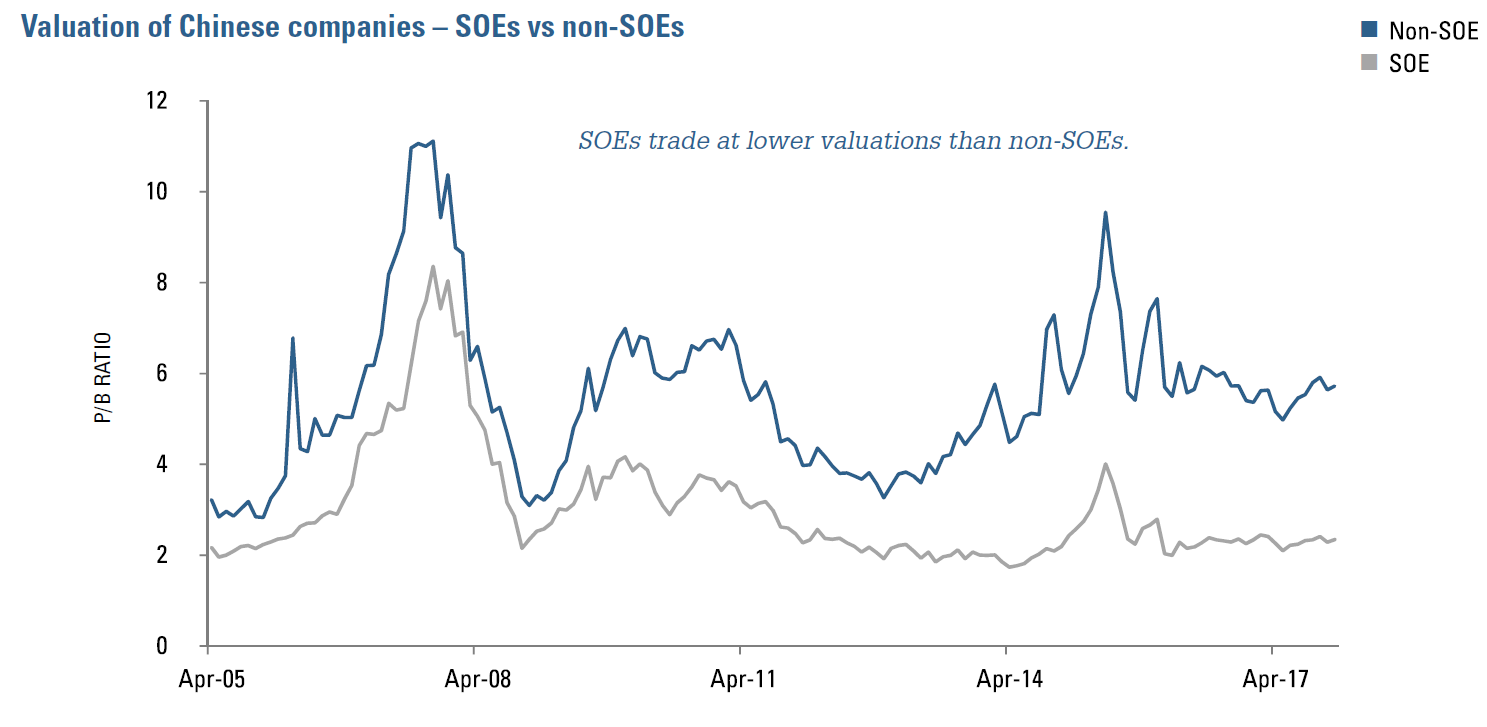

- Governance: We believe that governance-based factors, including board structure, investor rights, performance reporting, and corruption-related considerations, help to predict stock returns. We observe that companies with high levels of state ownership (SOEs) trade at a meaningful valuation discount relative to non-SOEs. (Figure 4) As the valuation discount is more pronounced in China than in other EM markets, we believe SOE ownership merits greater consideration than it does in EM more broadly.11

Figure 4

In addition to forecasting returns and building portfolios that aim to maximize risk-adjusted returns, Acadian engages in ongoing dialogue with selected companies that we hold to promote best practices. In our experience, we have observed relatively low response rates to engagement activities and limited disclosure on ESG issues among Chinese corporates. This recognition aligns with the broader market view that Chinese companies would benefit from more robust investor relations and increased awareness of ESG issues.

Conclusion

We recognize that China’s ESG scores are low and acknowledge that low ESG scores are not atypical for emerging markets. As part of our ESG analysis, we seek to identify both risks and potential opportunities within the ESG realm. While we can only speculate as to what China’s ESG landscape will look like in the future, we expect that ESG progress will be aligned with China’s longer-term policy objectives: economic growth, social development, and environmental protection. Acadian believes that there is significant investment opportunity in China and that incorporating ESG considerations into the investment process can potentially enhance stock selection in this vast and growing market. As we have seen in other developing economies and capital markets, we expect meaningful improvement in each of these areas as ESG-driven and traditional investors alike turn their focus to this expanding market. With respect to directing capital at the company level, we believe that ESG considerations represent universally relevant investment criteria, and they are particularly influential in our China investment process.

Endnotes

- “Investor Duties and ESG Integration in China,” PRI, UNEP FI, The Generation Foundation, IIGF. March 2018.

- Renewables 2018 Global Status Report. Renewable Energy Policy Network for the 21st Century. Web.

- Hertzke, Patrick, Nicolae Muller, and Stephanie Schenk, “China’s Electric Vehicle Market Plugs In,” McKinsey Quarterly, July 2017. Web.

- Sanchez, Caroline, “From Local to Global: China’s Role in Local Poverty Reduction and the Future of Development,” The World Bank. Dec. 7, 2017. Web.

- Magni, Max and Felix Poh, “Winning the Battle for China’s New Middle Class,” McKinsey Quarterly, June 2013. Web.

- Baijie, An, “President Calls for Rejuvenation,” China Daily, Sept. 26, 2017. Web.

- I.e., an entity that has control without majority voting rights.

- Source: MSCI. Copyright MSCI 2018. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI.

- Xinhua. Authorities promote mandatory environmental disclosure as listed companies fail test. ChinaDaily.com.cn

- https://www.unpri.org/download?ac=4496, p.14.

- For further discussion of prevalence and performance of Chinese SOEs, please see our recent “Perspectives” piece, State-Owned Enterprises – Buyer Beware?, Acadian Asset Management, April 2018.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.