ESG Engagement: By the Numbers

Key Takeaways

-

Perhaps surprisingly, systematic investment managers are uniquely positioned to conduct company engagements.

-

Scalable and sophisticated analytical methods, including Artificial Intelligence (AI) applied to analyse alternative data, can generate distinctive insights for prioritising and conducting engagements in the context of expansive holdings universes.

-

Based on our data science toolkit, we engage with companies in relation to three ESG themes that are integrated into our investment process, Climate Action, Corporate Culture, and Corporate Behaviour, as well as other ESG-related controversies that pose financial risk to companies that we own.

Table of contents

One high profile aspect of the rapid growth of Responsible Investing has been an increased focus on corporate engagement. Managers seek dialogue with companies that they own to advocate for ESG-aligned objectives and, through their fulfilment, to improve those firms’ performance and risk-adjusted investment returns.

While corporate engagement has traditionally been associated with activist funds applying pressure derived from concentrated ownership stakes, systematic managers are—perhaps surprisingly—also well-positioned to engage based on the strengths of their investment process. That’s because the scalable and sophisticated analytical machinery that drives return and risk forecasting across expansive investment universes is equally valuable in identifying and prioritising engagement candidates and producing evidence to support advocacy.

In this note, we outline Acadian’s engagement program. We explain its motivations and how they shape its thematic focuses. We discuss our systematic approach to engagement and present three real-world case studies to demonstrate benefits of sophisticated analytical methods, including AI-techniques applied to alternative data. We close with examples of actual engagements, both direct engagements and collaborative, driven by our systematic approach and perspective.

Motivations and Thematic Focuses

Our ESG engagement program is rooted in our fiduciary duty to our investors. We believe that targeted dialogues on ESG themes with companies that we already own can influence management behaviour to correct ESG-related deficiencies or reduce ESG-related risks and, in turn, to further improve the investment outlook.

As such, we align engagement actions with three ESG-related themes that are integrated into our alpha model:

-

Climate Action — We advocate for companies to disclose climate change risks, informed by Task Force on Climate-Related Financial Disclosures (TCFD), and board-level oversight of climate risk and overall climate strategy. Guided by the Science Based Targets initiative (SBTi), we seek adoption of company-wide emissions reduction goals, with commitments to short, medium, and long-term targets. We also push companies for climate-related scenario analysis, including assessment of business risks to policy responses aimed at limiting warming to less than 1.5 ̊C.

-

Corporate Culture — We expect companies to comply with the U.N.’s Guiding Principles on Business and Human Rights. We advocate for adherence to International Labour Standards for procurement, implementation of controls to prevent modern slavery throughout supply chains, and monitoring of subcontractors with respect to labour rights and health and safety. We scrutinize corporate policies towards employee wellbeing, engagement and loyalty, training and development opportunities, and gender equality at all levels.

-

Corporate Behaviour — We advocate for shareholder rights, which we view as critical to companies’ long-term success. Those efforts focus on elimination of governance structures that stifle changes of control or limit voting rights, promotion of management transparency and board independence, and alignment of executive compensation with shareholder interests. We also advocate for management responsiveness to financially material stakeholder concerns.

In addition to these themes, we engage with owned companies that we believe are being or could be drawn into escalating ESG controversies, seeking to understand steps that they are taking to mitigate business and reputational risk. We also may engage to learn about how companies are approaching ESG-related issues and to advocate for disclosure practices that could benefit our investment process.

Acadian systematically identifies and prioritises engagement activity based on “ALERT” criteria

.png)

A Systematic Approach to Engagement

Identifying and prioritising targets is a crucial aspect of an effective and efficient ESG engagement program, but this step is often skimmed over in practitioner and media discussions. That’s natural, since anecdotes relating how pressure was brought to bear and what actions were ultimately taken make for livelier discussion than decision analysis and data inputs.

In keeping with the spirit of our broader investment process, we apply a systematic framework to engagement selection. One key decision criterion is our financial exposure. Consistent with our fiduciary duties, we focus on companies for which we have an overweight position, a condition under which our investors are likely to benefit the most from improvement in ESG-related corporate behaviours and characteristics. Because we tend to hold broad portfolios, whose contours extend well beyond traditional benchmarks, this approach provides an expansive universe of potential engagement targets.

To make use of that opportunity set, we apply the same scalable analytical toolkit that we use to forecast returns for 40,000 stocks globally. That toolkit has been developed to rapidly and consistently analyse massive volumes of disparate and messy data in order to identify ESG (and other) corporate characteristics that predict future returns and risk. In the engagement context, it has similar relevance in identifying situations that require some degree of intervention to induce changes in management behaviour that could boost investment performance.

A second key criterion is the quality of the evidence that we can bring to bear. We expect that companies will be more receptive to dialogue and remediation if we can provide them with targeted insights regarding our ESG concerns. In searching for potential engagement candidates, we apply state-of-the-art AI methods to produce data-driven findings that more rudimentary screening methods would likely miss.

The sidebar that follows offers three examples of our engagement analysis. The first is an application of text processing that identified connections between Acadian’s Climate Action engagement theme and human rights abuses of the Uyghur people in China. The second demonstrates the value of machine learning in exposing evidence of forced labour buried deep in an automaker’s supply chain that the company’s own internal controls had missed. The third highlights the application of Natural Language Processing (NLP) of companies’ public statements to identify greenwashers, i.e., companies whose actions regarding ESG do not match their words.

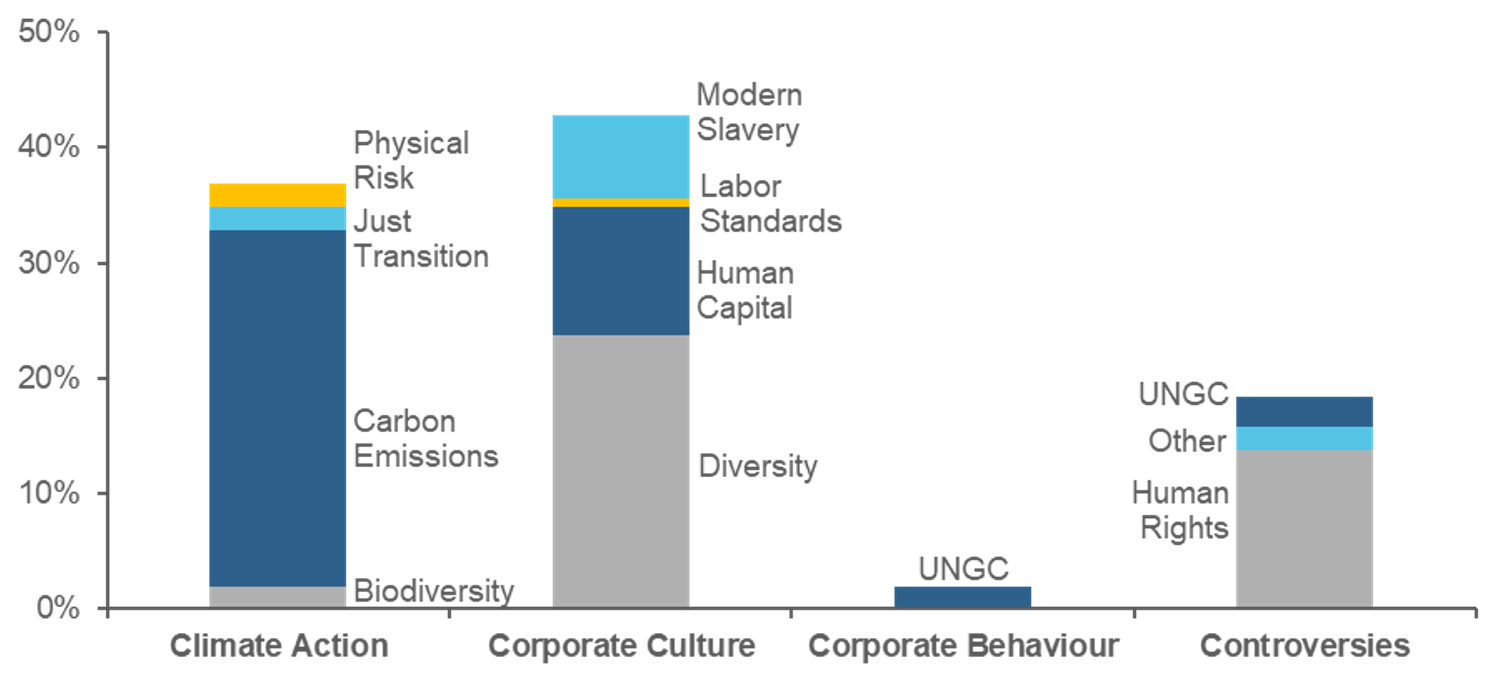

Much as the weightings on signals in our return forecasting model vary across market contexts and conditions, the prioritisation of engagement targets is informed by where our analytical techniques are generating the most valuable insights. In our recent experience, that has been with respect to environmental and social themes. (Figure 1) Over time, though, the number and focuses of our engagements may vary considerably, depending on the themes and specific issues that our analyses identify.

Figure 1: Acadian 2021 Engagements by Theme

Case Study #1: Emerging ESG Risks

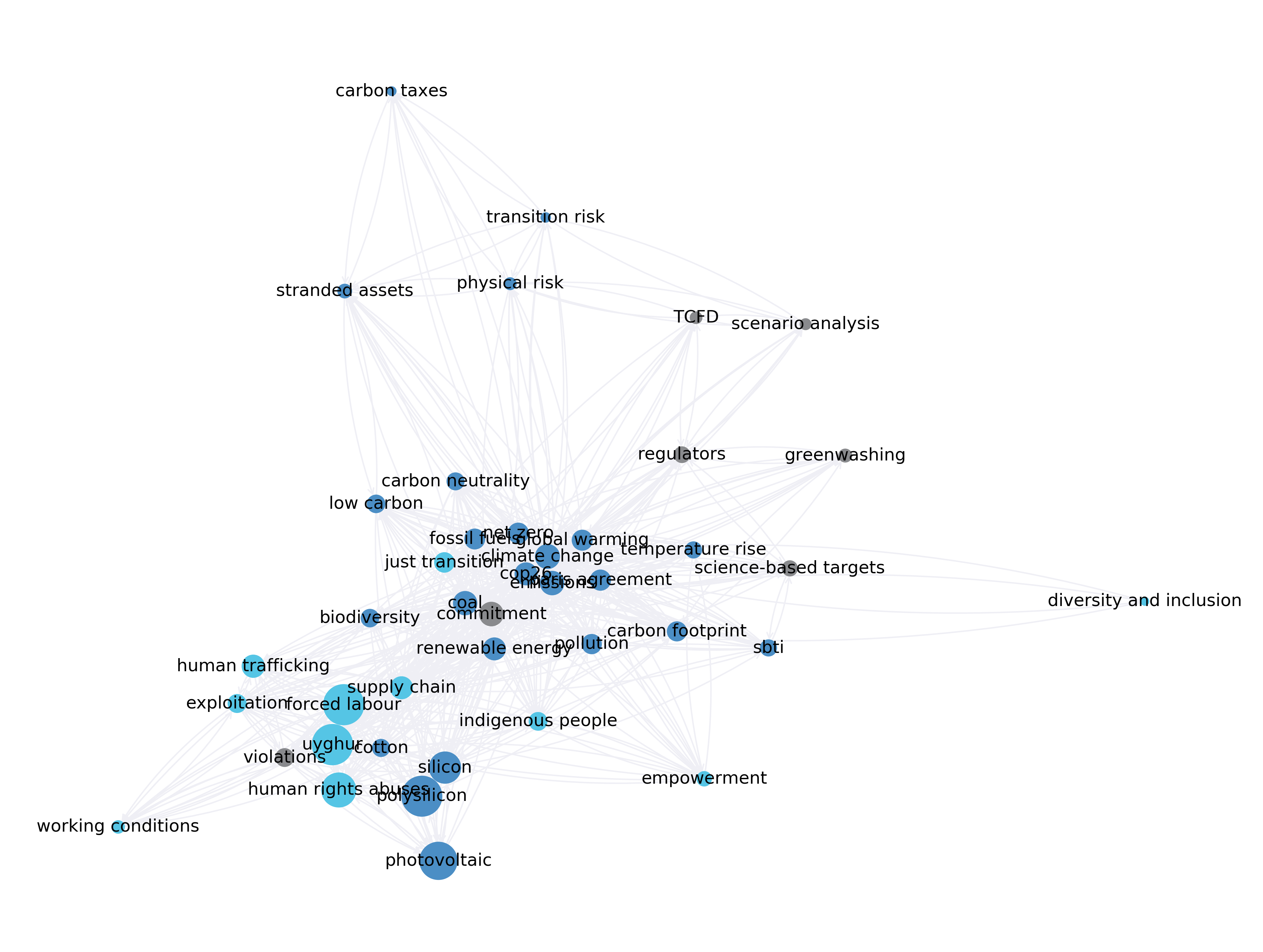

In identifying and prioritising ESG-related issues for engagement, systematic analysis of text and other forms of alternative data with machine learning algorithms may offer significant—and perhaps unexpected— benefits. In one element of our AI-based framework, for example, we mine through NGO and media reports for perceptions of violations of the U.N. Global Compact Principles and other ESG concerns and controversies, to discern emerging themes in ESG risk and to assess their importance.

Our approach employs a network analysis, which is a technique designed to reveal connections among concepts. Figure 2 depicts its application to climate news. The dots—or “nodes”—in the diagram represent different aspects of ESG concerns that were discussed in climate-related media reports during 2021. We’ve colour coded the issues by category: environmental in dark blue, social in light blue, and governance in grey. The links between the nodes map out interdependencies across the topics as inferred from the analysis. The size of each node proxies for the media’s perception of the severity of risk associated with that facet of the topic.

Figure 2: Network Analysis of Trending Climate News

We apply this “unsupervised” machine learning technique to automatically identify escalating ESG risks within portfolios.1 For instance, during 2021 it traced out connections between discussions around Net Zero, the need for a Just Transition, and human rights issues in the Uyghur region.2 In addition, the algorithm helps us to identify specific firms that merit engagement from across our expansive holdings. For example, in 2021 our algorithm flagged a particular European automaker as a strong candidate for outreach based on increasing concern that its supply chain might contain companies that use forced labour.

Case Study #2: Selecting Engagement Targets

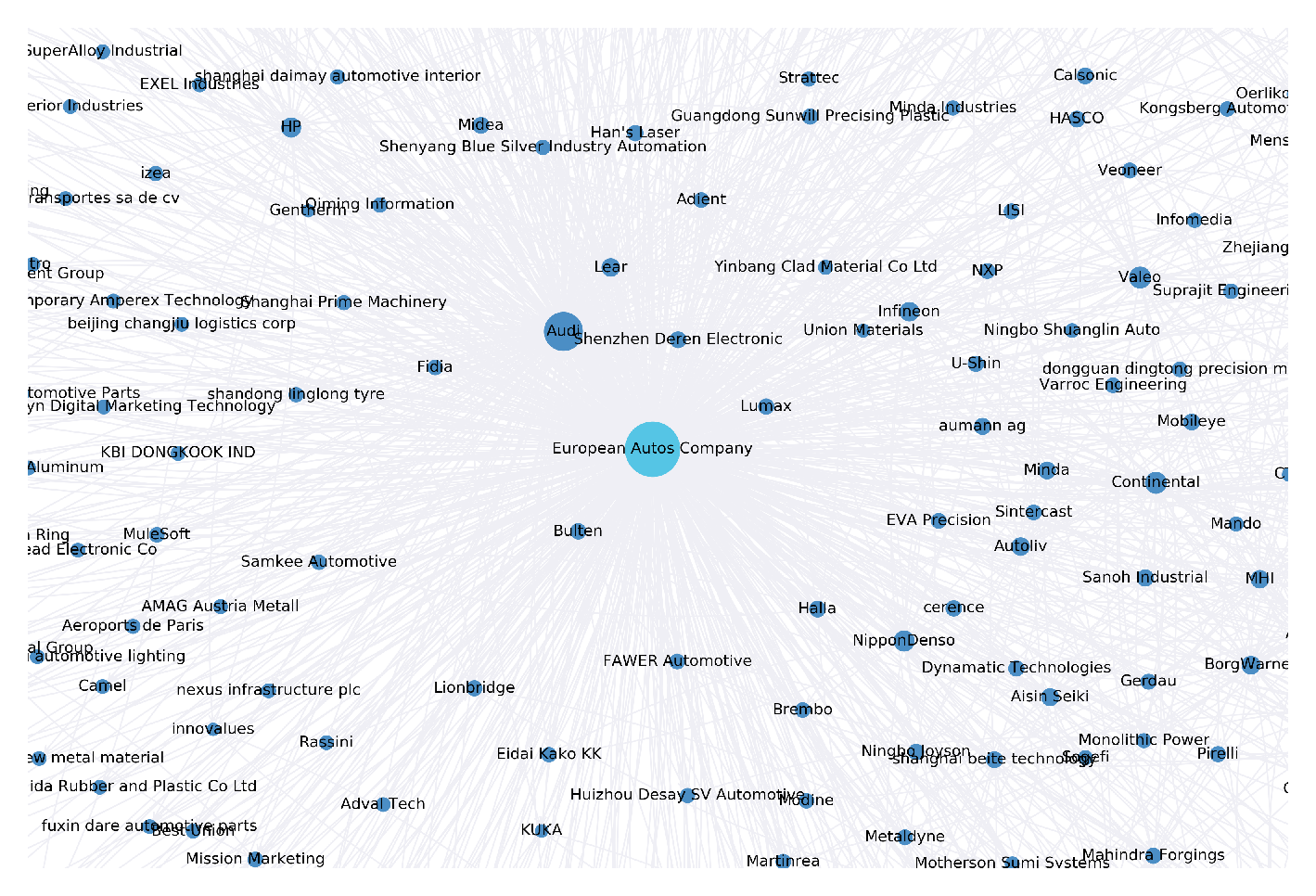

We also use machine learning algorithms to produce specific, data-driven evidence to support our engagements. For example, based on the analysis described in the first case study, we reached out to the automaker and asked whether any of its suppliers raised flags in connection with human rights abuses involving the Uyghurs. While the firm did respond and acknowledged the broad issue, it claimed that it had not found evidence of forced labour in its supply chain.

Unsatisfied by what seemed a boilerplate response, we conducted our own analysis, applying machine learning to map potentially distant producer-consumer relationships that might have gone overlooked by a more conventional assessment. That network analysis (an illustration of which is depicted in Figure 3) did, indeed, flag a suspect supplier.

Figure 3: A Machine Learning-Informed Map of an Automaker’s Supply Chain

As a result, we contacted the automaker again and requested that it: 1) confirm that the suspected violator had been excised from its suppliers, and 2) describe how it monitors for and responds to such concerns. The auto company replied that it would investigate the supplier in question. The automaker’s staff also commented that it was impressed by our analysis and asked where they could find the application that we had used to discover it.

Case Study #3: Detecting Greenwashing

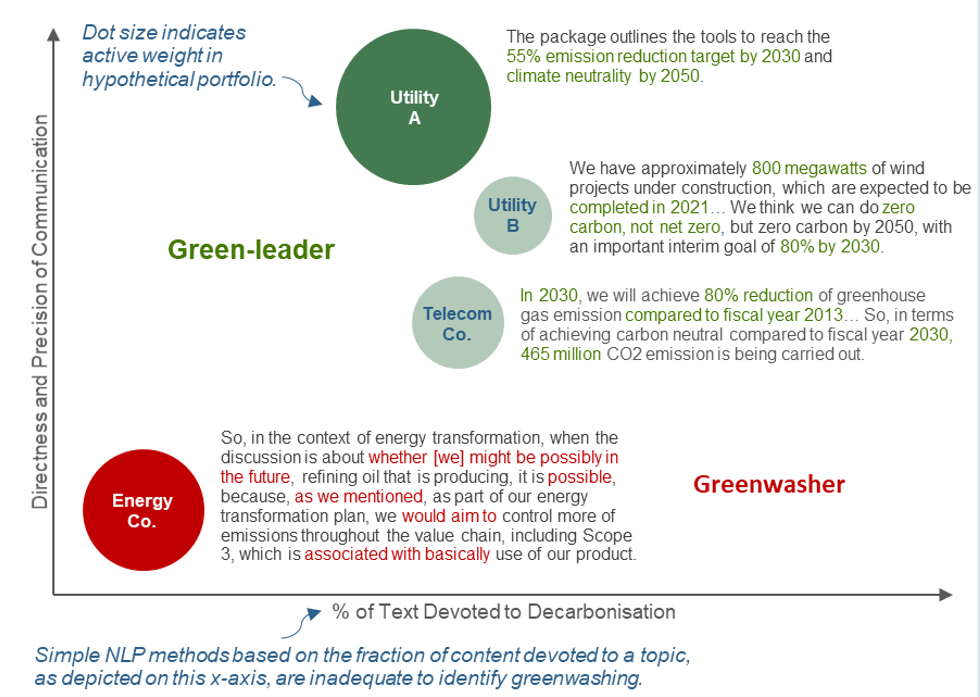

In 2021, we developed an AI-based tool named “ENGAGER”* to detect greenwashers by evaluating 1) the directness and precision of their communications on relevant ESG topics, and 2) the consistency of their actions and words. To do so, ENGAGER applies advanced NLP and other machine learning techniques to process and analyse companies’ sustainability reports, earnings call transcripts, Annual General Meeting statements, regulatory filings, and web data. We prioritise suspected greenwashers for engagement on the basis that such companies are unlikely to remediate ESG-related deficiencies and risks without being prompted to do so. By systematizing the search for greenwashers, ENGAGER allows us to screen through large numbers of holdings to identify the most appealing targets for engagement with respect to decarbonisation and other ESG themes.

To bring the ENGAGER methodology to life, Figure 4 illustrates a subset of the information that the system provides.

* ENGAGER stands for Engaging on Non-Green company Actions Gathered by Evaluating management Rhetoric.

Figure 4: ENGAGER—A Stylized Illustration

Among the key features:

-

The horizontal axis measures the fraction of content devoted to decarbonisation. Although this attribute is straightforward to generate using commonplace NLP-based methods, we don’t find it valuable on a standalone basis in assessing greenwashing.

-

As a more informative indicator, the vertical axis displays the directness and precision of the companies’ communications as assessed using more sophisticated methods. Towards the top of the chart, we find companies that clearly state target quantities and dates (e.g., “55% emission reduction target by 2030”). Towards the bottom, we find companies whose communications are vague or qualified (“we might be possibly in the future”).

-

As a summary indicator of the companies’ actions, the colour of each bubble measures the change in carbon intensity over the prior year (green = decreasing, red = increasing).

Engagement Approaches

Once we decide whether to engage, we may do so directly, through a collaborative initiative, or via a hybrid approach, depending on context. Case Study #2 highlights a circumstance in which individual outreach made sense given the well-defined nature of our concern and the precise evidence that we had generated on which to base our inquiry. As another example of the value of analysing unstructured text as the basis for engagement, we flagged a Brazilian agricultural company that, during a management earnings call, blamed adverse weather for poor performance even though it had claimed in its annual sustainability report that its land holdings were resilient to physical climate change. The ability to tease out such discrepancies provides the Responsible Investing team with a basis for specific and constructive feedback to management.

In collaborative contexts, we work with asset owners, umbrella organisations, NGOs, and other asset managers. As one example, with the Climate Action 100+ we have been engaging with an Australian energy firm that has not committed to ceasing investment in fossil fuels despite having set an “aspirational” goal to reach Net Zero by 2050. Specifically, we have urged the company to promulgate a credible decarbonisation strategy that does not rely on carbon offsets. With the Investor Alliance for Human Rights (IAHR), Acadian is supporting an engagement with a U.S. technology firm whose subsidiary manufactures equipment that may have been used in surveillance or detention of the Uyghur people. Following the deadly 2019 failure of a tailings dam in Brazil, Acadian joined the U.N. Environment Programme, Church of England Pensions Board, the Council on Ethics of the Swedish National Pension Funds, and over 100 other asset managers in the Investor Mining and Tailings Safety Initiative. That effort led to the promulgation of relevant industry standards, the creation of an independent body to help oversee them, and a vast improvement in data resources associated with tailings dams.

In addition to scaling influence by aggregating shareholdings, collaborative engagement has the advantage of ensuring that companies receive consistent messaging from shareholders and stakeholders, which may increase firms’ receptivity to discussion and the likelihood that they will implement sought-after changes.

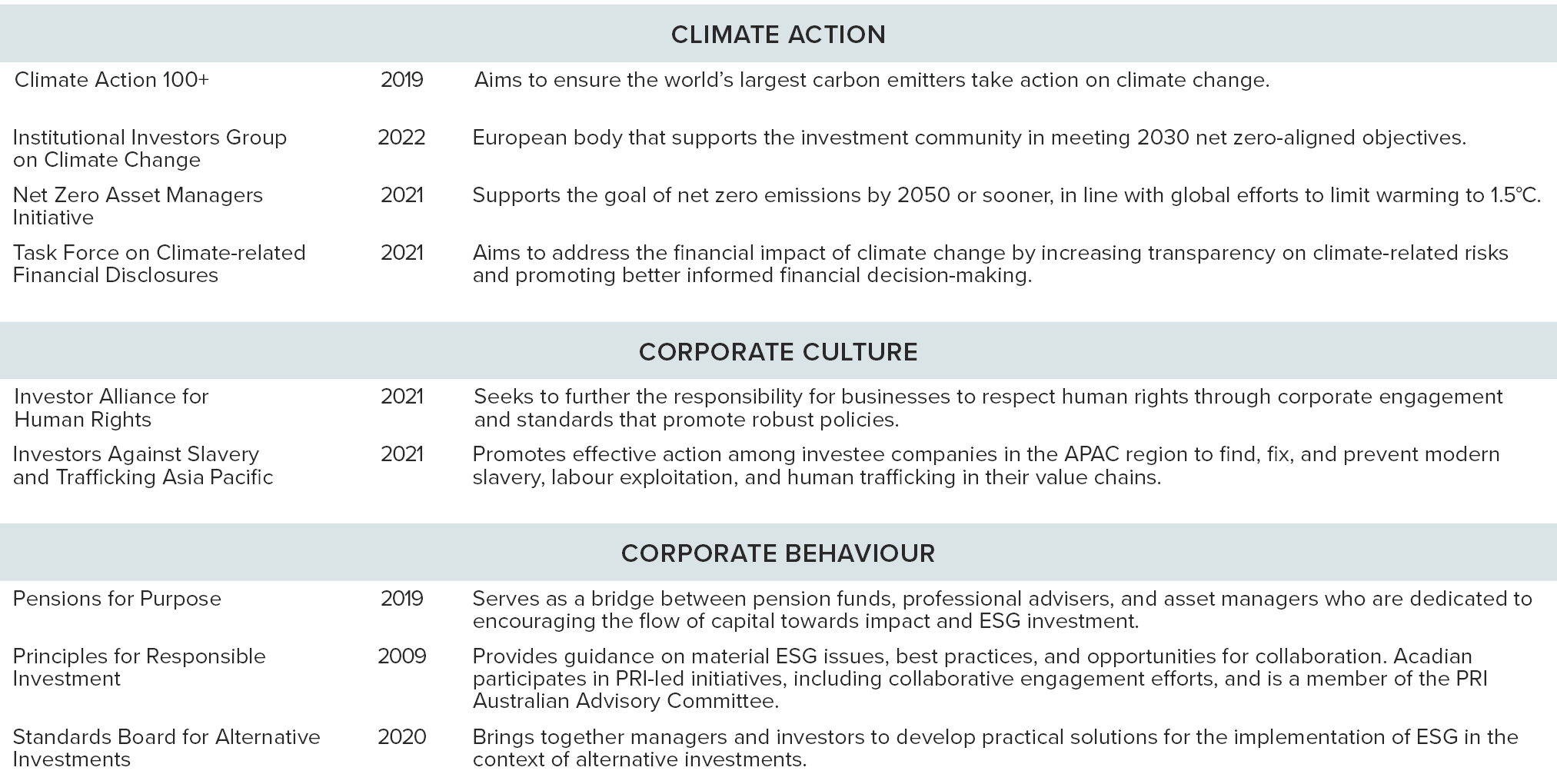

Acadian also participates in third party initiatives related to issues that are financially material to our investors and relevant to the ESG themes that are integrated into our investment process. Figure 5 highlights selected examples. Partnering with discretionary managers and NGOs has many benefits, including the opportunity to learn from others’ perspectives and expertise.

Figure 5: Selected Third Party Initiatives

Conclusion

While some investors may associate ESG engagement with discretionary and concentrated investing approaches, the systematic investing process offers two important benefits in the engagement context. First, the same scalable analytical toolkit that facilitates returns forecasting and risk analysis across vast investment universes can also be applied to identify and prioritise engagement targets across broad sets of holdings. Second, sophisticated methods, including the analysis of alternative data with AI-based methods, can generate evidence of ESG-related concerns that more traditional methods would miss. Contrary to popular perception, therefore, the systematic investing approach offers both a natural setting and an effective toolkit for a distinctive form of ESG engagement.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.