We are Not in an AI Bubble

Key Takeaways

- While the U.S. stock market is expensive, it doesn’t look like a bubble.

- We do see some bubble symptoms, including high valuations, inflows, and investors who think the market is overvalued.

- However, unlike historical bubbles, we see no wave of IPOs, and existing firms are repurchasing equity instead of issuing it.

Table of contents

Is the U.S. stock market in an AI bubble? We certainly have the preconditions for one: a revolutionary new technology and spectacular profit growth for leading firms. And in the past two years, we’ve seen several bubble symptoms: increased retail participation in equity markets, rising market valuations, and absurdly high prices for certain stocks. However, the preponderance of the evidence does not support the diagnosis that the whole U.S. stock market is currently in a 1999-style bubble.

The missing ingredient is equity issuance. Starting with the South Sea Bubble of 1720, equity bubbles have featured waves of issuance. Today, there is no wave of IPOs, and existing firms are repurchasing equity instead of issuing it. Perhaps there’s an AI bubble in private markets (in which case I’d suggest getting out of private markets ASAP), but I don’t see one in public equity.

As of today, we are in an AI boom, but not yet in an AI bubble. However, it’s easy to imagine scenarios in which a bubble arrives in full force in the coming year.

Defining terms

Is the U.S. stock market in an AI bubble? To answer this question, we need to define these words.

Bubble: The word “bubble,” like the word “love,” has many meanings. Here’s my definition:1

A bubble is a self-sustaining rise in prices over time resulting in the speculative trading of an obviously overvalued asset.

AI Bubble: To me, “AI bubble” means “a bubble triggered by AI breakthroughs.” In contrast, many people use the phrase “AI bubble” to mean “U.S. corporations are overspending on AI.” That may be true, but I wouldn’t call that a stock market bubble if it doesn’t involve stock prices that are clearly too high. I agree that the level of current capex is one indicator that the market is overvalued.2 However, “overbuilding” is not a synonym for “bubble.”

U.S. Stock Market: I want to assess whether we see a bubble in the cap-weighted U.S. stock market as opposed to one isolated to certain market sectors. Today’s stock market contains a lunatic fringe of highly volatile and outrageously overvalued crypto/meme/cult stocks.3 But this fringe, while growing, is still small. In order to have a market-wide bubble, either the fringe must become a bigger fraction of the market, or the rest of the market must get crazier.

Diagnosing bubbles

To diagnose bubbles, here are my Four Horsemen of the Bubble Apocalypse:4

- First Horseman, Overvaluation: Are current prices unreasonably high according to historical norms and expert opinion?

- Second Horseman, Bubble beliefs: Do an unusually large number of market participants say that prices are too high, but likely to rise further?

- Third Horseman, Issuance: Are there unusually high levels of equity issuance by existing firms and new firms (IPOs) and unusually low levels of repurchases?

- Fourth Horseman, Inflows: Are unusually large numbers of new participants entering the market?

All four horsemen were clearly present in 1999/2000. Where are we as of December 2025?

- First Horseman, Overvaluation: Plausibly present, although it’s not a slam-dunk case.

- Second Horseman, Bubble beliefs: Present. Bubble beliefs emerged in late 2024.

- Third Horseman, Issuance: Not present.

- Fourth Horseman, Inflows: Present. We see increased buying by U.S. individual investors and by foreign investors.

Let’s examine each item on the checklist.

FIRST HORSEMAN: OVERVALUATION

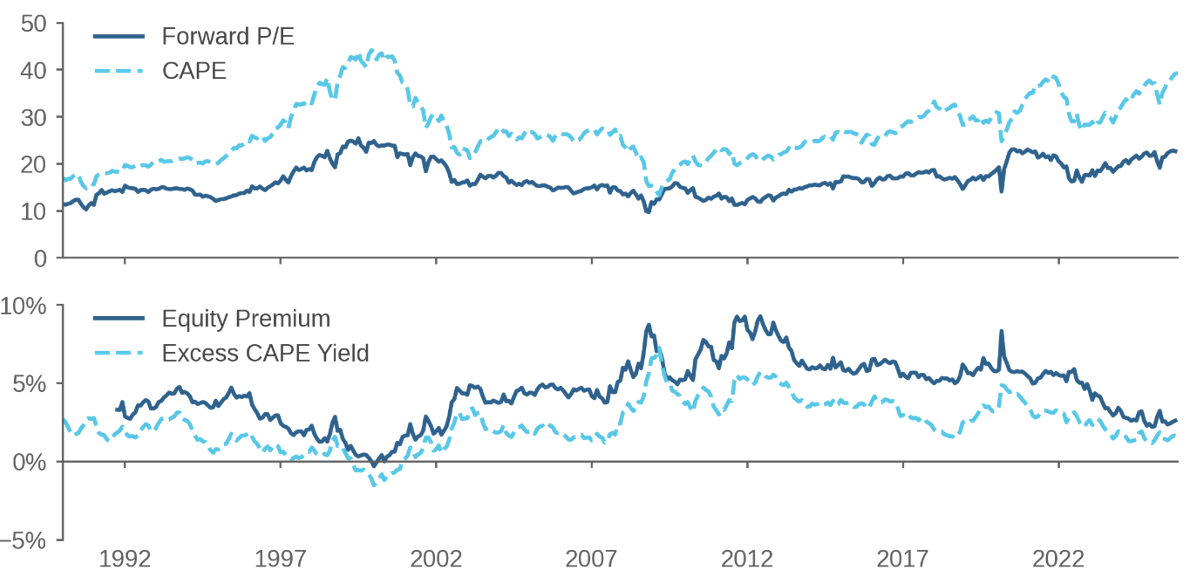

The top panel of Figure 1 shows two measures of aggregate stock prices normalized by earnings. The dashed line is the Cyclically Adjusted Price/Earnings (CAPE) ratio, which is based on a trailing measure of inflation-adjusted earnings, and the solid line is the forward P/E ratio on the S&P 500. As of today, both measures are quite high, while still slightly below March 2000.

Figure 1: U.S. Market Valuations (top) and Expected Returns (bottom)

January 1990 to November 2025

As an alternative to P/E ratios, the bottom panel of Figure 1 shows two measures of the expected return on stocks minus bonds, i.e., the “equity premium,” after properly adjusting for inflation.5 The dashed line is Shiller’s “excess CAPE yield,” defined as the trailing earnings yield (inverse of CAPE) minus the real 10-year Treasury yield. The solid line is the expected real excess return on the S&P 500, i.e., the difference between the forward E/P ratio and the real 10-year yield. These measures show that the equity premium today is between 1.6% and 2.6%, relatively low but not zero or negative as during the tech-stock bubble. The bottom panel of Figure 1 does not scream “bubble” to me.6

During prior bubbles, leading academics publicly questioned market prices.7 In contrast, I’m unaware of recent public comments from respected financial economists stating that prices are obviously too high. I’ve previously provided a list of eminent financial economists, which I call the Flagrantly Overvalued Market Committee.8 Today, committee members do not seem to feel that the market is flagrantly overvalued.9

In private discussions with academic economists in recent months, I’ve encountered many who wonder about a bubble, but only a few who say “of course” there’s a bubble. In contrast, in 2006 with the housing market and in 2000 with the stock market, more economists seemed confident that a bubble was occurring.

SECOND HORSEMAN: BUBBLE BELIEFS

While academic economists do not seem ready to declare that the market is overvalued, market participants today have no such reticence. A substantial majority of both professional and amateur investors currently say that the U.S. stock market is overvalued.

As of October 2024, a long-running Yale survey revealed that a large majority of individual investors believed that the market was overvalued, and a large majority also believed the market would rise further.10 We saw a similar set of beliefs in April 2000.

Other more recent evidence shows widespread bubble beliefs. An October 2025 survey showed 67% of individual investors said the market was overvalued.11 In the November 2025 Bank of America Global Fund Manager Survey, the number of respondents agreeing that “global equity markets are currently overvalued” reached its highest level in the history of the survey since 1998.

THIRD HORSEMAN: ISSUANCE

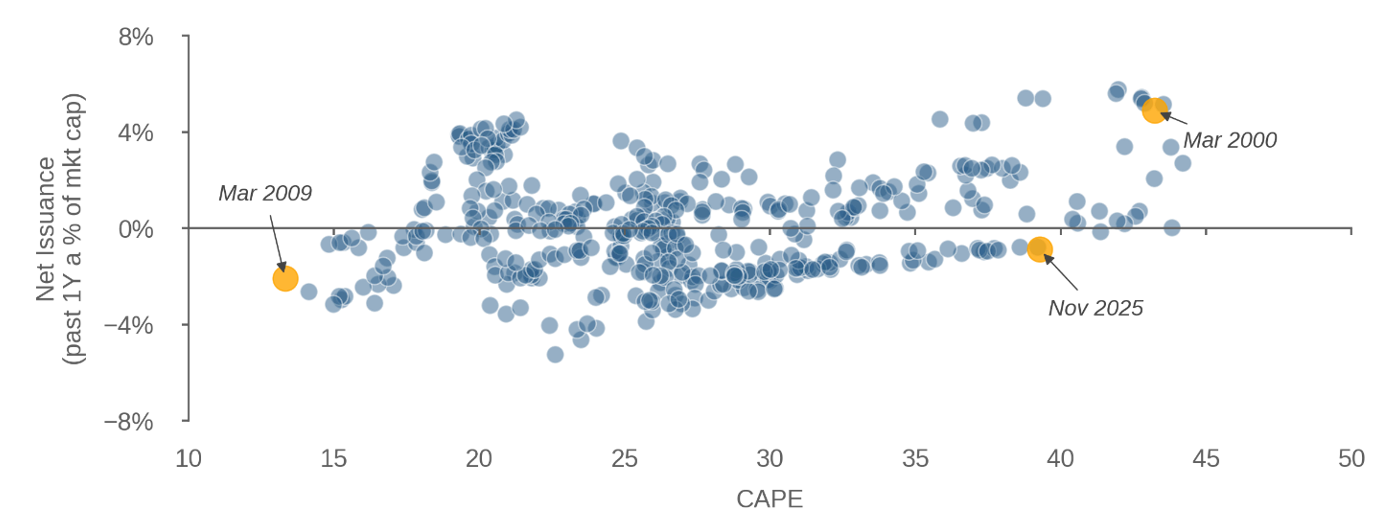

Firms are smart money, and when firms sell equity, that’s a sign that equity is overpriced.12 Currently, we do not see positive net issuance across the entire market – i.e., firms are not net sellers of equity to external investors. This fact is evident in Figure 2, which shows the sum of dollar net issuance in the past year, normalized by the stock market’s total capitalization.13 For much of the 1990s, issuance was positive, and at the peak of the bubble in 2000, issuance was more than 5% of market cap, meaning that 5% of the market had been newly issued in the past year. After that bubble collapsed, issuance turned negative and has largely remained so, with the notable exception of the COVID bubble of 2021, when issuance peaked above 2%. But today, issuance is decidedly negative at -0.9%; the supply of shares is shrinking. Ballpark figures, the value of U.S. common stock is around $65T, and every year companies are buying around $500B more equity than they’re selling.

Figure 2: 12-Month Net Issuance as Percent of Market Cap

January 1990 to November 2025

Historically, bubbles in different countries (Britain, Japan, the U.S.) have involved waves of issuance, including waves of new firms entering the stock market. If there were a bubble, we’d expect a wave of IPOs. We saw a wave of IPOs in 2021, so why no wave today?

FOURTH HORSEMAN: INFLOWS

Bubbles involve buying by new market participants. Today, we see increased buying by two groups: foreign investors and U.S. retail investors.

Foreign money poured into the U.S. stock market in 2025, with only a slight pause amid the tariff-related turmoil of April 2025. Data from the Treasury International Capital System shows that net foreign purchases of equity securities summed to around 1% of all U.S. shares outstanding in the past year. U.S. exceptionalism is alive and well.

One set of eager buyers comes from South Korea, which was 9% of foreign inflows. Korean retail investors are certainly contributing to speculative madness in corners of the U.S. equity market.14 If and when there is a full-blown bubble in the U.S. stock market, I’d expect Korean retail investors to be right at the center of it.

U.S. retail investors are also increasingly buying equities. First, retail trading volume as a percent of total equity volume has risen, perhaps to “an all-time high.”15 Second, we see ample evidence of flows into retail investment vehicles. JPMorgan Chase showed that dollars flowing from bank accounts to retail brokerage accounts in March 2025 were even higher than in February 2021.16 Leveraged ETFs have also attracted substantial inflows.17 Consistent with the increase in retail trading activity, retail brokerage stocks have soared of late.18

How close are we to 2000?

To summarize, today, we have three horsemen present. Now, maybe three out of four is enough for you, but I put more weight on issuance and overvaluation as bubble indicators, because these variables are easier to measure and compare across time. Since overvaluation is a weak yes and issuance is a firm no, I say no bubble today.

How close are we? Let me give you a visual representation.

Figure 3 shows CAPE on the horizontal axis and net issuance on the vertical axis. Each point represents a calendar month between January 1990 and November 2025. Notice the positive correlation between issuance and CAPE: When CAPE is high, firms sell equity, and when CAPE is low, they repurchase it. In economics, we call that an upward-sloping supply curve: when prices go up, supply goes up.

Figure 3: Net issuance vs. CAPE

January 1990 – November 2025

Now let’s consider the two extreme points, March 2000 and March 2009. In 2000, equity prices were high. How did firms respond? Just as Adam Smith predicted in 1776: “the quantity brought thither will soon be sufficient to supply the effectual demand.” We can describe the events of 2000 as firms bringing supply “thither” to eager purchasers. March 2000 was the worst time to buy equity, when CAPE and issuance were both high. The best time was March 2009, when CAPE was low and the smart money was buying.

Where are we as of November 2025? According to Figure 3, we’re not that far from March 2000. It wouldn’t take much to push us up and to the right, firmly into bubble territory.

What would an AI bubble look like?

Suppose we eventually have a full-blown AI bubble. Here’s what we might see:

- A calendar crowded with IPOs (at least one every business day), with many IPOs doubling on their first day of trading.

- SpaceX, OpenAI, and Anthropic all go public (as suggested by recent reports).19

- The Magnificent Seven, in order to fund their massive capex, issue $1T in new equity.

- The NASDAQ 100 doubles in a year (as NASDAQ did in 1999).

- CAPE rises to 80 (similar to Japan’s CAPE in 1989).

Many of these events could happen in 2026; they are not far-fetched. But they haven’t happened yet.

Perhaps I’m wrong, and we’re already in the midst of a raging AI bubble. If so, it’s a pretty weird bubble, with the IPO market unaccountably sedate, and firms that plan to spend trillions on capex failing to raise equity on favorable terms.

Endnotes

- See “Owenomics: No, we are not in a bubble yet,” Acadian, March 2024.

- “Owenomics: Massive AI spending: a red flag?,” Acadian, February 2025.

- For example, quantum stocks as explained in “Owenomics: A quantum of confusion,” Acadian, April 2025.

- See “Owenomics: No, we are not in a bubble yet,” Acadian, March 2024.

- For a discussion of inflation and valuations, see “Owenomics: Mismeasuring the market: Valuation indicators to ignore,” Acadian, January 2025.

- Although it is one piece of evidence that suggests reducing U.S. equity exposure; see also “In an Unsteady World, Time to (Finally) Tilt Away from U.S. Equities?“, Acadian, July 2025.

- For example, in February 1989, Professors Ken French and Jim Poterba wrote a paper asking, “Are Japanese stock prices too high?” (answer: yes). And on March 31, 2000, The New York Times ran a story quoting Nobel laureate Franco Modigliani with the headline “Modigliani’s Message: It’s a Bubble, and Bubbles Will Burst.”

- “Owenomics: Are we in a bubble? Here’s who to ask,” Acadian, April 2024.

- In August 2025, Professor Jeremy Siegel commented that market valuations were “hardly bubble territory.” “Friday’s Employment Bombshell,” WisdomTree, August 4, 2025. In December 2025, Professor Aswath Damodaran estimated that the equity premium is between 4% and 6%, much higher than the numbers in Figure 2 Home page of Aswath Damodaran as of December 8, 2025.

- “Owenomics: Bubble beliefs: Prices are too high but going higher,” Acadian, November 2024.

- “Q4 2025 Trader Client Sentiment Report,” Charles Schwab, October 2025.

- “Owenomics: Firms are the smart money,” Acadian, November 2025.

- For an explanation of this calculation, see “Owenomics: A Trillion Reasons We’re Not in an AI Bubble,” Acadian, November 2025.

- “Owenomics: The Squid Game stock market,” Acadian, March 2025.

- “Retail Crowd Beats the S&P 500 as Soaring Trading Sparks Concern,” Bloomberg, October 10, 2025.

- “A decade in the market: How retail investing behavior has shifted since 2015,” JPMorgan Chase, August 27, 2025.

- Why It’s Harder to Tell Gambling From Investing Nowadays,” Bloomberg, November 21, 2025.

- “Owenomics: Brokers and bubbles,” Acadian, October 2025.

- “SpaceX, OpenAI and Anthropic prepare to launch landmark IPOs,” Financial Times, January 1, 2026.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.