The Case for Multi-Asset Investing

Key Takeaways

- After decades of strong equity and fixed income markets, future long-term returns may fall below the requirements of many investors.

- Multi-Asset Class Strategies (“MACS”) may appeal to asset owners on the hunt for alternative, uncorrelated sources of return.

- MACS investing seeks to capture return sources within and across asset classes. Systematic tools provide an objective and consistent way to deal with the resulting complexity.

- Using an integrated approach to MACS investing involves an expanded universe of factors and requires particular attention to risk. Defensive positioning is essential to realizing the full potential of a MACS investment.

Table of contents

January 2018

A Problem and an Imperfect Solution

While global markets just posted yet another strong year in 2017, this has likely only furthered concerns about future long-term return prospects. Some recent predictions quote long-term annualized returns as low as 4-5% for equities, and 0-1% for fixed income,1 which would fall well below levels we have become accustomed to over the last few decades, and far below the requirements of many institutions and individuals to meet future spending needs.

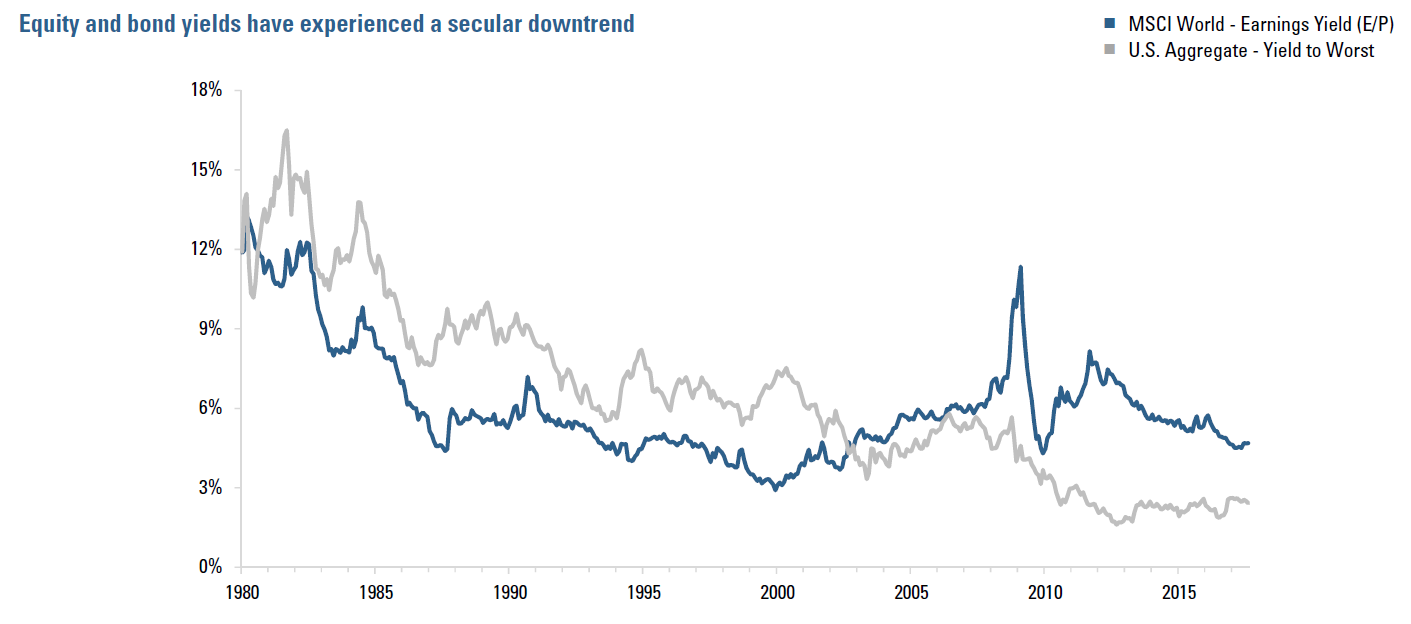

Figure 1 below helps illustrate the problem. A confluence of falling bond yields (from double digit levels in the early 80s) and multiple expansion for equities has driven the strong equity and bond returns of recent decades. However, these tailwinds will likely turn into formidable headwinds, as bond markets face record low yields and the potential adverse price impact from future yield rises. Meanwhile lofty equity valuations (which means low earning yields) leave future earnings growth as the main driver of future equity returns.

Figure 1

For illustrative purposes only. It is not possible to invest directly in any index. Every investment program has the opportunity for losses as well as profits. Index Source: MSCI Copyright MSCI 2018. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI. Bloomberg Barclays Indices are owned by Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

In an attempt to make up for lost ground, investors may decide to shift portfolio allocations towards riskier, possibly higher returning assets. However, such an approach comes at the price of greater overall risk, while increased equity exposure may leave portfolios more vulnerable to subsequent equity sell-offs.

MACS in a Nutshell

Faced with potential headwinds for traditional equity/ bond portfolios, asset owners have been on the hunt for alternative, uncorrelated sources of return, which could potentially generate much-needed returns, while diversifying away from equity risk. Multi-Asset Class Strategies (“MACS”) offer a possible solution, attracting investors with the potential for shallower drawdowns that do not necessarily coincide with equity bear markets. These types of strategies typically invest in various liquid asset classes and seek to generate excess returns from both active allocation across asset classes and active positioning within them.

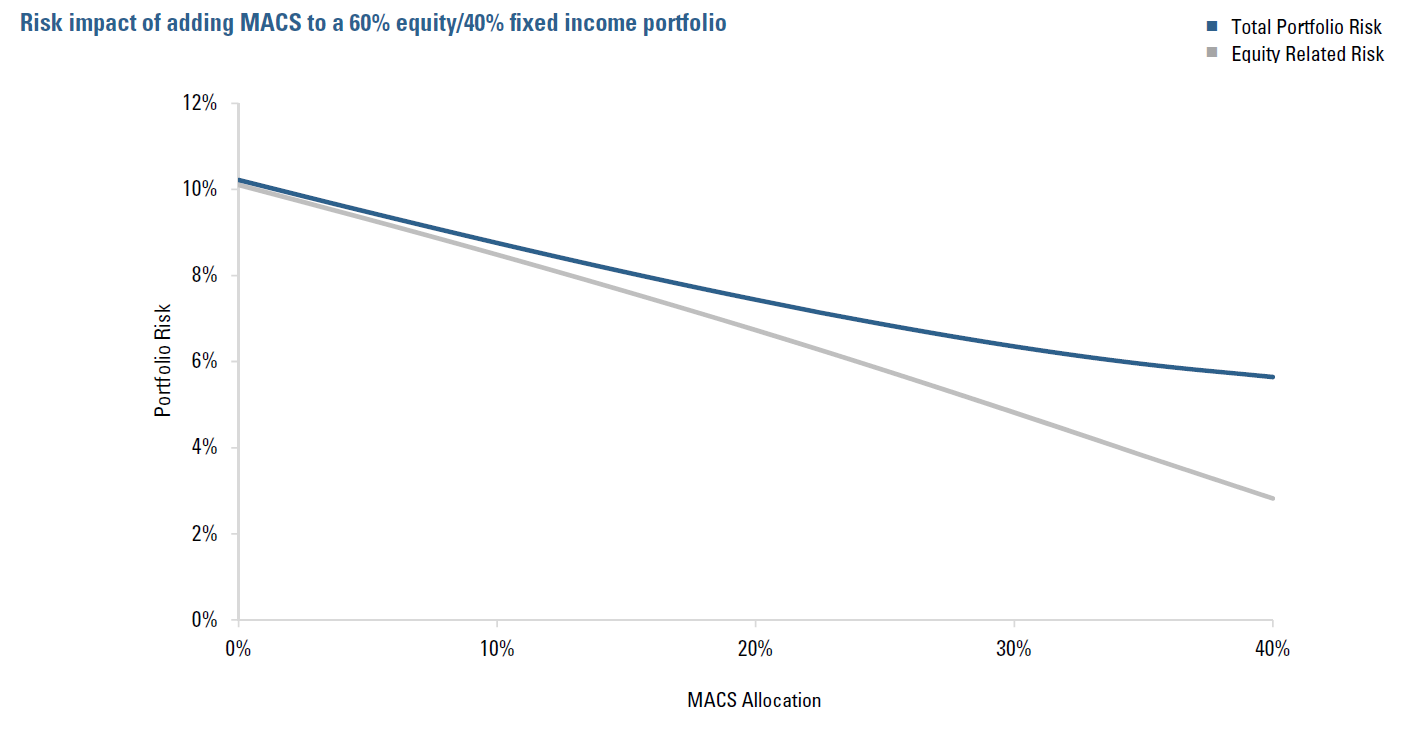

To illustrate the role of MACS in building more robust portfolios, Figure 2 below shows resulting hypothetical portfolio risk as a MACS allocation gets gradually increased, from an assumed starting point of a 60/40 portfolio (upper left-hand corner). MACS has low correlations with the hypothetical portfolio overall and with equities in particular, so funding MACS out of equities will decrease both the overall risk of the resulting portfolio and the risk contributed from equity related sources. As the MACS allocation grows, its diversification benefit to the portfolio starts to diminish, as indicated by the flattening blue line, while the equity contribution continues to drop.

Coping With Complexity

MACS investing involves the complexity of having to navigate across and within a number of heterogeneous asset classes. Some basic approaches address this challenge by repackaging existing standalone single-asset-class capabilities (in equity, fixed income, currency, etc.) into a combined framework. These types of approaches start out with separate portfolios for each asset class, then combine them from the top down.

Such siloed approaches mirror the traditional structure of investment firms, where it is not atypical to see fixed income, equity and currency teams located on different floors—if not in different cities or countries. Each area has its own investment philosophy and is generally focused on a different outcome. Simply shoehorning such disparate single asset class expertise together does not represent a truly coherent approach to multi-asset investing. It may miss return-enhancing opportunities, create risk management challenges, and limit flexibility to customize portfolios to meet investor needs.

Figure 2

For illustrative purposes only. This is meant to be an educational illustrative example of hypothetical contribution from equity risk to a 60/40 hypothetical portfolio where we gradually switch assets from Equities to MACS. It is not intended to represent investment results generated by an actual portfolio. They do not represent actual trading or an actual account. Results do not reflect transaction costs, other implementation costs and do not reflect advisory fees or their potential impact. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

The Need For an Integrated Approach

We believe that a more integrated approach, which holistically evaluates markets within asset classes and relationships across asset classes, is better suited to deal with the complexity and the opportunities of multi-asset investing. Such an approach systematically evaluates risk, return and implementation costs for all markets and asset classes simultaneously. Modern quantitative methods greatly help to model the inherent complexity effectively, and allow for comparisons within and across asset classes in an objective and consistent way. In particular, this type of methodology provides greater investment breadth, allowing portfolios to take fuller advantage of potential opportunities, via thousands of signals, forecasts and decisions across a large universe of assets.

Expanding The Opportunity Set

An integrated approach to MACS investing seeks to capture both the idiosyncratic nature of individual asset classes and the relationships across these asset classes. This requires an expanded universe of factors for return forecasting: Asset-specific factors seek to capture return drivers within asset classes, such as value, momentum, carry, and quality, each adapted to reflect the distinct nature of its respective asset class, while macro factors seek to capture cross-asset-class effects.

How exactly to construct such macro factors involves some subtlety. Standard economic data has limitations as a forecasting tool, due to its lagged and backward-looking nature. However, Acadian’s research has shown that market-priced metrics—in particular, measures of cross-asset momentum—can serve as indicators of macro conditions that are predictive of future asset prices. This allows themes like growth, stimulus and inflation to be defined by market prices and incorporated into a multi-asset framework in a timely and actionable way, enhancing the potential for predicting asset returns.

Emphasizing Risk

Taking diverse assets and forecasts and combining them into a robust portfolio requires particular attention to risk. Individual asset classes may behave quite differently, and their underlying assets may interact in surprising ways, possibly leading to portfolios with undesirable risk exposures. Portfolio positions need to be understood in terms of the risk they contribute, and how this aligns with potential returns. The ability to go long/short is a helpful tool to tailor exposures and mitigate unwanted risks, with the goal of maintaining low correlations at the overall portfolio level with respect to traditional and alternative betas. Indeed, positioning defensively in an effort to limit the impact of market drawdowns, is essential to realizing the full benefit of a MACS investment.

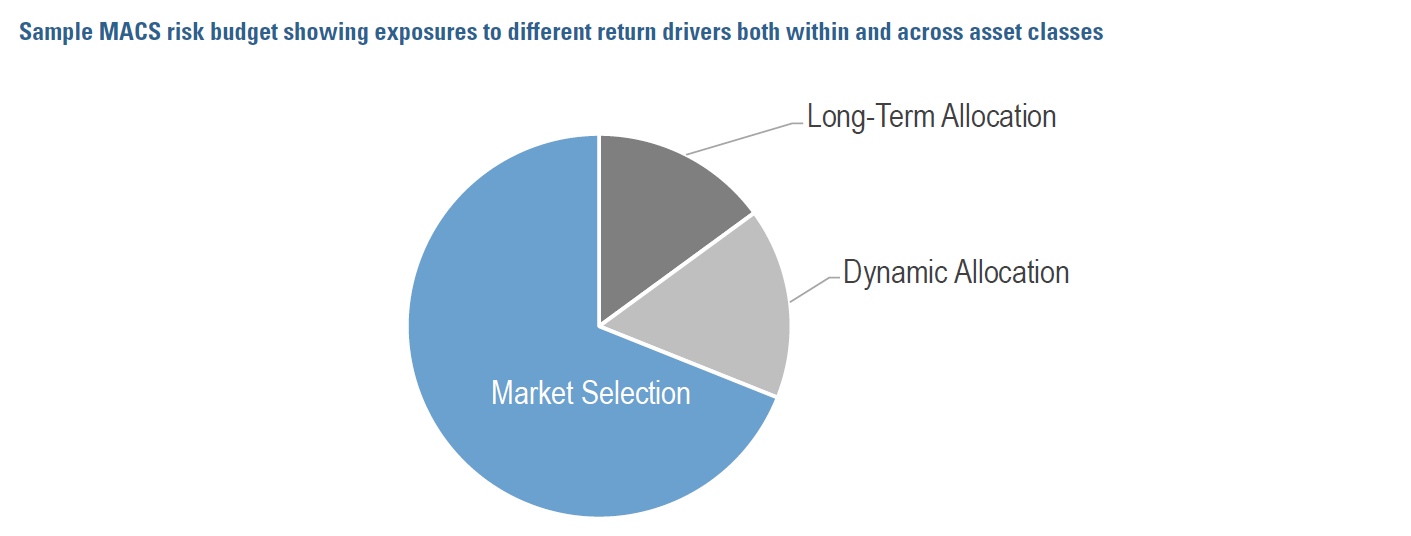

Figure 3

Flexible Implementation

We view modern MACS more as a capability than an off-the-shelf product, namely a skills-based approach that can be engineered to achieve specific investor outcomes. This capability is greatly facilitated through the use of listed derivatives in a long/short implementation, which increases flexibility and efficiency to achieve asset class and market exposures. Moreover, nimble implementation may enhance return opportunities and result in more efficient risk control. Well-implemented MACS strategies represent a best-of-both-worlds approach, borrowing investor focus and bespoke implementation from the “institutional, long-only world,” and looking to the model of the “hedge-fund world” for efficient implementation of investment ideas.

A Changing Landscape

Acadian’s new multi-asset capability reflects of a number of developments in the investment industry. One, that outcome-oriented investing is an expanding and enduring trend. Investors can no longer afford to set a basic asset allocation with off-the-shelf investment strategies and hope for the best. They are increasingly looking to the funding needs of their plan first, and working actively with a broad range of investment options to craft a program specifically tailored to a desired result.

Two, MACS underscores the role that systematic investment approaches are increasingly playing in the mainstream. As investors look globally across multiple asset classes and types of implementations, it is too challenging for a traditional investment approach to acquire and analyze sufficient information to gain a forecasting edge and manage risk exposures effectively. However, expertise in each asset class is required to build an effective multi-asset investment process.

Three, institutions are getting better and better at working productively with managers to obtain the strategies and outcomes they need. Increasingly sophisticated institutional staff want ever more opportunity to fine-tune and customize. They want to work with managers who offer platforms of capabilities, rather than simply products. MACS is just one example of a customizable, creative solution to a low return environment. The trend is toward demand for many more.

Endnotes

- “Why You’ll Need to Save Way More Than You Think,” Time Magazine, Apr 28, 2016.

Hypothetical Legal Disclaimer

Acadian is providing hypothetical performance information for your review as we believe you have access to resources to independently analyze this information and have the financial expertise to understand the risks and limitations of the presentation of hypothetical performance. Please immediately advise if that is not the case.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.