A Bubble in Low-Vol Stocks or Low-Vol Indices?

Table of contents

Introduction

Over the past few months, we've heard a steady drumbeat of concern from the financial press about the stretched valuations of low-volatility stocks.1 As the narrative goes, their fast-growing popularity as a defensive investment and the appeal of bond-like stocks in a prolonged low-rate environment has inflated low-vol stocks’ market prices to a point that cannot be justified on the basis of fundamentals. As a result, low-volatility strategies no longer offer the extra margin of safety that investors seek, and they’re vulnerable to the piercing of a bubble.

But a closer look at the evidence doesn’t support that conclusion. Rather, we argue here, it exposes shortcomings of simplistic, smart beta implementations of low-volatility investing: 1) they fail to utilize the full opportunity set of low valuation stocks in order to find attractive valuations, and 2) they take unnecessary risks, most notably interest rate exposure.

Anxieties over low-volatility strategies, therefore, are misdirected. The problem actually lies with deficiencies of inherently restrictive smart beta investment processes, not low-vol investing as a whole. The logical solution, in our view: a careful, active, implementation of low vol.

Low-Vol Valuations: A More Complete Picture

Recent analyses of low-volatility stocks’ valuations have tended to focus on mean or median multiples within cap-weighted indices (e.g., the S&P 500) and popular smart beta low-volatility indices (e.g. MSCI Minimum Variance). But in forming investment portfolios, the breadth of the full opportunity set is more important than the mean or median valuation within any particular benchmark.

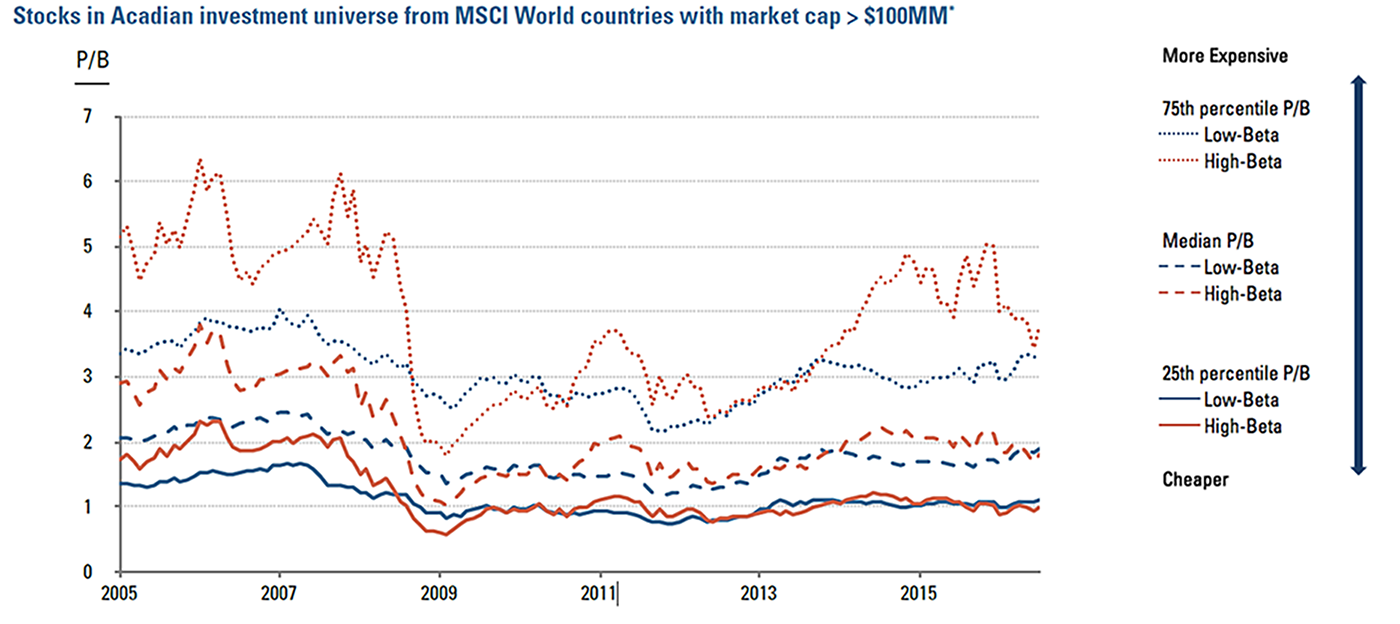

Figure 1 – Valuations of low-beta vs. high-beta equities

* Betas are relative to MSCI’s World equity index, according to an investment-caliber risk model that incorporates (only) information that was known on each respective date. Estimation uses daily returns and a rolling four-year lookback period. Sources: MSCI. Copyright MSCI 2016. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI. P/B and market capitalization calculated by Acadian based on data from Bloomberg and WorldScope.

For illustrative purposes only. This chart does not represent characteristics of an actual portfolio but rather Acadian’s investment universe of securities for the period specified in the chart. These attributes are not achievable via actual trading; they do not reflect transaction cost or other implementation considerations. Characteristics of the investment universe may change. Past performance is no guarantee of future results. Investors have the opportunity for losses as well as profits.

With that in mind, Figure 1 compares distributions of P/B ratios among high and low beta quintile stocks across Acadian’s full equity universe ($100MM+). Overall, valuations look quite similar. Of special interest in the search for cheap low-vol stocks, high- and low-beta 25th percentile valuations are nearly indistinguishable. What’s more, the valuation range of low-beta stocks doesn’t look narrow by historical standards. In sum, it appears that we have plenty of attractively valued low-vol stocks from which to choose. Said differently, by incorporating an explicit sense of valuation, an active manager should be able to form a low-vol portfolio with a reasonable multiple.

A study we published earlier this year squares this result with the flawed popular narrative.2 In our prior analysis we found evidence that constituents of MSCI’s Minimum Volatility Index indeed have higher P/B multiples than other stocks. But looking across the broader equity universe, we found no statistically significant association between beta and valuation at the stock level, and the data actually suggested a tendency for lower-beta industries and countries to have relatively low multiples. In other words, our research shows it is smart beta low-vol implementations that have become expensive, not low-vol stocks in general.

Interest Rate Exposure: An Unnecessary Risk

Our previously published analysis does support the conventional wisdom that bond-like stocks, as a whole, now have relatively high valuations. But we don’t believe that it’s necessary or valuable for low-vol portfolios to take on active interest rate risk relative to market benchmarks. In fact, we explicitly constrain active exposure to an interest rate factor in forming our Managed Volatility portfolios. We do so because we view bond-like stocks as having no special relationship to the low-volatility mispricing. As a result, we see this restriction as having only a modest impact on our opportunity set, a price well worth paying to neutralize a material, but incidental, risk.

Conclusion

Based on our research, lower-beta stocks don’t appear overvalued relative to higher-beta stocks, on the whole. Misplaced concerns over low-vol valuations and interest rate exposure actually reflect drawbacks of smart beta implementations. Specifically, artificial restrictions on the investment universe, lack of an explicit sense of valuation, and rudimentary risk management may impede smart beta’s ability to exploit a broader opportunity set and to avoid valuation, interest rate, and other unintended exposures.

We believe that low volatility investing will endure, because it reflects a mispricing that is deeply rooted in behavioral biases and protected by asset owners’ ongoing, broad commitment to capitalization-weighted benchmarking. In our view, the appropriate inference from a closer look at the popular narrative around low-vol valuations and rate risk isn’t to abandon the strategy but rather to go with an active implementation.

Endnotes

- For example, Lahart, Justin, “Two Strategies, One Crowded Trade,” The Wall Street Journal, August 22, 2016.

- Acadian Asset Management, “Beta, Indexing, and Valuations,” May 2016.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.