Acadian MAARS: Distinguishing Features

Key Takeaways

- Successful macro investing requires an appreciation of the complex and dynamic relationships across heterogeneous asset classes globally.

- Capitalizing on these relationships requires breadth in terms of available assets, a wide range of refined— and often proprietary—signals, and dynamism in forecasting both returns and risk.

- Simple and narrow macro investing approaches forego design elements that we see as essential to capitalizing on the nuanced and constantly evolving macro relationships within and across diverse asset classes.

Table of contents

September 2020

Acadian’s Multi-Asset Absolute Return Strategy (MAARS) is a systematic global macro strategy designed to generate absolute returns regardless of market conditions. A defining tenet of the underlying investment philosophy is that the challenges of delivering on that objective – finding and extracting truly diverse sources of returns and constructing portfolios that can endure severe market stress – require a sophisticated investment process and ongoing commitment to its continual enhancement. It is unrealistic to expect simple and static approaches to deliver enduring alpha.

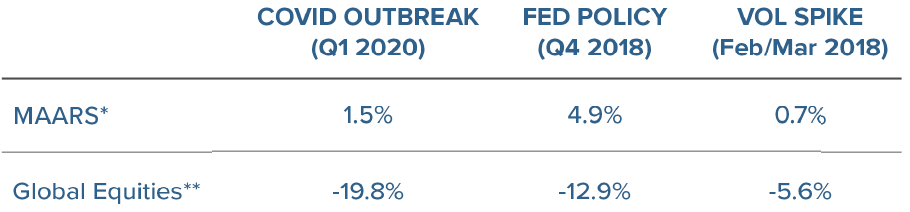

Since its launch in 2017, MAARS has indeed navigated a variety of environments (Figure 1), including spates of volatility in 2018 as growth cooled, a steady rally in 2019 as stimulus resumed, as well as the generational COVID crisis. These shifts in the market environment have laid bare the shortcomings of investing approaches that rely on limited and conventional assets and sources of return.1 Many types of seemingly balanced multi-asset strategies, including ARPs, CTAs, and risk parity, have struggled to provide durable diversification and stable performance.2

Figure 1: MAARS Performance in Periods of Difficult Equity Markets

* MAARS 6v Agg composite performance is net of fees. Investors have the opportunity for losses as well as profits.

Past performance is no guarantee of future results. Past performance may differ significantly from future performance due to market volatility. Reference to the benchmark is for comparative purposes only and is not intended to indicate that the composite will contain the same investments as the benchmark. The above index is not the primary benchmark for the strategy and is being shown for additional comparison. The complete performance disclosure can be found in the composite performance disclosure page attached.

** Global Equities: MSCI World Index (100% hedged to USD). Index Source: MSCI Copyright MSCI 2020. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI.

This note highlights three of MAARS’ design features that differentiate it from narrower and simpler approaches and that we believe are instrumental to achieving the strategy’s objectives: asset breadth, signal diversity, and dynamic positioning.

Asset Breadth

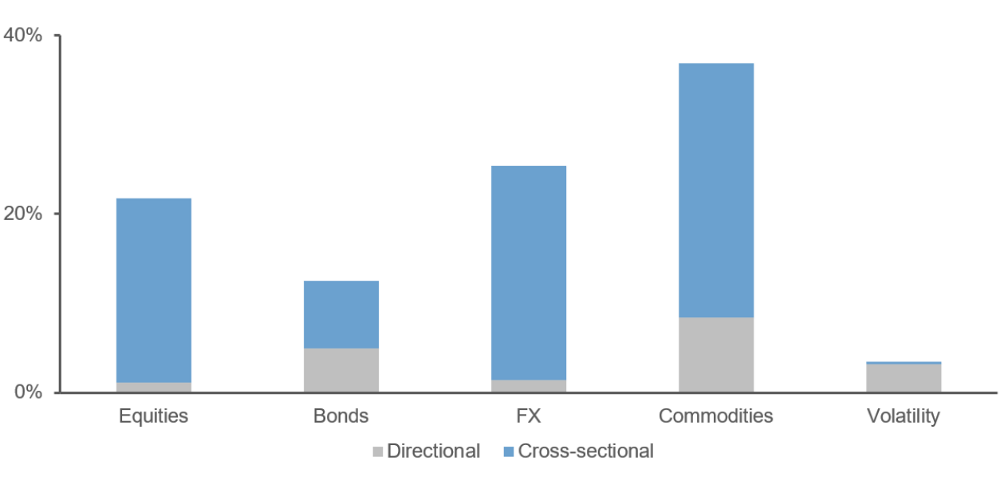

While most multi-asset offerings restrict their investments to equities, bonds, and currencies, because they are easy to trade and are highly liquid, MAARS extends the opportunity set to include commodities and volatility, asset classes that also require significant domain expertise. In fact, MAARS typically allocates significant risk budget to commodities, as shown in Figure 2. This reflects the potential of commodities for alpha generation and diversification. To unlock that potential, MAARS considers the individuality of seven highly differentiated commodity sectors—petroleum, natural gas, grains, livestock, softs, industrial and precious metals—rather than treating the asset class as a monolith as many conventional strategies do. Moreover, the bulk of the commodities risk budget is devoted to highly diversifying long/short positioning within each sector, which offers greater breadth and efficacy rather than directional positioning at the sector or asset-class level.

Figure 2: Typical MAARS Risk Budget

Source: Acadian Asset Management LLC. The information provided is for illustrative purposes only based on proprietary models.

Allocating to a wide array of diverse assets requires a rigorous portfolio construction framework. Most multiasset strategies take reductive portfolio construction approaches, which helps to explain why they opt for narrower sets of factors and assets, entirely eschew returns forecasting, or maintain static positioning. While simple portfolio formation processes are easy to explain, the resulting portfolios may contain unintended and/or concentrated exposures that make their performance difficult to interpret.

MAARS' portfolio construction, in contrast, is built around a rich risk management framework that incorporates important cross-asset relationships— e.g., Australian dollar correlation with the industrial metals complex—to mitigate portfolio exposure to macro risks that span asset classes. Asset class exposures are tightly constrained—in both notional and beta terms—to limit the performance impact of broad directional moves in equities, rates, currencies, and commodities. Thus, emphasis is placed on market selection (cross-sectional long/short positioning) in allocation of the risk budget.

Shock events challenge conventional risk modeling frameworks, which are derived from trailing information. To help protect against such unforeseen events, MAARS incorporates a combination of guardrails, including multifaceted exposure limits that are set based on assets’ tail risk and liquidity characteristics. Other key design elements include dampeners on position sizing as asset volatility decreases and adjustments to return forecasts that diffuse the potential influence of “overconfident” signals.

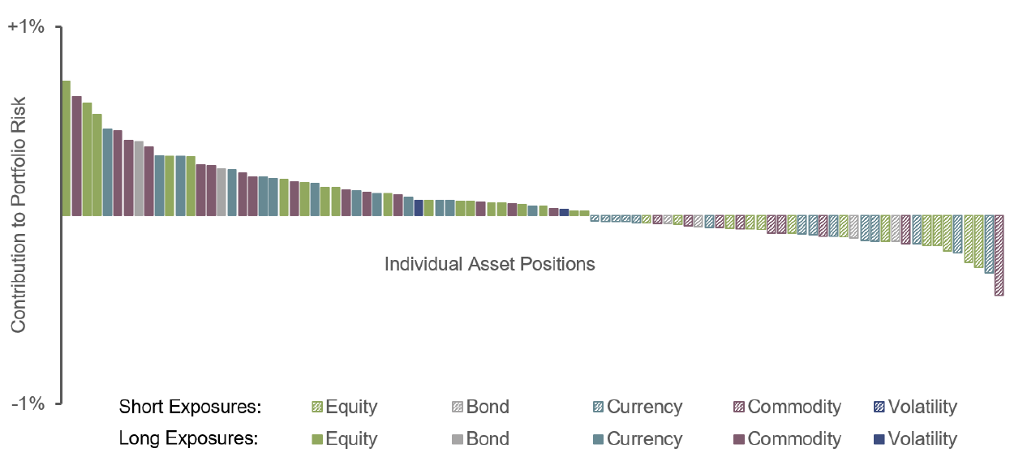

Figure 3 provides direct evidence that asset exposure contributions to portfolio risk are well distributed across asset classes via long and short positions.

Figure 3: Portfolio Risk Contribution from Individual Asset Positions

As of July 31, 2020

Source: Acadian Asset Management LLC. The data presented here is for the MAARS 6v Agg representative portfolio. Investors have the opportunity for losses as well as profits. Past performance is not indicative of future results. The complete performance disclosure page can be found in the attached composite performance disclosure.

Signal Diversity

The information set that MAARS employs to forecast asset returns is broad and diverse. In fact, the return forecasting models include more than 300 signals, which are grounded in fundamentals, economics, and sentiment. They fall into two broad categories:

- Macro/Cross-Asset themes that capture economic and policy-related influences on returns, including credit risk, growth, stimulus, and inflation. These signals are often implemented via cross-market pricing relationships.

- Asset-Specific themes that are based on fundamental and pricing characteristics of the assets themselves, including quality, sentiment, and market positioning.

Many of the signals are proprietary, market-specific, and constructed from alternative data sets. Returning to commodities as an illustrative example, the return forecasts within each of the seven sectors are derived from models that are carefully tailored to the individual markets. They employ an array of data sources used to capture predictive information related to supply/ demand balances and trade flows, ranging from crack spreads and sector-specific inventory details to more esoteric data, such as sea surface temperatures, frost risk, pipeline flows, and ethanol-to-gasoline ratios. Many standard multi-asset strategies forego this rich source of uncorrelated returns and portfolio diversification, in choosing not to invest in the domain expertise required to model nuances of the behavior and market structure of each commodity sector.

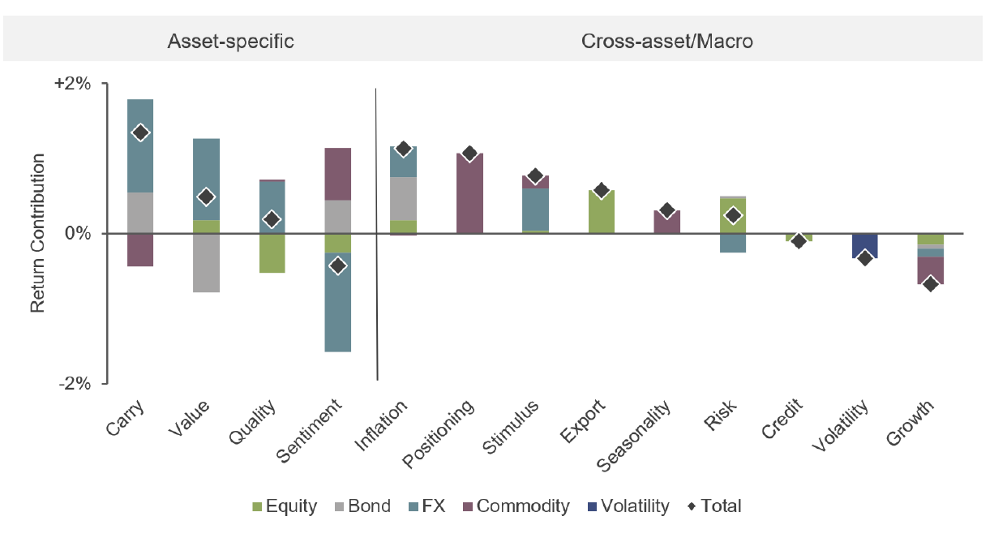

Figure 4 summarizes the contributions of the signal themes to performance across the five asset classes and demonstrates the breadth and diversity of MAARS’ return drivers. In particular, the significant contributions of the macro/cross-asset signals showcase their potential benefit in stabilizing the sometimes uneven performance of more traditional asset-specific themes, such as value or sentiment, which contribute to the vulnerability of ARP and CTA strategies. We believe that macro/cross-asset signals provide MAARS with better forecasting ability in more-policy driven environments. For instance, they helped it to navigate the abrupt shift in risk sentiment at the beginning of 2019 when global central banks adopted a more accommodative policy stance.

The wide range of fundamental, technical, and macro signals deployed across heterogeneous asset classes allows MAARS portfolios to express nuanced views based on shades of conviction, while avoiding concentrated exposures to high-stakes macro risks.

Figure 4: MAARS Return Contributions — By Factor Theme and Asset Class

Inception to date: Nov-17 to Jul-20

Source: Acadian Asset Management LLC. Preliminary. The data presented here is for the MAARS 6v Agg representative portfolio and is supplemental to the composite performance disclosure page attached. Investors have the opportunity for losses as well as profits. Past performance is no guarantee of future results. Past performance may differ significantly from future performance due to market volatility.

Return contribution numbers are calculated from daily gross excess returns over cash of a representative account and are sourced from internal data. Investments in derivatives can be used to take both long and short positions, be highly volatile, involve leverage (which can magnify losses), and involve risks in addition to the risks of the underlying market(s) on which the derivative is based, such as counterparty and liquidity risk. Derivatives and commodity-linked derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks associated with such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political, and regulatory developments. Investing in derivatives could lose more than the amount invested. Fixed income securities are impacted by changes in interest rates. Bonds with longer durations tend to be more sensitive and more volatile than securities with shorter durations; bond prices generally fall as interest rates rise.

Dynamic Positioning

The MAARS investment process is designed to adapt in a timely fashion to meaningful changes in market conditions. Processes that are insufficiently responsive run the risk of being overtaken by events, particularly during periods of market stress, when news flow is intense and policy actions and investor sentiment are prone to abrupt shifts.

MAARS’ return forecasting models dynamically incorporate a variety of market-based and other explicitly forward-looking signals. They are designed to capture shifts in investor sentiment, evolving macroeconomic policy, and changes to fundamental conditions before they register in traditional metrics, which often are coincident or lagging.

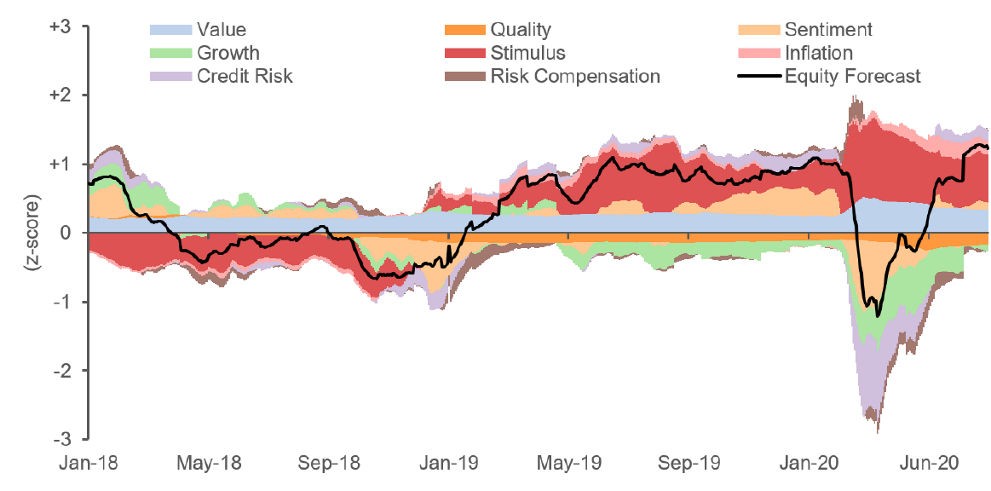

To illustrate the models’ responsiveness, Figure 5 shows the historical evolution of MAARS’ directional developed market equity forecast and its component thematic drivers. Unsurprisingly, the most pronounced shift in our forecasts was associated with the impact of COVID in 2020. Through the early stages of the outbreak, the model adapted swiftly to rapidly deteriorating conditions, including the collapse of sentiment, acute worries over credit conditions, and the partly offsetting impact of stimulus expectations. Another notable shift occurred over the course of the Q4 2018 selloff, when the stimulus theme anticipated the easing of monetary policy before the Fed announced its pivot at the beginning of 2019.

Figure 5: MAARS Developed Market Equity Forecast

Jan 2018 – Jul 2020

Source: Acadian Asset Management LLC. The information provided is for illustrative purposes only based on proprietary models. There can be no assurance that the forecasts will be achieved.

MAARS’ risk models, the other main input into portfolio construction along with the return forecasts, are also highly dynamic. By blending forecasts of volatility and correlation estimated over varying measurement windows, they help modulate position sizing as the riskiness of assets rises and falls. The risk forecast is carefully calibrated to the strategy’s expected holding period, so that it is appropriately sensitive to evolving conditions, neither systematically underreacting nor passing through too much noise into the portfolio.

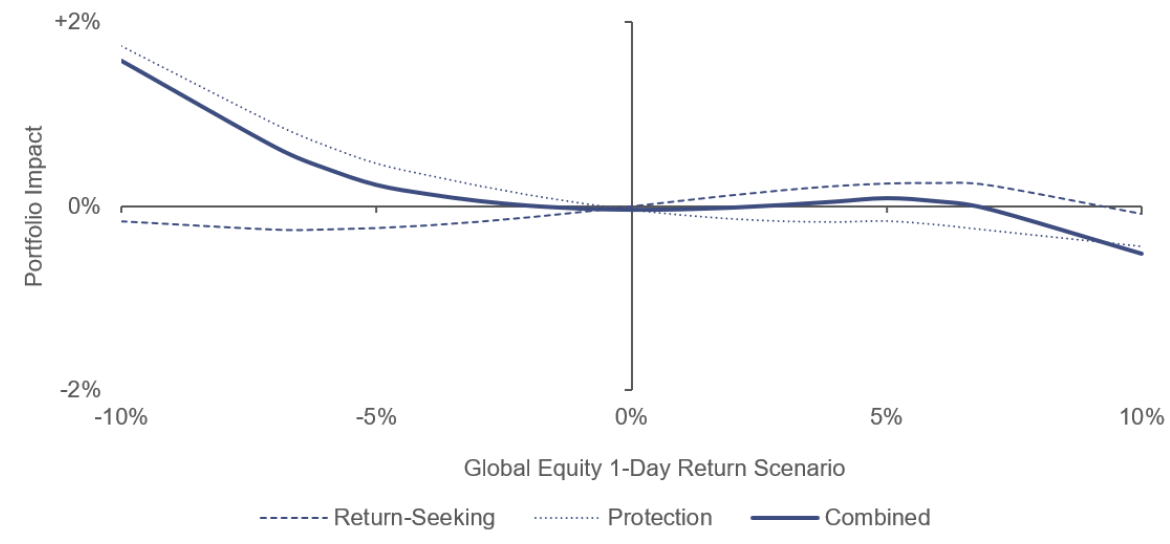

MAARS’ net volatility or options positioning offers an especially informative illustration of the strategy’s overall dynamism. Of the minority of multi-asset strategies that incorporate volatility, many include either a risk-seeking short-volatility element, typically aimed at harvesting a return premium embedded in equity index option prices or a long options/volatility component designed to provide protection in the event of market stress. But doctrinaire one-way positioning—either short or long—and crude implementations carry substantial risk. This was exemplified by several recent high-profile short volatilityinvesting blowups in both the COVID crisis and the February 2018 XIV ETN collapse. With long volatility strategies, there is perpetual lament over the high cost of systematic options hedging.3

MAARS, in contrast, combines both return-seeking and protective volatility components within a dynamic framework. To do so, it exploits variation in pricing across different types of options in an effort to permit the harvest of short-volatility risk premia in one market segment while elsewhere sourcing defensive long volatility positions at reasonable cost. In addition, MAARS’ volatility implementation is tailored to limit the risk of explosive losses. Risk management includes forward-looking scenario analysis to measure portfolio exposure to sudden market “gap” moves.

At any point in time, the relative allocation to the short volatility (return-seeking) and the long volatility (protective) components is based on the attractiveness of the opportunity set associated with each and their contributions to portfolio risk—all of which vary with market conditions. As return and risk forecasts evolved, the strategy was net long volatility—i.e., overweight protection and underweight return-seeking—entering both the COVID crisis and the Q1 2018 volatility spike. Figure 6 demonstrates that during the COVID crisis, MAARS’ volatility positioning was poised to provide protection against sudden and severe equity market losses—which ended up occurring.

Figure 6: MAARS Net Long-Short Volatility Positioning – Sensitivity to Sudden Equity Moves

As of February 29, 2020

Source: Acadian Asset Management LLC. For illustrative purposes only. The options shock scenario analysis models the p/l impact of instantaneous 1-day equity moves on the options component of the MAARS 6v Agg representative portfolio, as a percentage of portfolio NAV. This is meant to be an educational illustrative example of the impact of hypothetical market shocks on the MAARS 6v Agg representative portfolio as of February 29, 2020. Investors have the opportunity for losses as well as profits. Past performance is no guarantee of future results. The complete performance disclosure page can be found in the attached composite performance disclosure.

Conclusion

Systematic multi-asset investing requires process sophistication to holistically capture the complex and dynamic relationships across heterogeneous asset classes. It also requires humility to recognize limits on what we can predict and to incorporate safeguards against the unforeseeable. MAARS is designed to balance both characteristics. The result is a dynamic and diversified portfolio that has successfully navigated volatile and, in some cases, unprecedented market conditions. Those conditions have offered excellent stress tests for the strategy and an affirmation of MAARS’ unique approach.

Endnotes

- See Re-examining Diversification: 2020 Perspective, Acadian Asset Management LLC, June 2020.

- See Multi-Asset Performance in Difficult Market Environments, Acadian Asset Management LLC, May 2018.

- See Volatility Investing: Characteristics of a Well-Conceived Approach, Acadian Asset Management LLC, July 2020.

Derivatives Disclosure

Investments in derivatives can be used to take both long and short positions, be highly volatile, involve leverage (which can magnify losses), and involve risks in addition to the risks of the underlying indicator(s) on which the derivative is based, such as counterparty and liquidity risk. Derivatives and commodity-linked derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. Fixed income securities are typically impacted by changes in interest rates. Bonds with longer durations tend to be more sensitive and more volatile than securities with shorter durations; bond prices generally fall as interest rates rise.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.