The Emerging Opportunity in China A-Shares

Key Takeaways

- China’s equity market is one of the world’s largest and most liquid, reflecting the economic and financial strength that China has achieved in recent decades.

- Structural reforms to this market, such as the RQFII and QFII programs, provide access for foreign investors.

- Recognition of these improvements by index providers means that investment capital is likely to continue to flow into China from around the globe as investors will seek allocations to this class of equities to remain aligned with dominant benchmarks.

- Inefficiency in the A-shares market provides significant investment opportunity for active systematic stock pickers; however, the China-A shares market also presents unique risks.

Table of contents

January 2018

Backdrop

For decades, China has been slowly opening its economy and capital markets to the rest of the world. Following the death of Mao Zedong in 1976, the earliest reforms came under the leadership of Deng Xiaoping in the agricultural sector and were later followed by the adoption of joint stock corporations and limited liability entities in the late 1980s. The 1990s brought the opening of trade and establishment of capital markets, specifically the establishment of the Shanghai and Shenzhen stock exchanges. At the time, these nascent exchanges served an economy that reflected 3% of global GDP (versus approximately 15% today in nominal or current price terms).

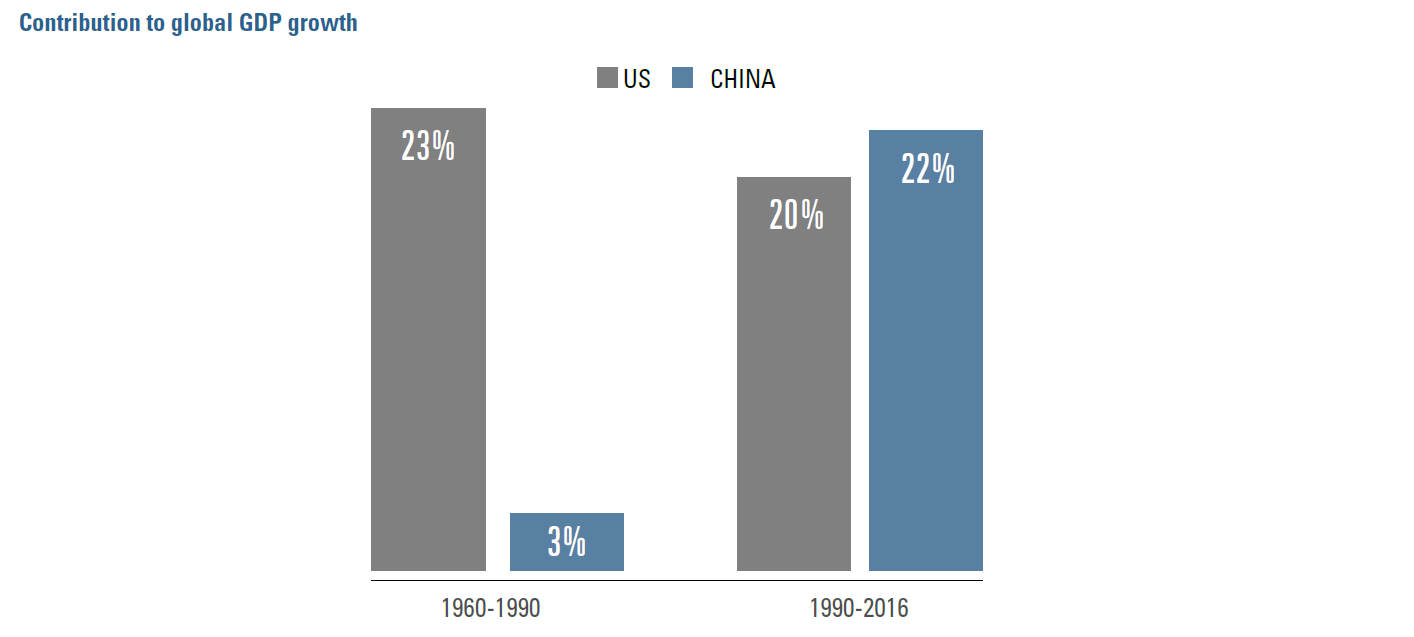

Since then, China has experienced tremendous economic growth, having become the world’s second-largest economy by nominal GDP. Today, China is the leading contributor to global growth, outpacing the U.S. and contrasting sharply with its prior modest contribution, as seen in Figure 1.

Figure 1

This growth has been largely the result of a managed liberalization, progressing away from an agricultural economy to a manufacturing-based one—and, more recently, toward information technology, professional services, and consumer-driven activity. Today, China has emerged as a middle-income level country with novel challenges for sustained growth.

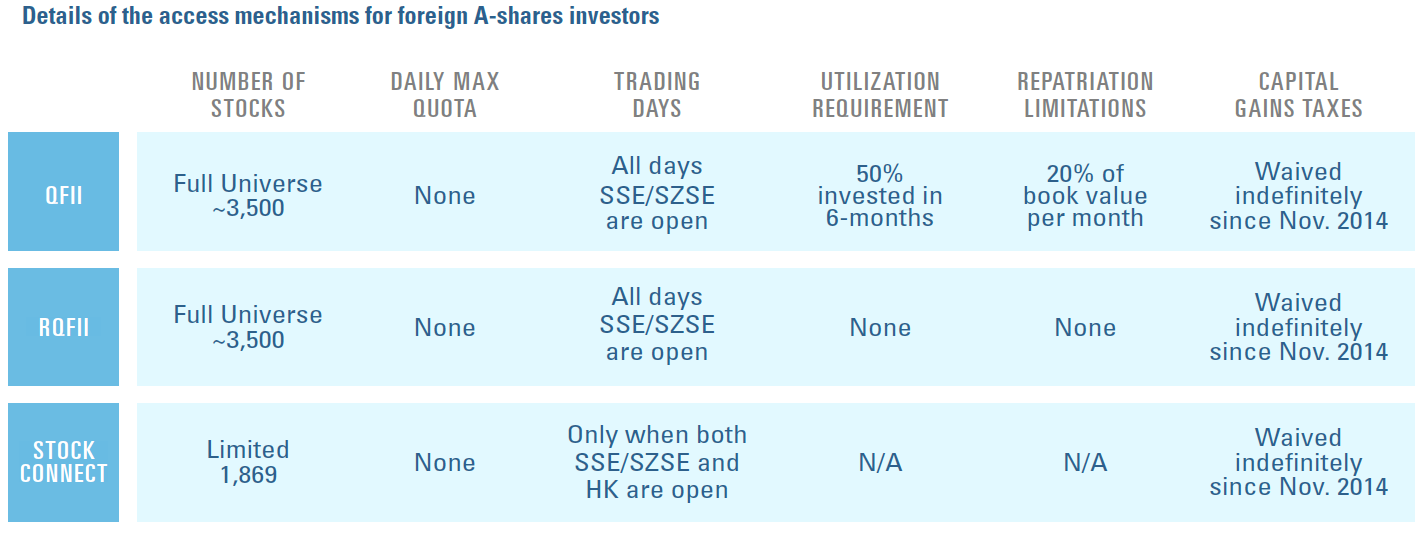

To promote further productivity gains, the Central Committee of the Communist Party of China convened in 2013 to establish a roadmap for continued growth; this plan included a focus on further liberalization of the financial system and broadening foreign investment and competition. This objective is being realized as the local capital market is now accessible to foreign investors through the establishment of several increasingly well-known programs including the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) programs, and the Hong Kong Stock Connect platform (see appendix for more details on these programs).

China’s Equity Market

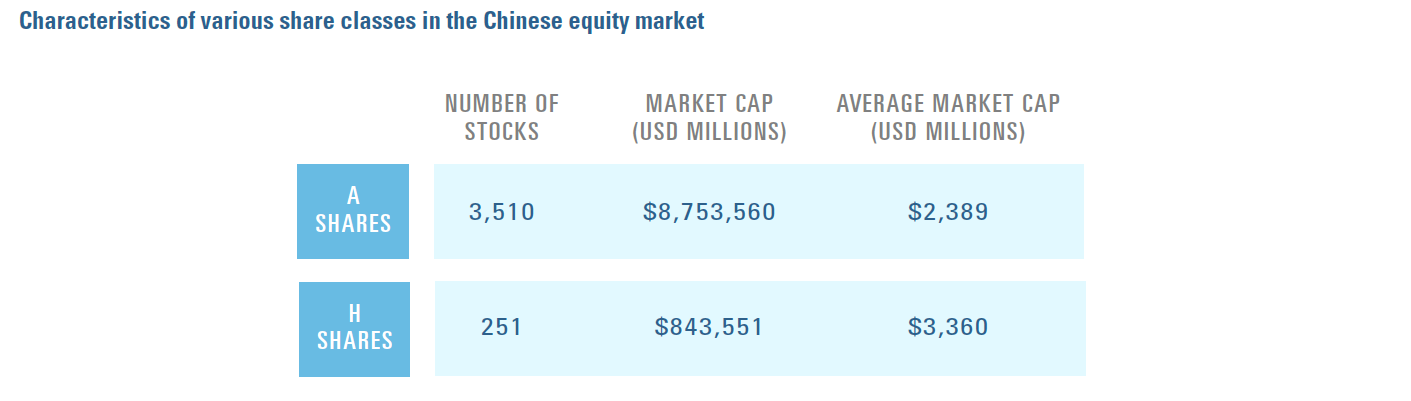

China’s equity market is comprised of exchanges in Shanghai and Shenzhen and a variety of share classes. Until now, foreign investors’ means to access the Chinese market has been primarily through a small set of overseas listings, primarily H-shares. A-shares have been largely reserved for domestic investors, with foreign access emerging only through the licensing framework of the QFII/RQFII programs, and more recently through the less-restricted Shanghai and Shenzhen Stock Connect mechanisms.

Foreign access to the A-shares market opens up an enormous opportunity set. With over 3,500 stocks traded and $8.5T in market capitalization, the A-shares universe represents the second largest equity market globally. In terms of listings and market cap it trails only the U.S. and exceeds that of Japan.

Even investors who are well-versed in China’s economic development may not be aware that the A-shares market includes some of the largest and most innovative companies in the world. For example:1

- Gree Electronics: the largest HVAC manufacturer in the world

- Kweichow Moutai: the most valuable liquor company in the world, surpassing Diageo (owner of the Johnny Walker brand)

- SAIC: one of the largest automotive companies in the world, advancing technologies on self-driving cars, internet enabling, and renewable technologies

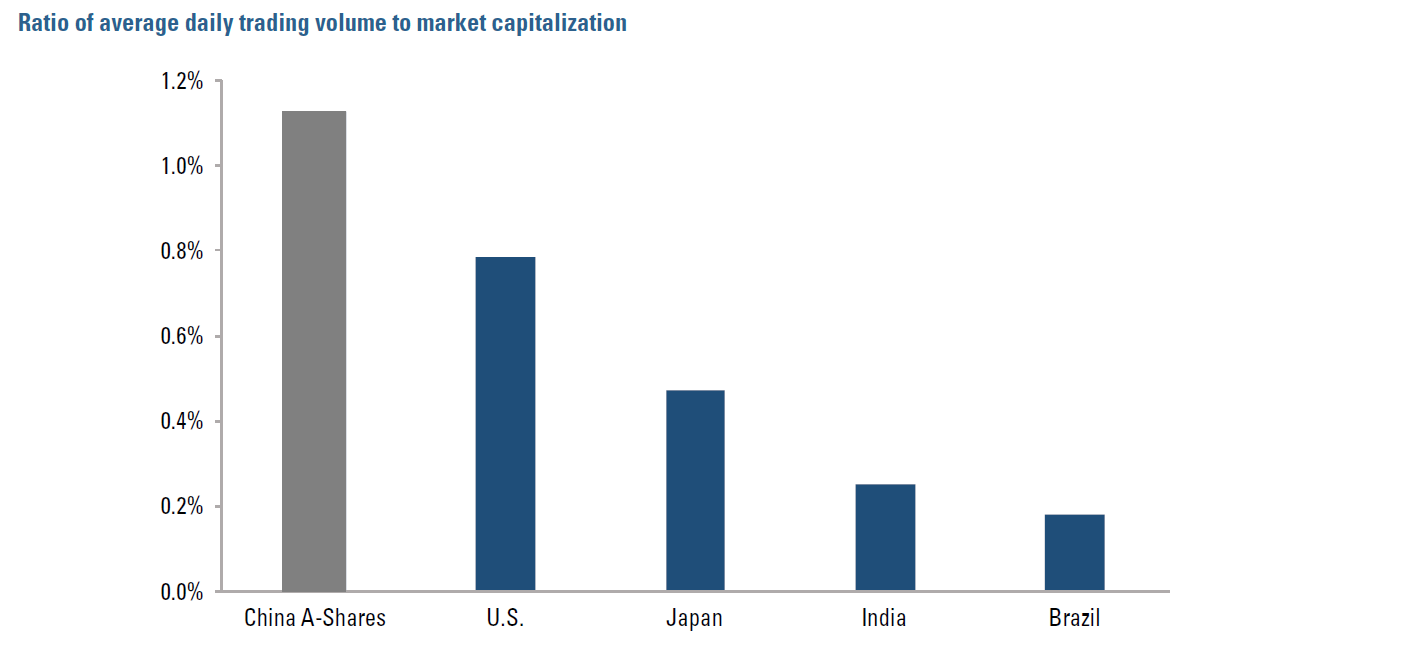

The A-shares market is not only broad but also exceedingly liquid, featuring some of the tightest bid/ask spreads in global equity markets (approximately half of median U.S. bid/ask spread2), lowest median cost to trade 5% ADV, and median average daily trading volume that stands far above any other market. In Figure 2 we offer a comparison of various countries’ ratio of average daily traded volume to their respective market cap for the 12 months ending 11/30/2017.

Figure 2

Figure 3

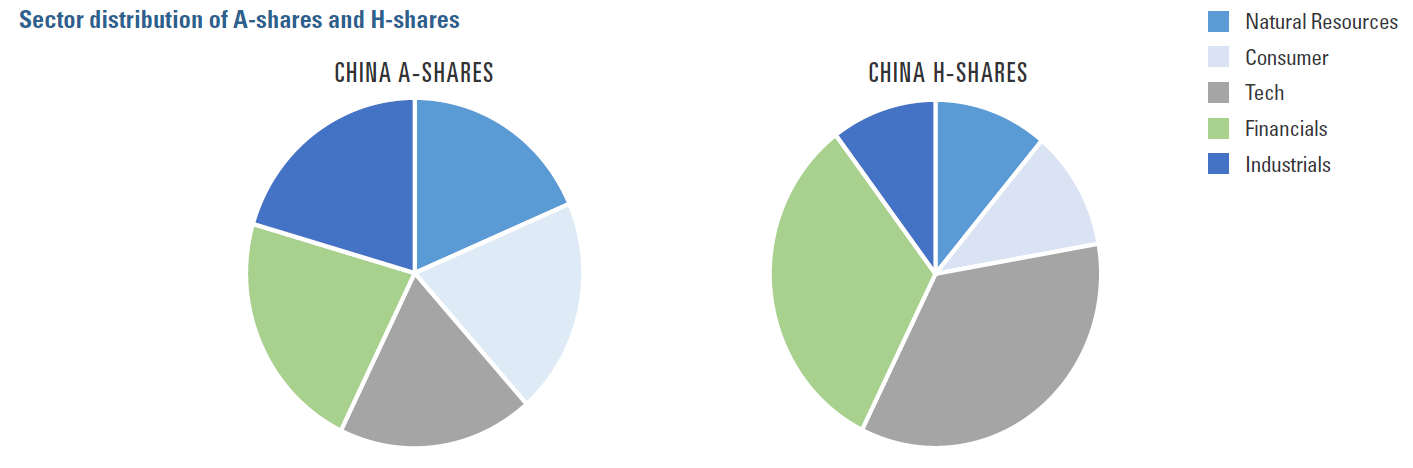

* also includes B-shares and ADRs

A-shares also represent a much larger and more diverse market than what H-shares have provided to foreigners. A-shares have more balanced sector representation than H-shares, which are dominated by financials and IT stocks. Figure 3 shows A-shares better distribution of exposures across commodities, consumer, financials, industrials, and IT.

Em Benchmark Inclusion In Context

MSCI’s initial inclusion of A-shares into its benchmarks will reflect only a small slice of the broad A-shares market. In June 2017, MSCI announced that 222 of the approximate 3,500 companies in the share class will be part of the initial inclusion that will take place in two phases in 2018. These stocks will initially comprise 0.73% of the MSCI EM index weight by August 2018. This modest initial weight reflects several factors including foreign ownership limits (currently at 30% for most A-share companies) and free float adjustments, as well as concerns about restrictive exchange practices associated with settlements, daily trade limits, and suspensions. As these issues are resolved, we believe that China will grow to represent a much larger portion of MSCI’s Emerging Market Index—as much as 40.8%, nearly half of which would be A-shares.3

Opportunities For A Systematic Investment Approach

Thoughtful quantitative investment processes have the potential to thrive in less-efficient markets. The China A-shares market, dominated by domestic retail investors, is rife with inefficiency. Retail participation in the A-shares market represents approximately 80% of daily trading, contrasted with institutional investors who represent the majority of participation in H-shares (30% retail).4 Further, the average local manager has only 2.6 years of experience.5

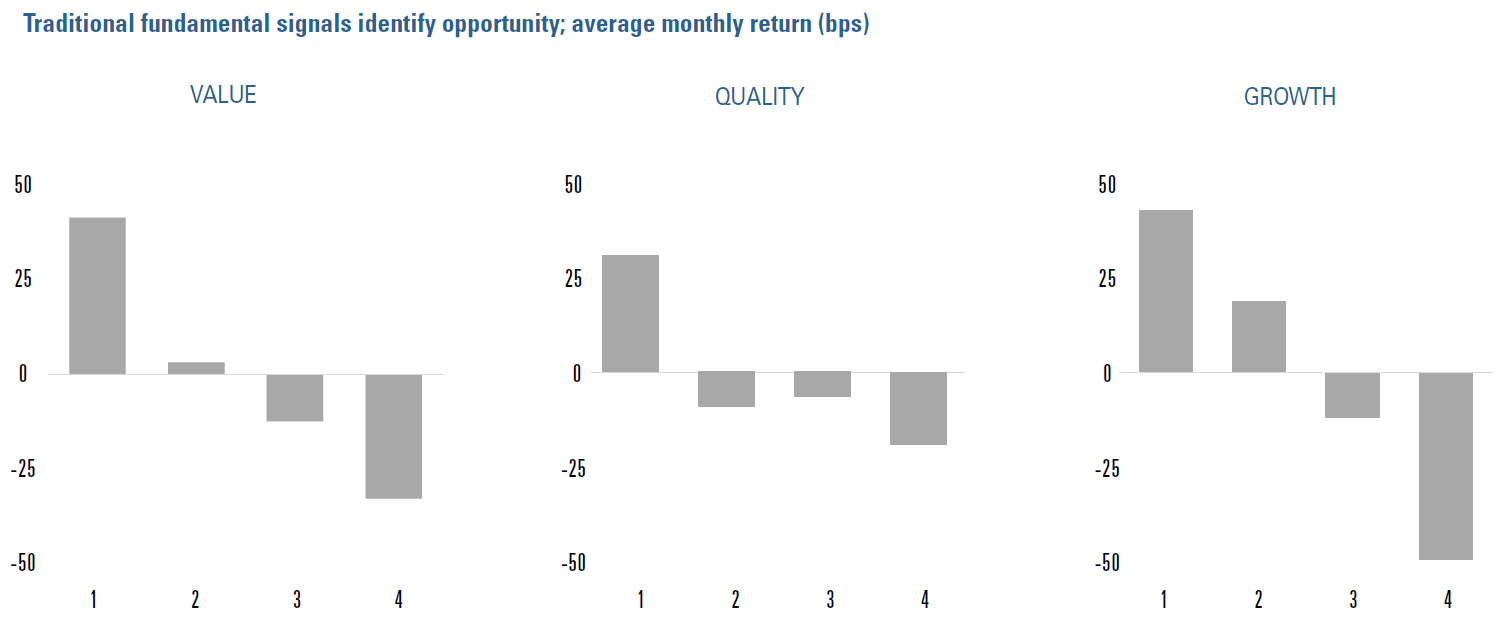

We are able to observe empirical evidence of this inefficiency. As shown in Figure 4, payoffs to factors such as value, quality, and growth over an extended period appear to be robust. Among our China A-shares universe, quartile returns reflect a market that typically rewards strong fundamentals.

Figure 4

Figure 5

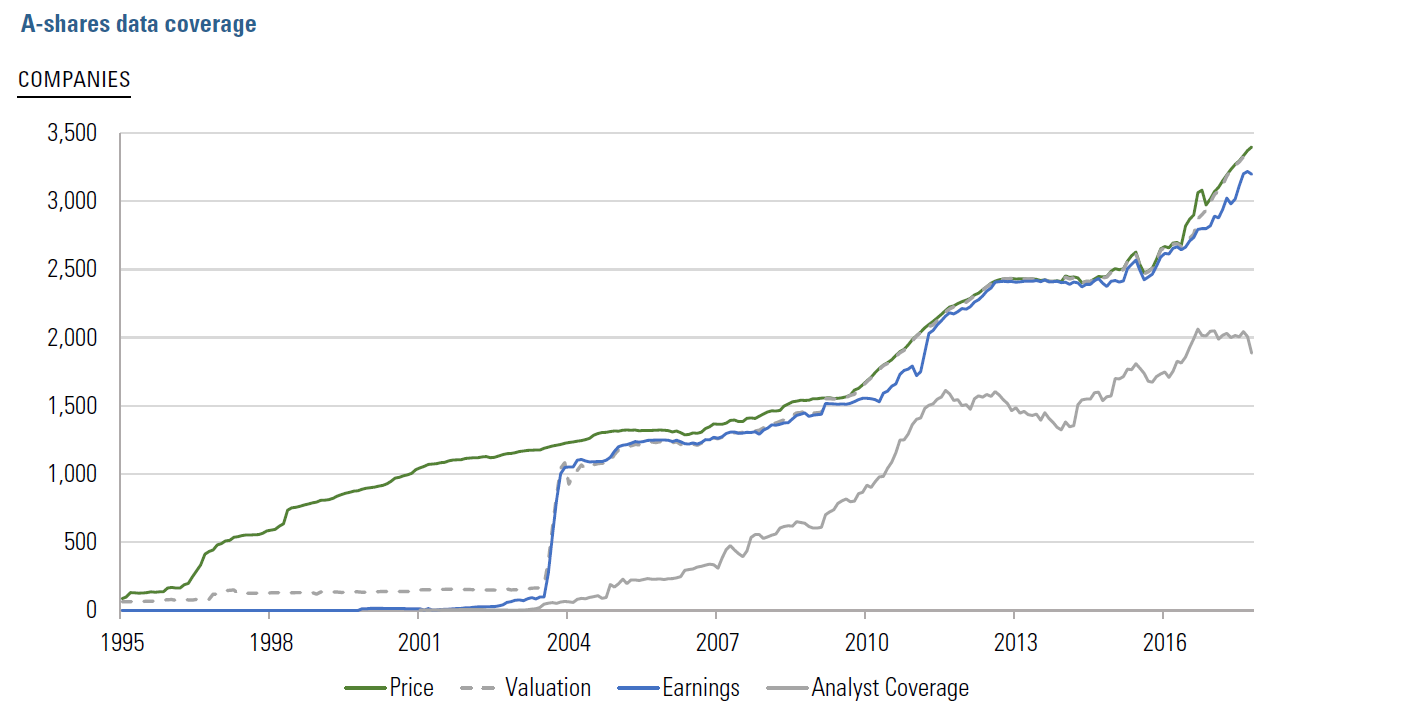

Systematic, fundamentally driven investing requires data. As the Chinese equity market has developed over the past two decades, so too has data availability, which provides information on various metrics such as price, valuation, and earnings. In addition to price and fundamental data, analyst coverage has grown from near zero in 2003 to over 2,000 A-shares companies currently, as shown in Figure 5. Perhaps surprising to investors new to the market, we have coverage and can apply our fundamentally focused alpha model to the overwhelming majority of the approximately 3,500 A-shares listed companies.

Figure 6

Unique Risks

Investing in the Chinese market presents unique risks, which help to explain MSCI’s lengthy process for index inclusion. With a dominant retail investor base, A-shares have historically been prone to higher volatility. As described above, the dominance of retail investing is most likely a factor that contributes to higher volatility in the A-shares market, with annualized five-year risk (standard deviation of annual returns) at 27.2% vs. 21.3% for H-shares. Likewise, a time series of one-year rolling standard deviation of returns shows a market that is more volatile than MSCI Emerging Markets and World indices.

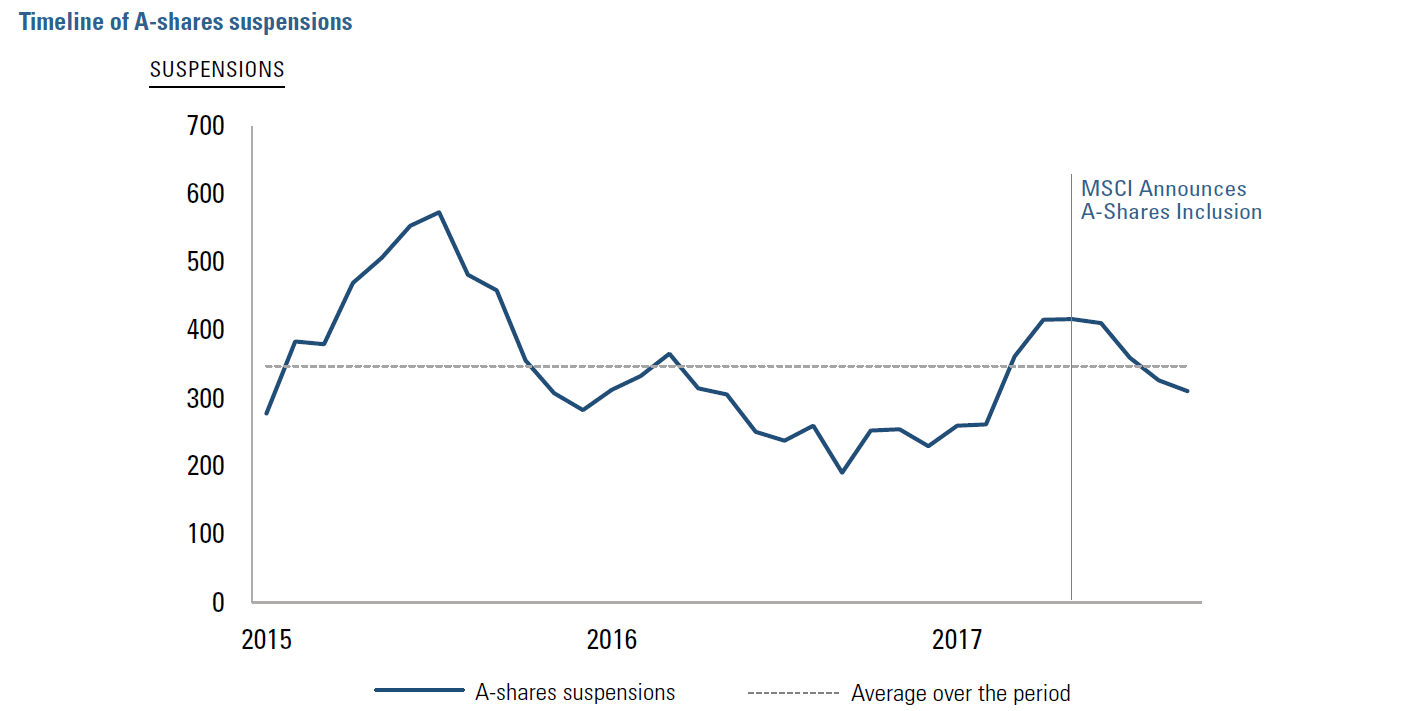

One element of the Chinese market that remains a concern for investors is the pattern of trading suspensions that have been more prevalent than in other markets. This consideration was noted by MSCI as they deliberated over A-shares inclusion. While liquidity is robust, investors may question whether it will be there when needed given the number and length of suspensions. Suspensions in China may occur for many reasons, including but not limited to: asset reorganization or restructuring, irregular trading activity, or an attempt to avert drastic price swings in periods of heightened volatility. While we believe that accounting for suspended securities in the portfolio construction process may mitigate some risk, this concern nevertheless merits consideration; however, we believe that the environment is improving, and will continue to do so going forward, as inferred from the downtrend noted in Figure 6. Furthermore, we believe a systematic investment process that continuously incorporates prudent risk controls in conjunction with alpha opportunities is the best approach to allocating in any new class of equities.

Conclusion

The China A-shares market presents an opportunity to participate in one of the world’s most expansive and liquid equity markets, underpinned by a major economy whose growth continues to outpace most others. We acknowledge that there is continued work for Chinese regulators, index providers, and investors alike as one of the largest yet least accessible components of the market continues to mature. We are encouraged that the availability of company data has largely accompanied the impressive growth of this market over the past two decades and that the commitment to reform exhibited by the Chinese government has allowed for continually improving access among foreign investors.

As this market expands, Acadian believes there is a robust investment opportunity for active systematic stock pickers. The A-shares universe materially broadens an investor’s opportunity set. Further, given the market inefficiency, our disciplined and structured approach is particularly well suited to invest in this unique share class of equities.

Appendix

Figure A1

Figure A2

For illustrative purposes only.

Endnotes

- The companies mentioned are not a recommendation to buy or sell a specific security and should not be considered investment advice.

- Source: ITG.

- MSCI “Are You Ready for China A-Shares?” June 2017

- Source: CITIC Group.

- Source: Asset Management Association of China (AMAC)

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.